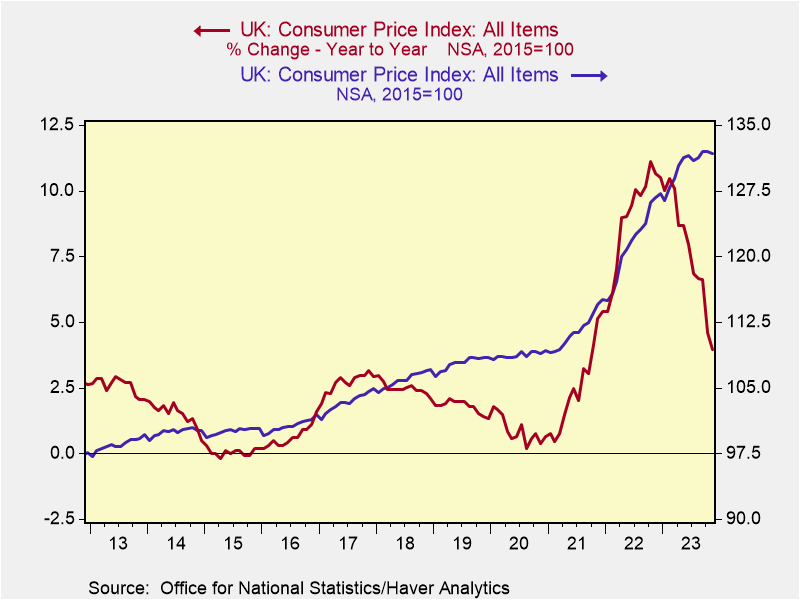

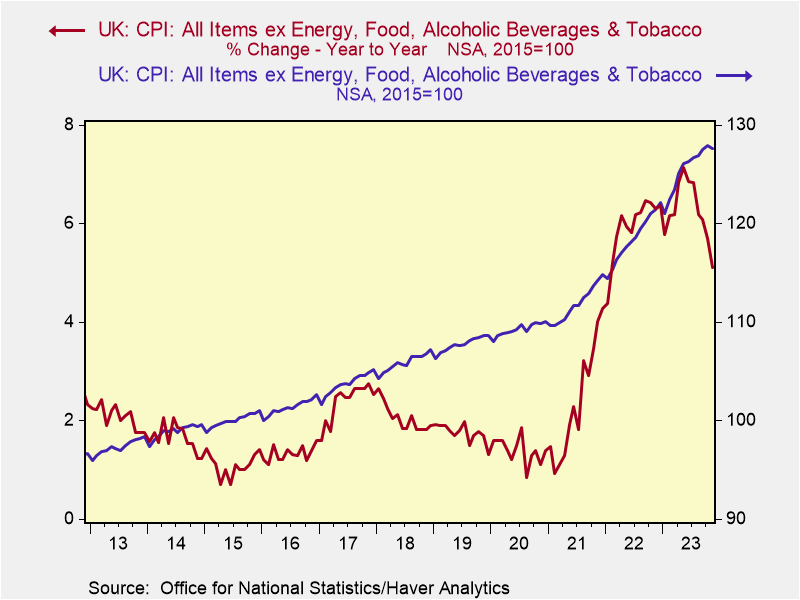

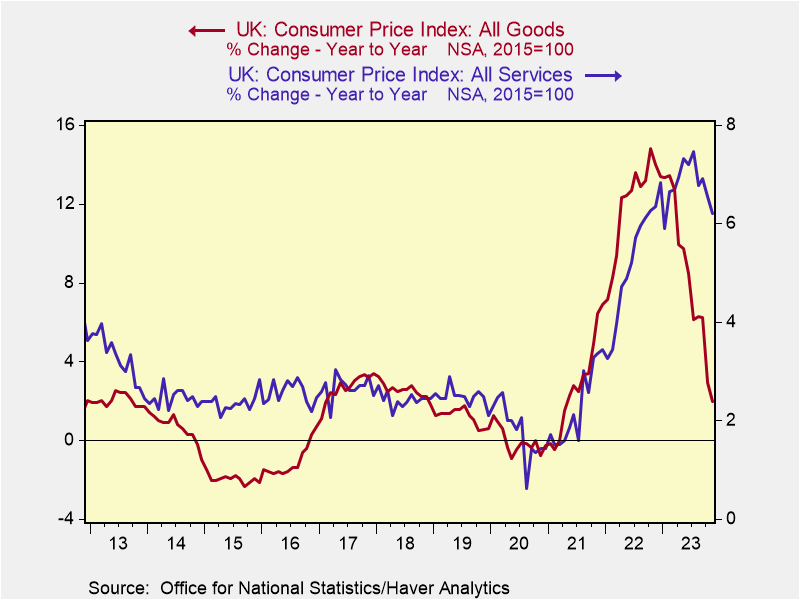

Big downside surprise: After a series of upside surprises to monthly inflation data during spring, which had prompted mostly overdone worries that UK inflation was much stickier than in other parts of the advanced world, inflationary pressures are easing rapidly. All key inflation measures fell below expectations in November. Headline inflation slowed to 3.9% yoy from 4.6% in October after a 0.2% mom fall – Chart 1. According to Bloomberg, consensus had expected that the yoy rate would slow to 4.3%. Core inflation, which strips away volatile energy and food prices, also slowed by more than expected: dropping to 5.1% yoy in November from 5.7% in October. Domestic-oriented services prices also moderated by more than expected. Services prices slowed to a still-high 6.3% yoy in November from 6.6% in October – whereas consensus had expected no change (Chart 3). Goods prices eased to 2.0% yoy from 2.9% in October.

Ignore the BoE, follow the data? Although Bank of England (BoE) policymakers are at pains to push back against growing rate cut bets for 2024 while inflation is still well above target, the direction of travel for prices now seems clear. Although all key inflation measures remain above the 2% yoy rate which the BoE aims for, the trend of the past few months suggests that inflationary pressures are fading about as quickly as they had emerged. As our charts show, abstracting from the big gas-related base effects, the level of overall prices has been largely moving sideways since the middle of the year. More recently, the rate of core price growth seems to be levelling off too. Reacting to the positive inflation surprise, the market for overnight index swaps (OIS) further added to its rate cut bets for 2024 and 2025 after big moves already in recent weeks. The OIS market now looks for roughly five cuts in 2024, with the bank rate falling from 5.25% to c4.0%, followed by four more cuts in 2025 to a year-end rate of c3.0%. Following the big downward shift in BoE rate expectations in recent months, the OIS market is now roughly in line with our own year-end calls for 2024 and 2025 which we have held since June.

Chart 1 |

|

Chart 2 |

|

Chart 3 |

|

Kallum Pickering

Senior Economist, Head of ESG & Data, Director

Mobile +44 791 710 6575

Phone +44 203 465 2672

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom![]()

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and authorised and regulated by the Financial Conduct Authority, firm reference number 959302. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.