Running hot: Chancellor Rachel Reeves today announced a major loosening of fiscal policy and a substantial increase in the size of the state. That presents an upside risk to our forecast for GDP growth of 1.5% in 2025. It also suggests that the Bank of England will have to be cautious when lowering interest rates. Because the Office for Budget Responsibilityâs forecast now envisages the economy overheating, the fiscal watchdog took the unusual step of increasing its interest rate assumptions by 25bps compared to what was priced into financial markets in its new forecast.

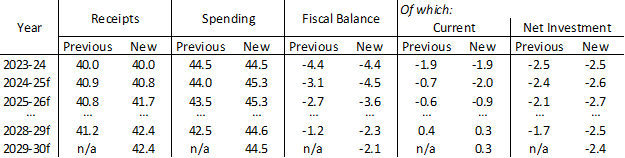

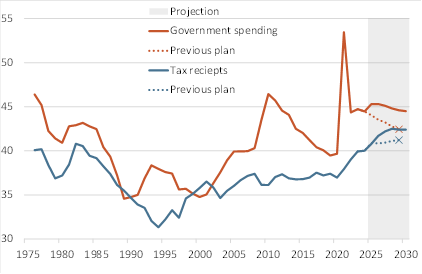

Part 1 - A larger state: It is helpful to split the budget package into two parts. Part one contains a large increase in day-to-day spending of £40bn (1.4% of GDP) to be funded almost entirely by a rise in taxation. As a result, the new Labour government will expand the state substantially, raising the tax burden to its highest level since 1950 â see Chart 1. Taken by itself, âpart 1â would provide a boost to near-term growth, as the government will raise day-to-day spending immediately but ramp up taxation only gradually over the next two years. According to the budget projections, the UK will meet the primary fiscal rule of eliminating the budget deficit for current expenditures (covering day-to-day spending with tax revenue) in the fiscal year 2029/2030 with £9.9bn (0.3% of GDP) to spare â see Table 1. However, the tight margin raises the risk that the government will need to raise more revenue in the future.

Part 2 - Borrow to invest: Rather than cutting public investment from 2.5% to 1.7% of GDP as the previous Conservative administration had planned, the government will spend an additional £21bn a year to sustain it at around 2.5% of GDP. That will prevent the UK falling further behind other G7 countries on public investment, but still leave it close to the bottom of the league table. Far more important for the UKâs long-term growth prospects is private investment, which has been hamstrung by an uncertain policy environment and high interest rates in recent years. While the government should put in place consistent policy, the intraday rise in gilt yields since the Chancellorâs speech ended highlights the risk that looser fiscal policy will crowd out some private investment. That could partly offset the boost to the economyâs supply side from higher levels of public investment.

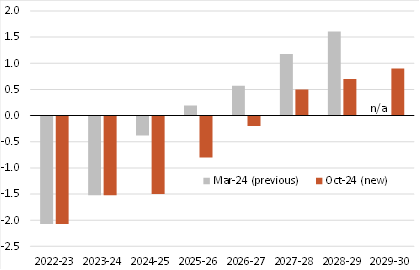

Multipliers versus incentives: Compared to a pre-budget baseline of severe fiscal consolidation, the Chancellor today announced a significantly less austere fiscal policy, by about 1% of GDP. Fiscal policy will still tighten, just more gradually than planned before â see Chart 2. Large fiscal multipliers for investment spending will help make the budget more growth friendly. But set against that, the increase in taxation will weigh on supply. Most of the £36bn increase in annual tax revenue stems from a rise in employersâ National Insurance Contributions, expected to bring in £24bn a year. Coming on top of successive large increases in the minimum wage, that will add to the upward pressure on labour costs for firms reliant on low-paid employees and weigh on hiring. Note, though, that the tax burden on employees is still lighter in the UK than in most of the rest of the Europe. So the benefit from fixing other problems, like underinvestment, could therefore more than offset this drag.

Ambiguous net effect on long term growth: Cancelling cuts to public investment will help prevent the UK from continuing to underinvest. But with the labour market still close to capacity and inflation stickier than elsewhere, the scale of the turn away from austerity in the budget was unnecessary. The 13bp rise in the 10-year gilt yield in the aftermath of the Chancellorâs speech shows that there is now a greater risk that stronger demand causes the BoE to slow the pace of rate cuts, which would hinder the recovery in private investment we forecast. Alongside an increase in the size of the state, that limits the boost from the budget to the economyâs long run growth rate.

Table 1: Changes to the forecasts of key fiscal aggregates (in % GDP) |

|

In % GDP. 2023-24 is outturn data, ââ denotes OBR forecasts. âPreviousâ is the March 2024 OBR forecast and ânewâ the October 2024 forecast released today. The OBR includes 2029-30 for the first time in the October forecast. |

Chart 1: Government tax revenue & spending |

|

In % GDP. Government spending is total managed expenditure and receipts public sector current receipts. Projection is the new OBR October 2024 projection. Dotted lines show the OBRâs March 2024 forecast. Sources: Haver, OBR, Berenberg |

Chart 2: Cyclically-adjusted primary deficit |

|

In % GDP. The primary balance excludes the cost of debt interest payments. Cyclically-adjusted based on OBR estimates of the output gap to provide a measure of fiscal stance. Sources: OBR, Berenberg. |

Andrew Wishart

Senior UK Economist

+44 20 3753 3017

For Berenberg the protection of your data has always been a top priority. Please find information on the processing of personal data here.

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail. In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com. Deutscher disclaimer.

Click here to unsubscribe from these emails.