Positive downside surprise

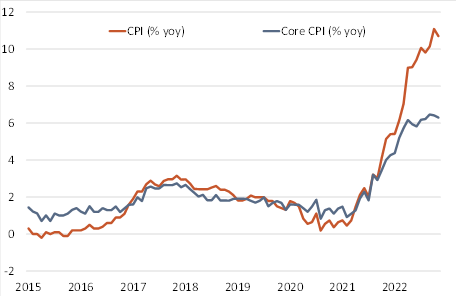

Following on from the positive inflation surprise in the US yesterday, a bigger-than-expected slowdown in UK inflation in November adds to the growing evidence that price pressures have probably peaked in the Western world. UK inflation dropped to 10.7% yoy in November from 11.1% in October.The annual rise was below consensus (10.9%) and our expectations (10.8%) - Chart 1. Month-on-month, prices rose 0.4% - a sharp drop versus October when the jump in household energy costs pushed the consumer price index up by 2.0% mom.

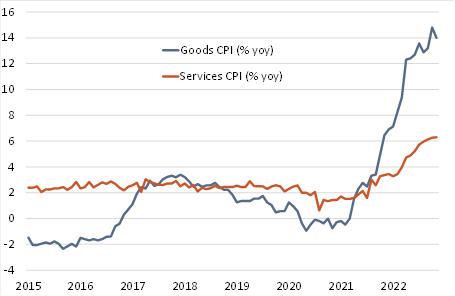

Core inflation, which strips out the often volatile energy and food components, dropped to 6.3% yoy in November from 6.5% in October – consensus had expected no change in the annual rate. Core inflation rose by 0.3% mom, down from 0.5% mom in October. On an annual basis, services inflation remained stable at 6.3% in November (Chart 2). Goods price inflation declined to 14.0% yoy from 14.8%.

Early Christmas present for the Bank of England

Policymakers at the Bank of England tomorrow look set to hike the bank rate by 50bp to 3.5%. While the sizeable drop in headline and core inflation in November will probably will not affect tomorrow’s decision, it strengthens our call that the BoE will not hike further beyond tomorrow’s move. While there is some risk that policymakers may go for one final 25bp hike at the February meeting, the case for doing so is weakening. As monetary policy works with a lag, we still do not know the full effects of the BoE’s tightening measures so far.

After hiking again tomorrow, it probably makes sense for policymakers to stand back and pause for a while until it becomes clear whether there remains any serious underlying inflation problem in the UK once the base effects of high energy prices wash out and the disinflationary forces of recession and tighter financial conditions have fully impacted price pressures.

Good news for risk markets

Although the outlook for inflation remains uncertain, and will depend a lot upon the course of the ongoing recession and global commodity price developments, a growing confidence that inflation has probably peaked reduces the risk central banks will have to go much further than signalled to curb inflation. This can support a recovery in risk appetites in financial markets.

Chart 1: UK headline and core consumer prices |

|

Monthly data. Source: ONS |

Chart 2: UK services and goods inflation |

|

Monthly data. Source: ONS |

Kallum Pickering

Senior Economist, Director

Mobile +44 791 710 6575

Phone +44 203 465 2672

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom![]()

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.