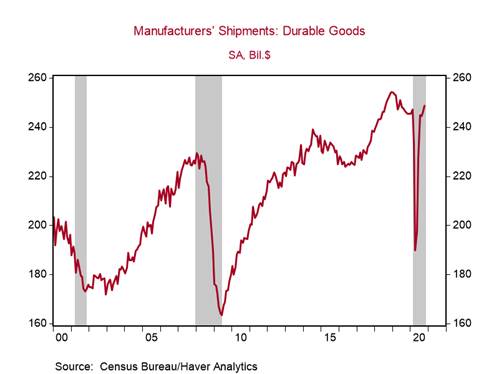

*The U.S. October Durable Goods Report showed a strong 1.3% m/m increase in orders (placing it just 2.2% below February’s level) - led by the (volatile) aircraft and parts sector - consistent with the optimism in regional and national manufacturing sentiment surveys and the inventory rebuild at retailers and wholesalers (U.S. inventory rebuilding and production: a positive note, September 23, 2020). Durable goods shipments increased by 1.3% m/m to a 16-month high (Chart 1).

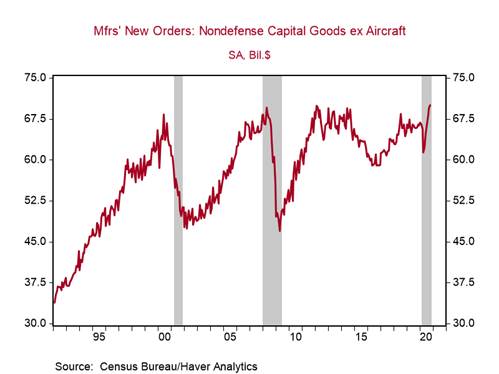

*Core durable goods orders (non-defense capital goods excluding aircraft), which gauge underlying manufacturing demand, increased by 0.7% m/m to an all-time high (monthly data began in 1992) and indicates that strong growth in shipments will continue in the coming months (Chart 2).

*Shipments of non-defense capital goods, a proxy for business equipment investment in GDP, increased by 3.7% m/m, lifting it 1.2% above February’s level and placing it on track to increase by a sizable 21% q/q annualized in Q4 (Chart 3).

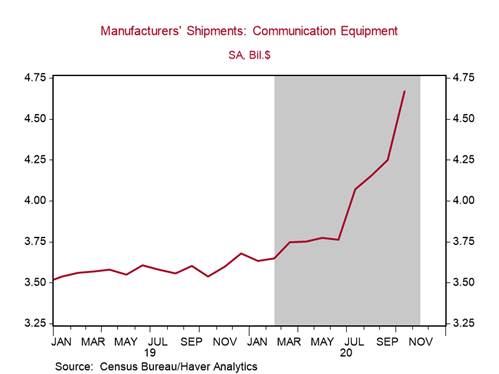

In October, eight of the nine primary categories of durable goods shipments increased. Shipments of machinery (+0.1% above February’s level), computers and related products (+5.1% above February’s level), and motor vehicles and parts (+1.4% above February’s level) have exceeded their pre-pandemic levels. But the standout performer by far, communications equipment shipments, surged by 9.9% m/m increase in October, lifting it 27.9% above its February level, reflecting increased demand from the shift to the work-from-home environment (Chart 4). Shipments of aircraft and parts are furthest below February’s level (-24.7%), reflecting the disproportionate effect of the pandemic on the sector, and idiosyncratic factors that plagued the sector before the pandemic (Chart 5).

Durable goods inventories increased by 0.3% m/m, lowering the inventory-shipments ratio at manufacturers to 1.70, a 13-month low.

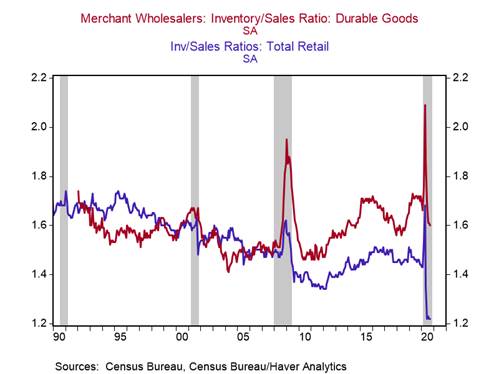

We expect the momentum in the manufacturing durable goods sector to remain robust over the coming months based on the strong growth in new orders and optimism in manufacturing surveys. The V-shaped rebound and continued strong growth in durable goods consumption (15% above its pre-pandemic level) has led to a significant liquidation of inventories at retailers and wholesalers. Inventories are likely to fall during the holiday shopping season. As a result, we expect demand for manufacturers’ goods to remain elevated next year (Chart 6).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Roiana Reid, roiana.reid@berenberg-us.com