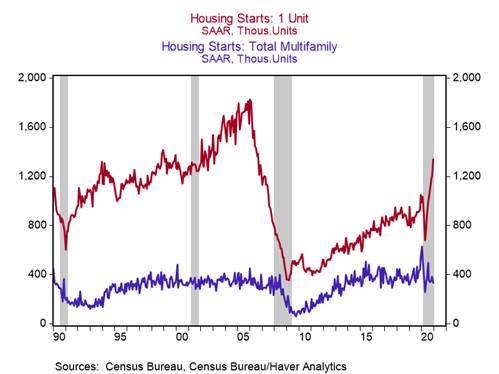

*U.S. housing starts jumped by 5.8% m/m to 1.67m annualized in December from 1.58m in November, the highest level since September 2006, bringing its 2020 average to 1.4m, an increase from its 2019 average of 1.3m (Chart 1). Housing starts staged an impressive V-shaped rebound in H2 2020 – regaining its pre-pandemic momentum – fueled by historically low mortgage rates, pent-up demand, and the tight supply of homes available for sale. We expect continued solid growth in the housing sector in 2021 as long as mortgage rates remain low.

*Single-family starts surged by 143k to 1.34m annualized in December, a 14-year high, indicating robust growth in homeownership, while multifamily starts declined by 52k to 331k (Chart 2). Housing starts increased in all regions except the Northeast: Midwest (+61k to 251k annualized), South (+45k to 858k), West (+42k to 453k), and Northeast (-57k to 107k).

*Building permits increased by 4.5% m/m to 1.71m annualized in December, driven by robust growth in single-family permits (+89k to 1.23m), reflecting the strong underlying demand for new housing units (Chart 3). Despite the jump in housing starts in December, the number of single-family housing units authorized, but not yet started, remained elevated (+18.0% yr/yr), indicating a sizable backlog of projects that could be started in the coming months (Chart 4).

We expect the tight supply of homes available for sale and strong demand to continue to spur residential construction. In November, the months’ supply of existing single-family homes available for sale declined to 2.2 months, an all-time low, and the months’ supply of new homes remained low at 4.1 months (Chart 5).

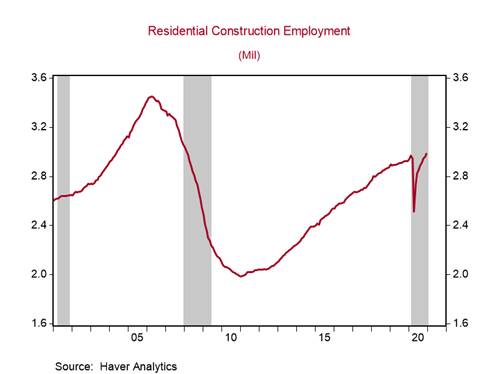

The strong growth in housing starts lifted residential construction employment above its pre-pandemic level in December (Chart 6), far outperforming most other sectors – total nonfarm employment was 6.5% below its pre-pandemic level in December.

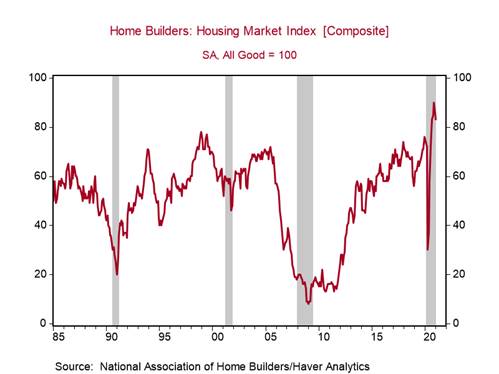

The National Association of Home Builders (NAHB) housing market sentiment index declined for the second consecutive month in January but remained near its historical high (Chart 7). This home builder optimism bodes well for continued strong growth in residential construction and new home sales. The NAHB blames the recent moderation in its optimism on supply-side factors “related to lumber and other material costs, a lack of affordable lots and labor shortages that delay delivery times and put upward pressure on home prices. They are also concerned about a changing regulatory environment.”

Historically low mortgage rates that have reduced the monthly cost of servicing a mortgage will continue to drive housing demand, offsetting the impact of higher prices on affordability. Although the 10-year UST yield has jumped this month, the 30-year fixed mortgage rate is still below 3% and the Fed is expected to support low interest rates for an extended period (Chart 8).

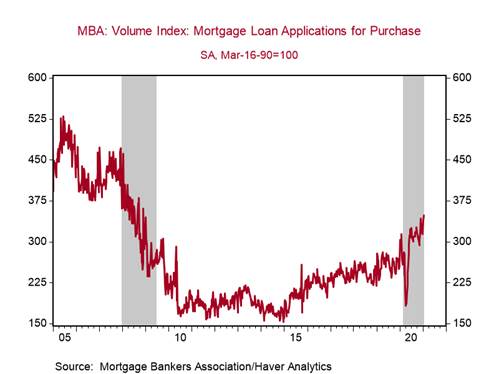

High frequency indicators point to further solid growth in housing activity in the intermediate run (Real-time insights, economic and financial pulse, January 19. 2021). The mortgage applications for purchase volume index jumped to a 12-year high last week (+15% yr/yr). Lumber futures remain high, despite its recent declines, indicating that home builders are planning for a strong spring home buying season (Charts 9 and 10).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Chart 10:

Roiana Reid, roiana.reid@berenberg-us.com