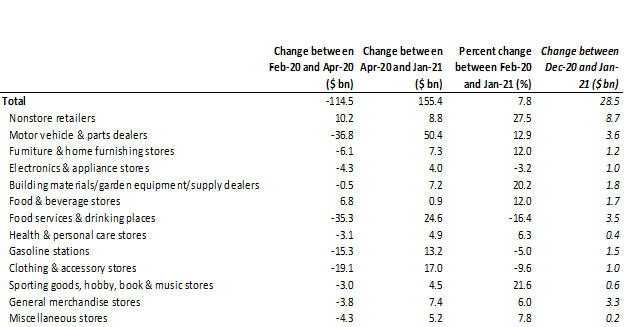

*U.S. retail sales surged by 5.3% m/m in January, one of its largest monthly increases on record, following three months of declines, lifting it to an all-time high and 7.8% above its pre-pandemic level (Chart 1). January’s sales were boosted by the government’s $600 income support checks to households and enhanced unemployment compensation, and the easing of the pandemic. We expect sales to continue to increase in the coming months as vaccines are more widely administered, state and local governments loosen restrictions, households receive additional income support checks from the government, and the pandemic ebbs. Today’s data support our above-consensus forecast of 6.5% real GDP growth in 2021 (Already strong U.S. economic growth outlook revised up further, January 29, 2021).

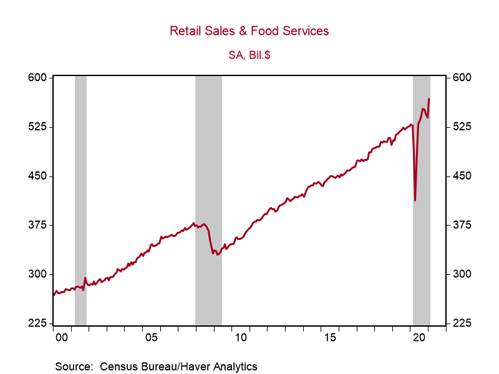

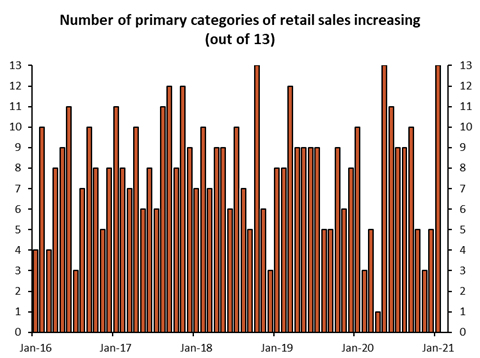

*Remarkably, all sales categories increased in January and nine out of 13 are above their pre-pandemic levels (Table 1 and Chart 2). Sales at nonstore retailers (+$8.7bn), motor vehicle & parts dealers (+$3.6bn), restaurants and bars (+$3.5bn), and general merchandise (+$3.3bn) stores contributed the most to overall sales growth (+$28.5bn). Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, jumped by 6.0% m/m, its first increase since September, placing it on track to increase by 15.9% q/q annualized in Q1 following its 2.4% annualized decline in Q4 (Chart 3).

*The strong increase in January’s retail sales sets a high baseline for consumption (scheduled for release on February 26). Although retail sales has long exceeded its pre-pandemic level, consumption is still 2.6% below because it includes a broader range of services. Once conditions begin to normalize this year, we expect the release of pent-up demand and the massive cumulative excess household savings (estimated to be $1.5tn through December) to boost services consumption.

Nonstore retail sales (includes online) jumped by 11% m/m to an all-time high in January after its surprising 7.4% decline in December, placing it 27.5% above its pre-pandemic level, making it the best performing category, by far, throughout the pandemic (Chart 4 and Table 1). Nonstore sales now account for 15% of overall retail sales, up from 13% in February 2020.

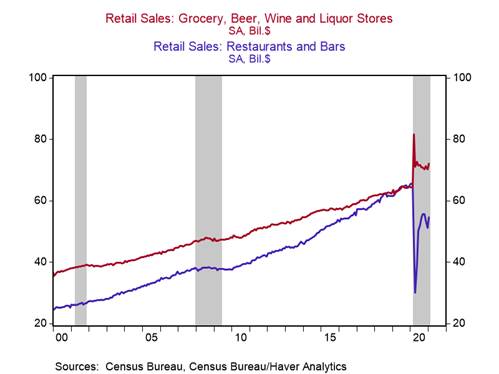

Sales at restaurants and bars increased by 6.9% m/m in January, placing it 16.4% below its pre-pandemic level, and sales at grocery and liquor stores increased by 2.4% m/m, placing it 12% above its pre-pandemic level (Chart 5). Before the pandemic, restaurant and bar sales exceeded grocery and liquor store sales by $1bn, but they are now $17.4bn below. This gap will narrow as conditions normalize.

Sales at housing-related retailers surged in January. Sales at electronics and appliance stores, and furniture and home furnishing stores increased by 14.7% m/m and 12.0% m/m, respectively (Chart 6). They should continue to be boosted by the strong growth in home sales. Sales at building materials, garden equipment & supply dealers increased by 4.6% m/m, lifting it 20.2% above its pre-pandemic level (Chart 7). This category has benefited from the shift to work-from-home, which has led many households to do home improvement projects.

We emphasize that high frequency data pointed to this strong increase in retail sales (Real-time insights, economic and financial pulse, February 16, 2021). Credit and debit card spending jumped in early January, after the $600 income support checks were disbursed to households, exceeding its pre-pandemic baseline. Mobility data reflect increased activity at retail and recreational spaces thus far in February, suggesting that this solid consumer momentum should continue.

Table 1: Retail sales trends since February 2020

Sources: Census Bureau and Berenberg Capital Markets

Chart 1:

Chart 2:

Sources: Census Bureau and Berenberg Capital Markets

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com