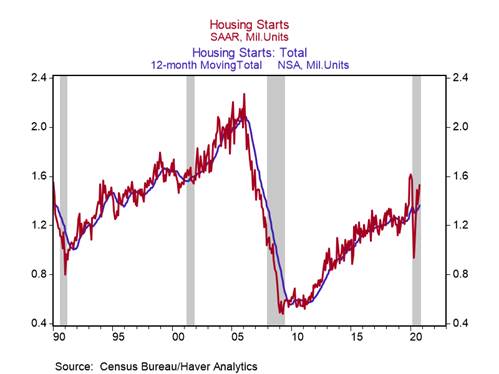

*U.S. housing starts increased by 4.9% m/m to 1.53m in October annualized from 1.46m in September, a 64% increase from its April low and its fourth highest level in the last 14 years, lifting its yr/yr change to 15%. The 12-month rolling sum of starts increased to 1.36m, a 13-year high, reflecting the surge in new housing construction between end-2019 and early 2020, and the V-shaped rebound following the sharp fall (Chart 1).

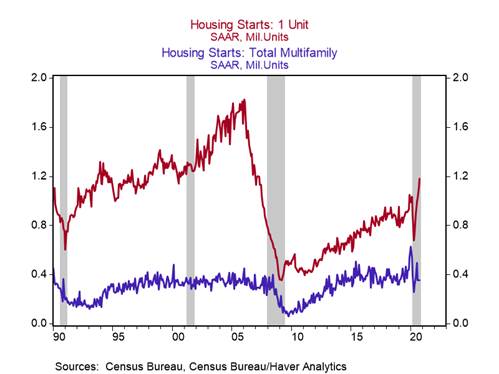

*Single-family starts increased by 6.4% m/m to 1.18m annualized, a 13.5-year high, indicating robust growth in homeownership, and multifamily starts were unchanged at 351k for the third consecutive month (Chart 2). Housing starts increased in most regions: South (+98k to 859k annualized), West (+15k to 374K), Midwest (+7k to 219k), and Northeast (-49k to 78k).

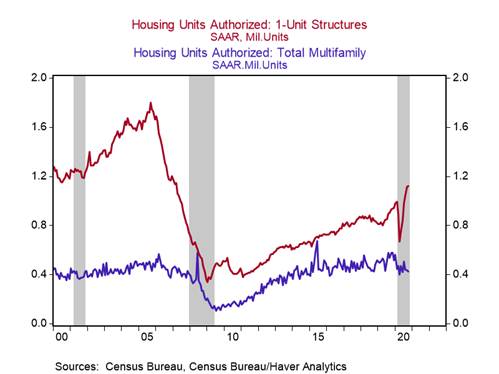

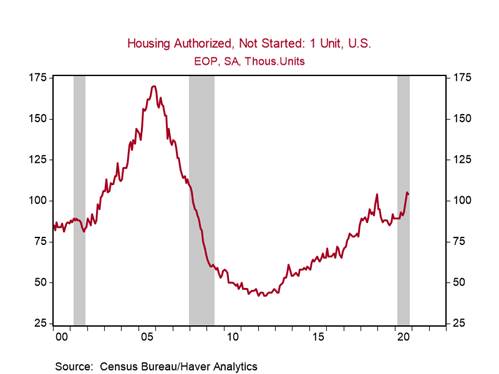

*Building permits were unchanged at 1.55m annualized in October. As was the case with housing starts, single-family permits (+0.6% to 1.12m) outperformed multifamily permits (-1.6% to 425k). See Chart 3. Despite the strong growth in single-family starts, the number of single-family housing units authorized but not yet started remains elevated, up 18% from a year ago, reflecting a sizable backlog of construction projects that could be started in the coming months (Chart 4).

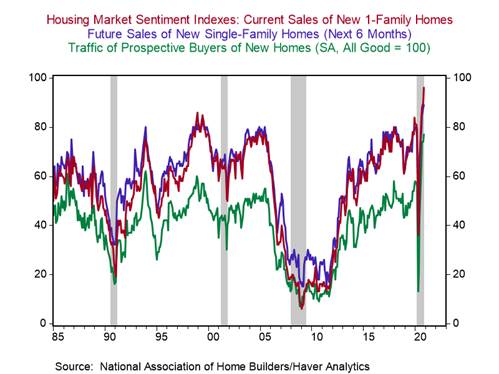

The increase in the National Association of Home Builders (NAHB) housing market sentiment index to another all-time high in November bodes well for sustained solid growth in new residential construction and home sales. Home builders’ assessments of current and future home sales, and prospective buyer traffic, have all surged (Chart 5). According to the NAHB, “Historically low mortgage rates, favorable demographics and an ongoing suburban shift for home buyer preferences have spurred demand and increased new home sales by nearly 17% in 2020 on a year-to-date basis.”

We expect construction activities to be more resilient than services activities over the next few months given the disproportionately adverse impact of COVID-19 on services. State and local governments are unlikely to shut down construction activities that can be done outside and with workers socially distanced.

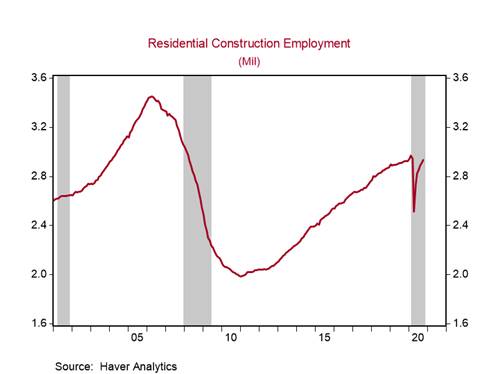

The strong growth in residential construction and home improvement has wide-ranging impacts on the economy: 1) Residential construction employment has increased by 425k from its April low to 2.93m, recouping almost all of the 457k decline in March-April and placing it just 1.1% below February’s level, compared to total employment that is 6.6% below its pre-pandemic level (Chart 6); and 2) sales at housing-related retailers such as building materials, garden equipment, and supply stores (+14.5% above February’s level) and furniture and home furnishing stores (+2.7%) have outperformed many other retail categories (Chart 7).

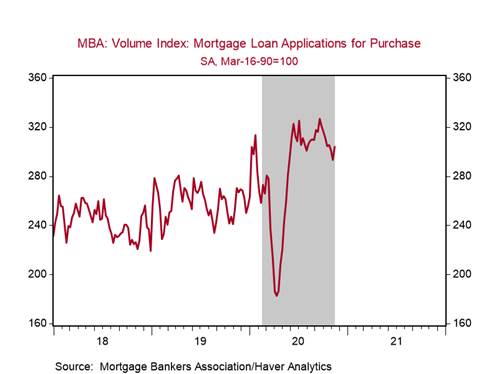

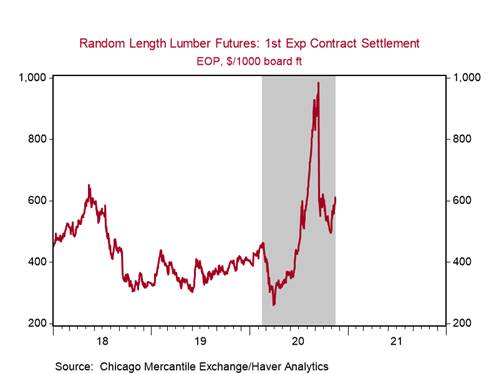

High frequency indicators point to continued solid growth in housing activity, but at a slower rate than the spring/summer (Real-time insights, economic and financial pulse, November 16, 2020). The U.S. mortgage applications for purchase volume index is 7.1% below its recent high and lumber futures have fallen to $600/1000 board feet after the unsustainable surge to $1,000, the highest price since at least 1990 (when the series began). Despite these declines, mortgage applications and lumber futures are 26% and 48% above year-ago levels, respectively (Charts 8 and 9).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Roiana Reid, roiana.reid@berenberg-us.com