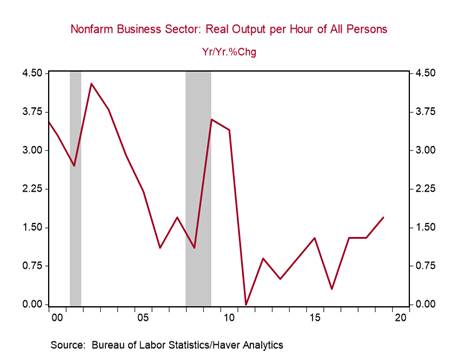

*U.S. nonfarm productivity ‑- real private sector output per hour worked ‑- increased by 1.4% q/q annualized in Q4 (consensus: +1.6%), reflecting a 2.5% q/q annualized increase in real nonfarm output and a 1.1% increase in hours worked. The yr/yr change in productivity increased to 1.8% in Q4 from 1.5% in Q3, continuing a trend of solid gains. Following years of subdued performance, productivity growth lifted to 1.3% in 2017-2018 and to 1.7% in 2019, the fastest rate of growth since 2010 (Chart 1).

*Unit labor costs (ULCs) increased by 1.4% q/q annualized in Q4, reflecting a 2.8% q/q annualized increase in compensation per hour minus the 1.4% increase in productivity. The 2.4% yr/yr change in ULCs in Q4 is close to the higher end of the range over the last five years (Chart 2).

*Productivity in the manufacturing sectors fell 1.2% annualized in Q4, lowering its yr/yr to -0.7% from -0.2%, its third consecutive quarterly decline. With compensation in manufacturing sectors rising 4.6% yr/yr, this boosted ULCs in manufacturing to 5.3% yr/yr. This input to manufacturing firmsâ margins requires close scrutiny.

Productivity growth increased to 1.4% on average over the last three years from 0.8% between 2012 and 2016. This is not exceptional by historical standards, but stronger productivity growth lifts estimates of longer-run potential GDP growth, constrains increases in ULCs, and supports higher real wages. It is decidedly positive for broader economic performance. Surprisingly, this stronger productivity growth has been accompanied by sustained strong job growth.

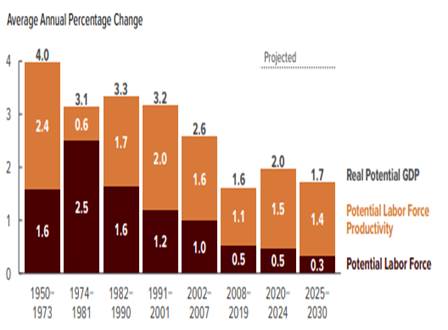

The Congressional Budget Office (CBO), in its just-released Budget and Economic Outlook: 2020-2030, projects that the pick-up in productivity growth in recent years will be sustained. It forecasts 1.5% annual growth in potential labor force productivity between 2020 and 2024, and 1.4% growth between 2025 and 2030, compared to the 1.1% increase between 2008 and 2019 (Chart 3). The labor force is expected to grow more slowly in the second half of the decade as the population ages.

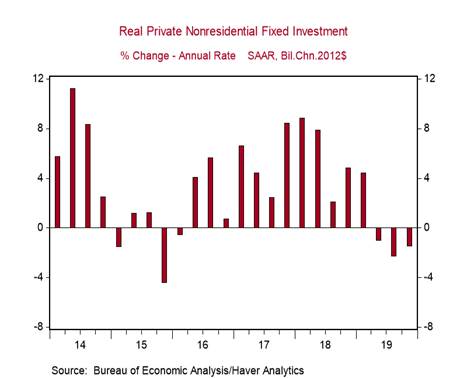

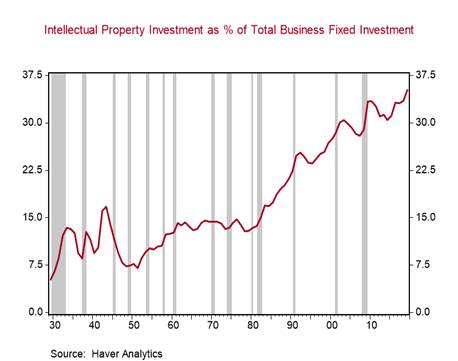

Note that the improvement in productivity growth in 2019 occurred despite the tariffs and trade-related uncertainties that likely offset some of the positive deregulatory initiatives and policies from the Tax Cuts and Jobs Act. Indeed, business fixed investment declined for three consecutive quarters in 2019 (Q2: -1% q/q annualized, Q3: -2.3%, Q4: -1.5%). See Chart 4. On the flip side, investment in intellectual property products (less sensitive to external developments) increased by 7.7% in 2019, its second fastest rate of growth over the last 19 years. Its share of total business fixed investment increased to 35% in 2019, the highest on record (Chart 5). Subsiding trade related uncertainties may lift business confidence and contribute to further improvement in productivity, although this may be offset by Presidential election-related jitters.

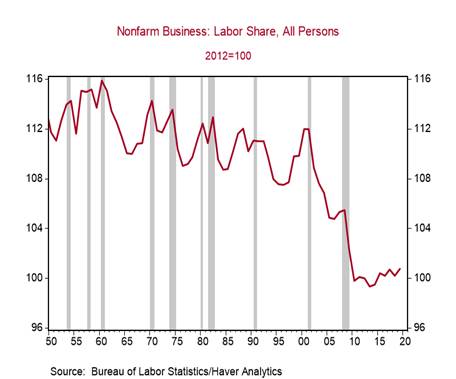

Labor compensation as a share of output remains very low historically and has declined significantly since 2001 (Chart 6).

Chart 1:

Chart 2:

Chart 3: CBOâs projections for productivity and labor force growth

Source: Congressional Budget Office

Chart 4:

Chart 5:

Chart 6:

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com