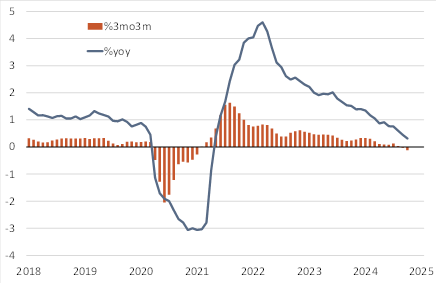

Employment at a tipping point: The rise in the unemployment rate to 4.3% in the three months to September from 4.0% a month earlier does not tell us a great deal because it is volatile due to data quality problems. However, the more reliable measure of payroll employment fell for a third consecutive month, confirming that hiring has stalled. In yoy terms payroll employment growth slowed to 0.3% yoy in September, continuing a downward trend that has been in place for three-and-a-half years â see Chart 1.

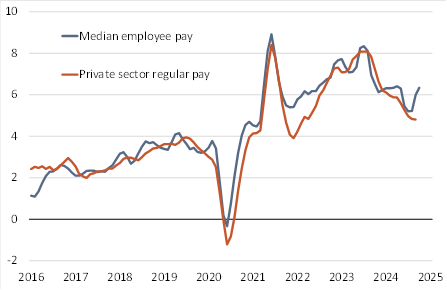

Pay growth robust: Growth in the three-month average of private sector regular pay, the Bank of Englandâs (BoEâs) preferred measure, was unchanged from the previous month at 4.8% yoy in September in line with the central bankâs forecast. It will tick up over the next few months due to base effects â the BoE forecast that it will rise to 5.1% yoy in December. However, the timelier payrolls-based pay data available for October suggest that, despite hiring cooling, pay growth could turn out significantly stronger than the BoE anticipates. Median employee pay growth rose from 6.0% yoy in September to 6.3% in October â see Chart 2.

Temptation to cut in December: The BoE faces a conflicting set of data. Employment has begun to contract but pay growth appears to remain strong. If employment softens again in the one remaining release before the 19 December BoE meeting and inflation is well behaved, the BoE will be very tempted to cut. But the fact wage growth is not yet responding raises the risk that more slack (i.e. higher unemployment) is needed for pay growth to slow to a target consistent pace of 2-3% yoy. We expect the BoE to hold off a cut in December, but it could be tight.

Chart 1: The number of payrolled employees is falling |

|

Number of employees paid through HMRCâs PAYE system. Sources: Haver, Berenberg. |

Chart 2: Pay growth remains robust |

|

In %yoy. Median total employee pay for workers paid through PAYE and 3-month average of private sector regular pay. Sources: Haver, Berenberg. |

Andrew Wishart

Senior UK Economist

+44 20 3753 3017