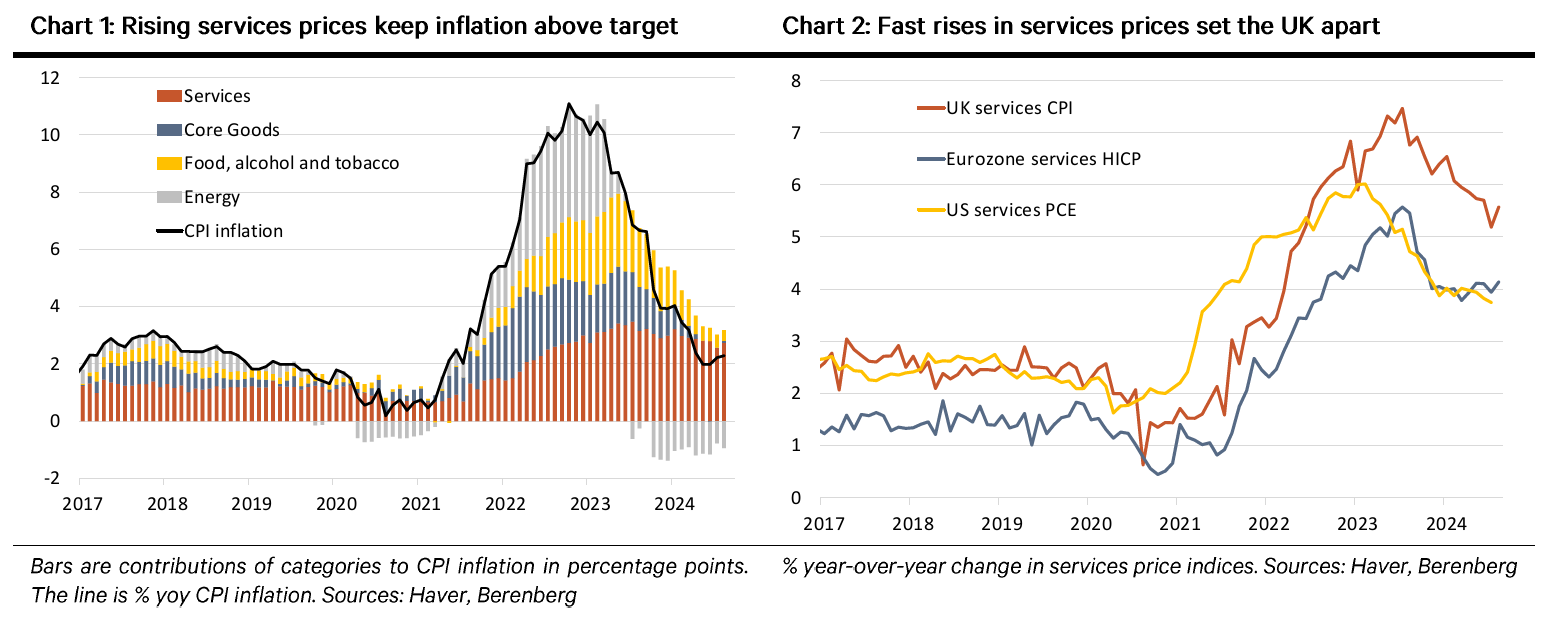

Breakdown of inflation highlights monetary policy challenge: Unchanged CPI inflation of 2.2% yoy in August masks the UKâs sticky inflation problem. While inflation came in below the Bank of Englandâs (BoEâs) forecast of 2.4% and in line with the Bloomberg consensus, the most persistent elements remain too high for comfort. Indeed, the only reason inflation did not increase is that price increases in the food alcohol and tobacco component fell from -0.6% yoy in July to -0.9% in August and in the energy component from -10.9% to -13.2%. That was enough to offset a rebound in inflation in services prices from 5.2% in July to 5.6% in August - see Chart 1. The rise in volatile airfares inflation, which rebounded from a dip last month, was the main driver of the rise in services inflation in August compared to the previous month.

Inflation likely to rise ahead: The large drag on inflation from energy prices will wane over the remainder of the year. While overall energy prices fell in August, the energy regulatorâs (Ofgem) announcement that the cap on household energy prices will rise by 10% in October suggests that trend will soon change. Price increases in the services sector are large enough to keep inflation above target on their own, contributing 2.7ppts to headline inflation in August. We see little prospect of it slowing suddenly. Indeed, services inflation is broad-based across the sector and tends to follow pay growth, which also remains elevated (see âBoE has good reason to hesitateâ). As inflation in energy prices rises, we expect CPI inflation to increase to 2.6% in Q4. The Bank of England (BoE) forecast a rise to 2.8%.

Unfavourable international comparisons: The surge in services prices is more pronounced in the UK than in the other major economies, which explains why we think that UK interest rates will only be lowered gradually. The latest increase in services prices of 3.7% yoy in the US (July) and 4.1% in the eurozone (August) are substantially lower than the UKâs 5.6% rate (see Chart 2.) Despite some evidence of labour market cooling, we expect the BoE to keep Bank Rate on hold at 5% tomorrow. That would make it an outlier after the ECB cut last week and the Fed lowers rates this evening (See âBoE preview: Data favours the doves but not enough to cutâ).

Andrew Wishart

Senior UK Economist

+44 20 3753 3017