Upside surprise rules out December cut: The larger jump in UK CPI inflation than most analysts predicted in October shows that domestic price pressures are too strong for the Bank of England (BoE) to cut interest rates again in December. The jump in inflation, from 1.7% yoy in September to 2.3% yoy in October, was in line with our forecast but above the Bloomberg consensus estimate of 2.2%. Most of the increase in the annual rate of CPI inflation compared to the prior month was due to the downward impact of past declines in energy prices waning. But a tick up in services price inflation suggests domestic price pressures remain elevated.

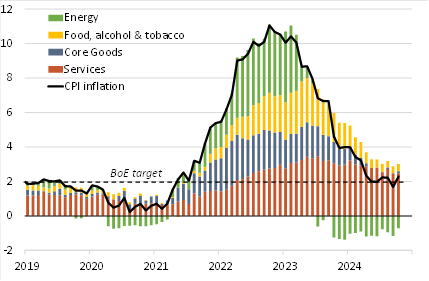

Energy price drag fades: Almost all of the rise in inflation in October was due to the fall in utility bills moderating â see Chart 1. The Ofgem energy price cap on UK householdâs energy bills fell in October 2023 as energy prices declined from their 2022 peak but rose this year, reducing the fall in energy prices from -16% yoy to -9% yoy. That accounted for 0.5ppt of the 0.6ppt increase in the headline rate compared to the previous month.

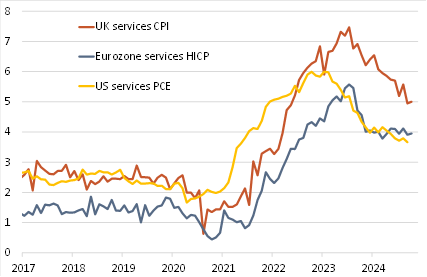

Underlying price pressures remain strong: While energy prices accounted for the bulk of the rise in the headline rate of inflation, underlying inflation also picked up. Core inflation, which excludes energy and food prices, firmed from 3.2% yoy to 3.3% yoy. While inflation in core goods prices rose, it was the rise in services price inflation from 4.9% yoy to 5.0% yoy which provided the strongest evidence that domestic price pressures remain strong. Historically services inflation of about 3% has been consistent with headline inflation of 2%. The UK is having more difficulty returning service price rises to that pace than the Eurozone or the US â see Chart 2.

Limited space to cut: The upside surprise in CPI inflation in October supports our view that persistent labour cost inflation will prevent the BoE from cutting by more than 25bp per quarter. In fact, in contrast to the consensus among economic forecasters that Bank Rate will drop to 3.75% by the end of 2025, we suspect that persistent inflation and a pick up in growth will cause the Bank to hold rates at 4.25% from Q2 next year.

Chart 1: Contributions to CPI inflation |

|

In ppt. Contribution to yoy CPI inflation. Sources: Haver, Berenberg. |

Chart 2: Services prices |

|

In % yoy. Sources: Haver, Berenberg. |

Andrew Wishart

Senior UK Economist

+44 20 3753 3017