Moderating inflation may encourage the BoE to strengthen the signal for a first rate cut in Q2

A further sizeable drop in headline inflation, to 3.4% yoy in February from 4.0% in January, will be welcomed by Bank of England (BoE) rate setters ahead of their March policy decision – due this Thursday at 12:00GMT. The February print came in below Bloomberg expectations of 3.5% yoy. So far, the BoE has been reluctant to give very strong guidance about the precise timing of the first cut. But after two years of economic stagnation following the massive gas supply shock in early 2022, policymakers will likely be hoping to take their foot off the monetary policy brake soon to support an already building recovery. Although headline yoy inflation remains too far above the 2% target to lower the bank rate just yet, it is fast heading towards target and another big drop is due in April when the consumer energy price cap declines again. There is a chance after today’s data, therefore, that policymakers give a nod to current market expectations for a first cut in June - which they can cement in May when they update their economic projections. A further dovish tweak at the March meeting would be in line with the trend in recent meetings of policymakers gradually losing their hawkish bias and turning instead towards the question of when to cut rates.

At the BoE’s February meeting two policymakers still preferred to hike the bank rate (currently 5.25%) by another 25bp while one member preferred to cut already. We would not be surprised if one or even both hawks voted this week to hold instead of hike or even if an additional member voted for a cut. In the past, the early moves of dissenters have often signalled upcoming turning points in BoE rate cycles. Short of another major supply shock to prices, we expect headline yoy inflation fall to 2% in spring and remain close to that rate for the remainder of the year. In turn, we look for the BoE to cut the bank rate five times in 2024, in 25bp increments, to 4.0% by year end. We then look for a further 50bp of cuts to 3.5% in early 2025. The risks to our call are tilted towards fewer cuts in 2025 – especially if the economic recovery builds a head of steam and policymakers begin to worry that strong growth could reignite wage pressures in already tight labour markets.

February inflation summary – base effects still dominate

Headline inflation based on the consumer price index (CPI) rose by 0.6% mom in February, offsetting the 0.6% mom fall in January but well below the 1.1% mom rise in February 2023. Despite the monthly rise, the headline rate declined on a yoy basis (see first paragraph) due to the still large negative base effect coming from energy prices. While measures of domestically generated inflation such as core inflation (which strips out volatile energy and food prices) and services prices (which are sensitive to domestic wage pressures) remained above headline inflation they continued to decline on trend. Core inflation decreased to from 5.1% yoy in January to 4.5% in February while services prices fell from 6.5% to 6.1% over the same period. While core inflation was slightly below consensus expectations (4.6% yoy) services prices grew slightly faster than expected (6.1%).

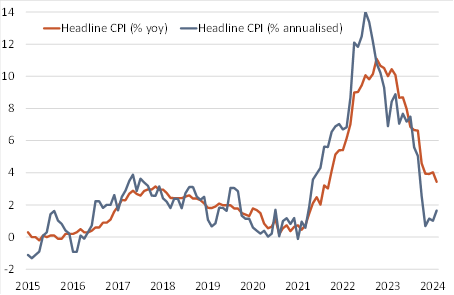

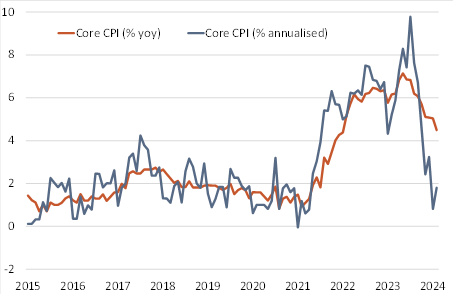

Due to the rapid acceleration in price growth through 2022 and H1 2023, yoy inflation rates remain inflated by base effects – and hence give a distorted picture of the recent trend in prices. In Charts 1a and 1b we compare yoy and six-month annualised calculations of headline and core inflation. The charts show that while the yoy change remains above the BoE’s 2% target for both aggregates, the picture is different on a six-month annualised basis (non-seasonally adjusted data). Both headline and core inflation are de facto at the BoE’s target – in coming months, yoy rates will converge towards the lower annualised rates.

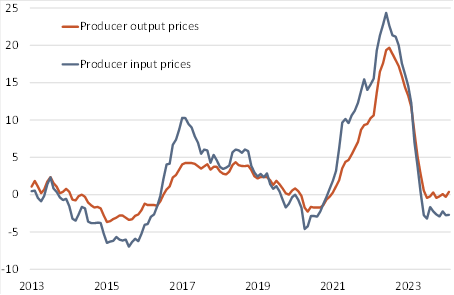

Looking across the components of CPI, nine of the twelve major components contributed to the decline in the annual rate of headline inflation between January and February, with the largest effects coming from food and non-alcoholic beverages (-0.23pp), restaurants and hotels (-0.13pp), communication (-0.06pp), and recreation and culture (-0.05pp). Producer prices remained soft in February – Chart 2. Input prices declined by 2.7% yoy after a 0.4% mom fall, while output prices rose by just 0.4% yoy after and 0.3% mom rise.

Chart 1a: Headline CPI – yoy and annualised (% change) | Chart 1b: Headline CPI – yoy and annualised (% change) |

|

|

Annualised estimates based on a six month moving average. Monthly data. Source: ONS | |

Chart 2: Producer prices |

|

In % yoy. Monthly data. Source: ONS |

Kallum Pickering

Senior Economist, Head of ESG & Data, Director

Mobile +44 791 710 6575

Phone +44 203 465 2672

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom![]()

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and authorised and regulated by the Financial Conduct Authority, firm reference number 959302. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to.