Click here for full report and disclosures

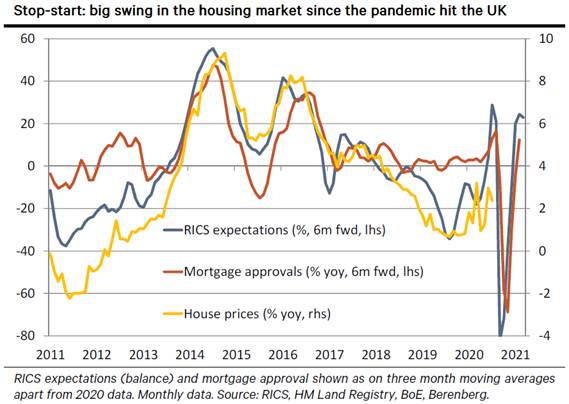

â  Stop-start: All aspects of housing market activity â construction, viewings and appraisals â ground almost to a halt when the UK was put under lockdown on 23 March to contain the spread of COVID-19. Fortunately, this turned out to be a temporary blip rather than the start of a sustained downtrend. As soon as housebuilders and mortgage brokers returned to work from mid-May onwards, the market sprang back to life. Recent trends are positive. Demand is up and prices are rising. Once again we have to ask ourselves, is it a blip or the start of a trend?

â  Gaining momentum: After sliding 72.9% between February and May, mortgage approvals snapped back during the summer. In August, they were a mere 2.0% below the pre-pandemic peak. From a low of -32.6% in May, the RICS house price balance jumped to an 18-year high of 61.4% in September while the expectations balance remained stable at 22.9% â up from -81.8% in March (the second lowest on record). The RICS balance of buyer enquiries (51.5%) and new vendor instructions (38.8%) remained firm in September. UK house prices increased 2.2% yoy in the three months to July versus 0.9% for the same period in 2019. Judging by the usual lag between mortgage approvals and survey expectations, house price growth looks likely to accelerate towards the 3-4% yoy range in the coming months â see chart.Â

â  What is behind the uptick? Three factors are driving the rapid turnaround in the housing market. First, the sector is playing catch-up after the lockdown, with the recent flurry of transactions partly reflecting pent-up demand. Second, due to the involuntary surge in household saving during the lockdown, many potential buyers now have more cash at their disposal. This raises the pool of potential buyers as well as the amount the average buyer can spend on a house. Third, backed by aggressive monetary policies that ensure a steady flow of cheap liquidity through the banking sector, the government is subsidising mortgages for new homes via its Help to Buy scheme. Since 8 July, the government is also supporting transactional activity with the stamp duty holiday on all homes up to £500k (ends 31 March 2021).

â  Uncertain supply outlook: In 2019, c52k houses were built in Great Britain per quarter, well below the 75k needed to meet the governmentâs ambition â for England only â to add net 300k homes to the stock per year by the middle of the decade. Concerned about continued risks and uncertainties linked to pandemic and a potential disorderly hard exit from the EU single market on 31 December, housebuilders will remain reluctant to start building on new sites until well into the new year. While the completion of existing projects will add to supply, the smaller flow of new houses onto the market since the summer and into next year could add to near-term house price inflation.  Â

â  Misguided policies do more harm than good: Rebounding employment and wages, as well as easily available low-cost mortgages, should underpin sustained gains in housing demand over the next few years. However, because the housing market has avoided a major correction despite the huge economic shock from the pandemic, it is now running well ahead of the broader economic upswing. The UK real estate sector is notoriously prone to big swings that can amplify the business cycle â as in the late 1980s/early 1990s or mid-2000s. We need to watch closely for signs of overheating in the coming years. The news that the government will promote home ownership by increasing the availability of high-risk 95% loan-to-value mortgages â with state support and less-stringent criteria â adds to this risk.

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659