One surprise after another

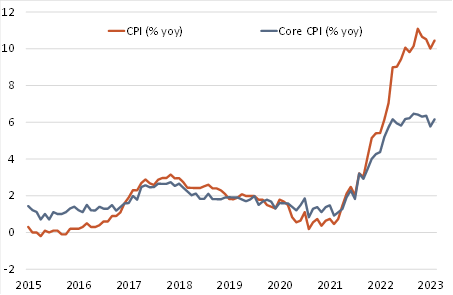

Inflation data surprised to the upside in February, jumping to 10.4% yoy from 10.1% in January – Chart 1. The consumer price index rose by 1.1% mom. The annual rise in prices exceeded both the market’s (9.9%) and our (10.1%) expectations. This upward jump in inflation interrupts the downward trend since October (when the annual change in prices peaked at 11.1%) – a downward trend which is all but certain to continue over the course of 2023 as energy base effects wash out. As monthly data can be highly volatile, we would not put too much weight on one-off surprises. After all, the bigger-than-expected jump in February comes immediately after the bigger-than-expected drop in January when the headline rate slowed to 10.1% yoy from 10.5% in December – below an expected 10.3% rate according to Bloomberg.

Finely balanced decision for the BoE

The significant upside surprise complicates the monetary policy decision for the Bank of England tomorrow. Following the serious banking sector troubles and resulting tightening of financial conditions, we changed our call to a hold at the 4.0% bank rate from our previous call of a 25bp hike. But the inflation data for February skew the risks towards a further hike. The decision will hinge on whether policymakers believe the backward looking inflation surprise is likely to be the start of a trend or whether it is a one-off linked to normal monthly volatility. Furthermore, policymakers will need to judge whether a likely period of liquidity hoarding and cautious lending behaviour by banks de facto does the BoE’s job for it – at least for a while. As the BoE is likely at or close to the end of its rate hike cycle, as signalled in February by its shift to data-dependant mode, this is probably the most finely balanced decision in living memory.

Caution still favours a hold

Amid the developing and fluctuating situation in the global banking system, and given that monetary policy is by now already tight, a cautious hold still makes sense, in our view. Policymakers could signal that further hikes may be necessary if financial conditions settle and inflation data continue to surprise to the upside. Hiking into potential further troubles in credit markets before the full impact of the global monetary policy tightening of 2022 has unfolded risks adding to problems that would eclipse those associated with excess inflation over the medium-term.

Big jumps in domestically-oriented prices

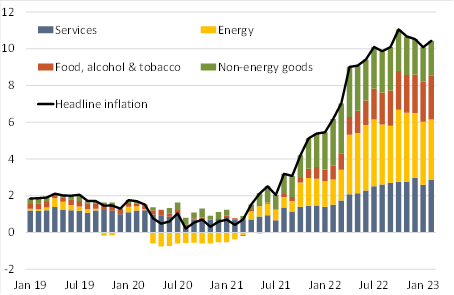

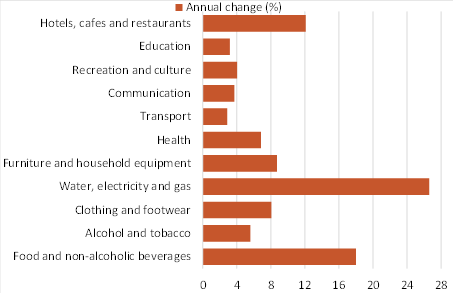

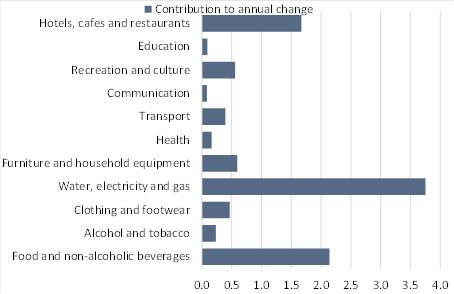

Goods prices, which are driven largely by the terms-of-trade shock in energy and food caused by Russia’s invasion of Ukraine, continued to grow strongly by 1.3% mom to 13.4% yoy in February – up slightly from 13.3% in January. The largest upside surprises occurred in the more domestically-focused parts of the consumer basket, namely core inflation (which increased to 6.2% yoy in February from 5.8% in January following a 1.2% mom rise), including services prices (which jumped to 6.6% yoy in February from 6.0% in January with a 1.0% mom rise) – Chart 2. The largest monthly increases occurred in food and non-alcoholic beverages (2.1% mom), clothing and footwear (2.6% mom) and restaurants and hotels (1.9% mom) – Charts 3a and 3b.

Important statistical note: Although the ONS changed the weights in the CPI basket in January and February – which can occasionally lead to sudden shifts in the headline rate, re-calculating the annual rate in February based on 2022 weights did not materially change the headline estimate. In other words, the surprise is a real rather than a statistical phenomenon.

Chart 1: UK headline and core consumer prices |

|

Monthly data. Source: ONS |

Chart 2: CPI breakdown by major category |

|

Annual percent change in consumer price index. Percentage point contribution from key components. Source: ONS |

Chart 3a: CPI breakdown by major component (% yoy) | Chart 3b: Contribution to headline CPI % yoy (ppt) |

|

|

Monthly data. Source: ONS | Monthly data. Source: ONS |

Kallum Pickering

Senior Economist, Head of ESG & Data, Director

Mobile +44 791 710 6575

Phone +44 203 465 2672

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom![]()

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.