Inflation will be below 2% only temporarily: The larger than expected drop in CPI inflation, from 2.2% yoy in August to 1.7% in September (consensus 1.9%), is likely to reverse in October due to an increase in household energy bills. But the downside surprise in September inflation reflects more than lower energy prices - core inflation excluding energy and food also dropped back to a three-year low, decelerating from 3.6% yoy in August to 3.2%. If that is sustained, the chance would rise that the Bank of England may cut rates by 25bp in December, on top of the 25bp rate reduction that we forecast in November.

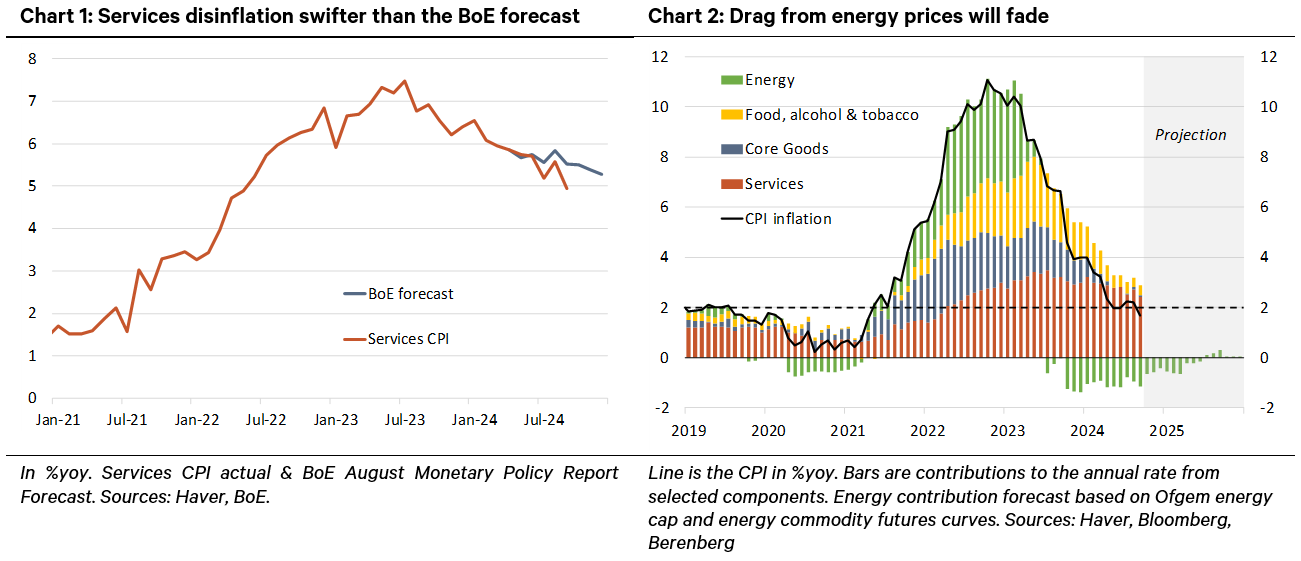

Softer services prices: Volatile components played their part in the drop in services inflation from 5.6% yoy in August to 4.9% in September (consensus 5.2%). In particular, the volatile airfares category accounted for 0.2ppts of the decline in the annual rate and hotels another 0.05ppts. But wider disinflation in the services sector progressed too, and faster than the Bank of England expected. Indeed, services inflation of 4.9% in September was the lowest rate since May 2022 and well below the BoE’s forecast that it would be 5.5% - see Chart 1. Greater confidence that services inflation is on a downward path may eventually embolden the BoE to speed up the pace of interest rate cuts.

Energy drag fades: Nonetheless, services price inflation is still running hotter in the UK than in the US and Europe. That will translate into a rise in the headline inflation rate as the offsetting drag from falling utility bills fades. A 10% increase in the household energy price cap in October will add 0.5ppts to the headline rate, likely raising headline inflation back above the 2% target – see Chart 2. Against a background of slightly above target inflation throughout 2025, the BoE will find it hard to justify a faster pace of rate cuts.

Demand boost? While the latest GDP data was a little dissapointing, we still see a robust case for strong private consumption to drive above-consensus GDP growth next year. Lower inflation supports this view as it boosts households’ real purchasing power. With wage growth currently running at 4-5% yoy depending on the measure used and inflation around 2%, real incomes are growing solidly. Over time, that will support demand. So we still think the BoE needs to be wary of loosening policy too quickly. Reducing services price inflation from its current pace of 4.9% yoy to 3%, which has historically been consistent with headline inflation of 2%, could yet prove difficult.

Andrew Wishart

Senior UK Economist

+44 20 3753 3017