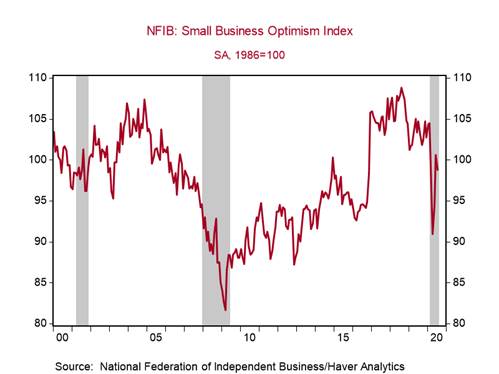

*The National Federation of Independent Business (NFIB) Small Business Optimism Index declined by 1.8pts to 98.8 in July, after solid gains in May and June, reflecting sluggish demand, business restrictions, and the spike in incidence of COVID-19 that led many states to reverse or slow their reopenings (Chart 1).

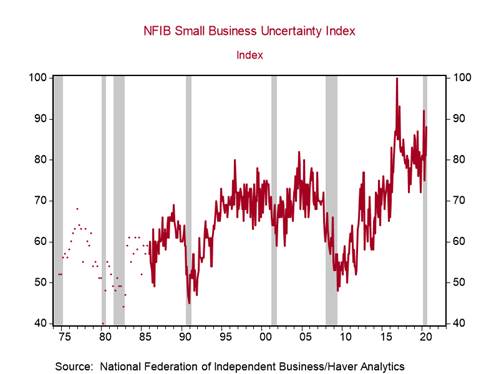

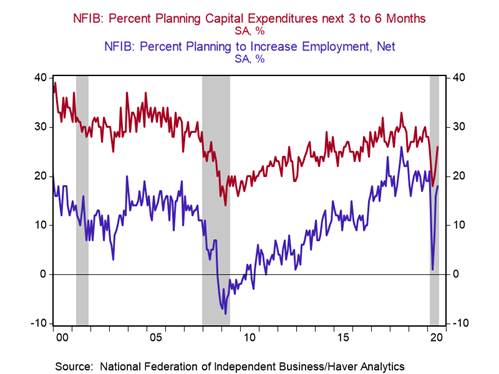

*The 7pt jump in the NFIB’s uncertainty index to 88 in July, barely below March’s level and one of the highest values on record, reflects these COVID-related issues (Chart 2). As a result, only 11% of small businesses believe that now is a good time to expand, well below the pre-pandemic average of 26%, and 25% expect the economy to improve, down sharply from 39% in June (Chart 3). Still, more small businesses plan to increase employment and make capital outlays in the next three to six months (Chart 4).

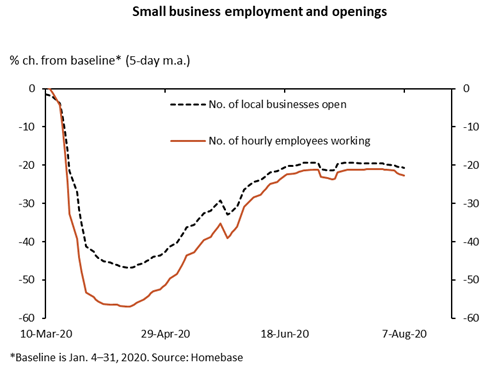

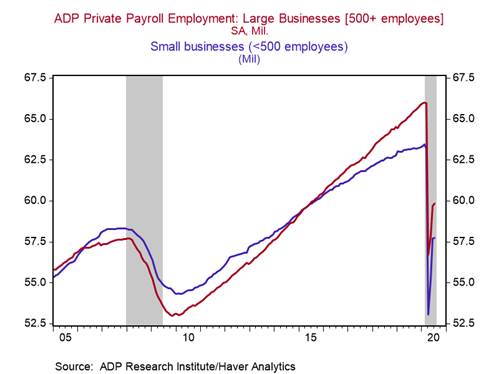

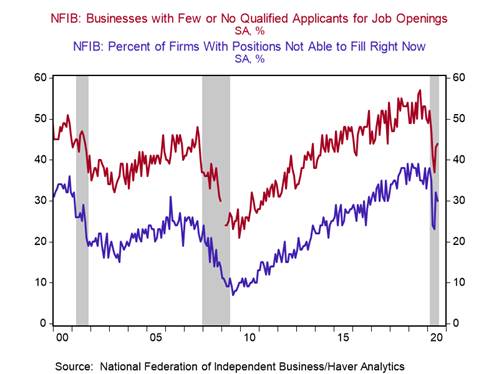

The NFIB survey reflected low staffing levels and elevated employment churn at small businesses in July. Firms reduced employment by 0.06 workers per firm on average, with 7% of firms increasing employment and 18% reducing employment. This is consistent with data from Homebase – a scheduling and time tracking tool used by small businesses – that shows flat employment since late June, and ADP’s estimate of a slight 38k increase in small business (<500 employees) employment in July (Charts 5 and 6). Only 30% of small businesses had job openings they could not fill in July, down from the pre-pandemic average of 37%, and only 44% reported few or no qualified applicants for job openings, compared to 52% pre-pandemic (Chart 7). These labor market assessments suggest that soft labor demand continues to be a bigger problem than insufficient labor supply stemming from the government’s income support programs.

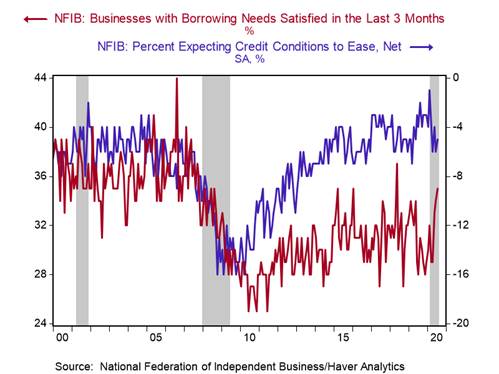

Unlike the Great Recession of 2008-2009, small businesses continue to rank credit conditions very favorably, reflecting the Fed’s aggressive policy initiatives and the government’s financial support to small businesses through the Paycheck Protection Program (PPP). The percent of businesses reporting that borrowing needs were satisfied in the last three months jumped to 35%, one of the highest values over the last 12 years, and the net percent of respondents expecting credit conditions to ease remained relatively high (Chart 8). The actual interest rate paid on short-term loans by small businesses fell to 4.1% in July, the lowest on record.

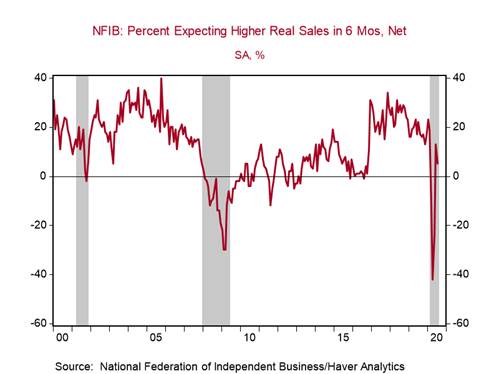

Inflationary pressures remain benign. The net percent of small businesses raising average selling prices remained depressed at -2% and the net percent planning to raise prices inched up to 13%, still well below the pre-pandemic average of 21%. Sluggish demand will continue to place downward pressure on prices in the initial stages of the recovery. Indeed, the net percent of small businesses expecting higher real sales in the next six months fell to 5% in July, well below its 2019 average of 18% (Chart 9).

The net percent of small businesses reporting that current inventory levels are too low remained relatively elevated at 1% in July. The government shutdown constrained production while the reopening of the economy resulted in a faster rebound in consumption than production, resulting in dramatic inventory liquidation (U.S. Real GDP plunged in Q2, July 30, 2020). Further growth in manufacturing production is needed to replenish business inventories in coming quarters.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Roiana Reid, roiana.reid@berenberg-us.com