Click here for full report and disclosures

Click here to request a call about this note.

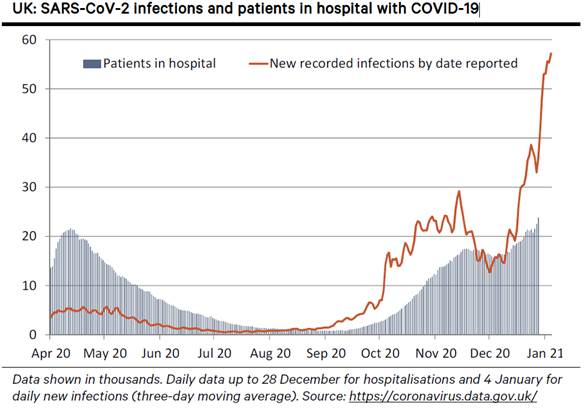

â  Lockdown 3.0: Reacting to a surge in the number of recorded SARS-CoV-2 infections and COVID-19 hospitalisations, UK Prime Minister Boris Johnson yesterday announced that England would enter a third lockdown beginning on 6 January. COVID-19 hospitalisations now exceed the peak of the first wave of the pandemic in April 2020. To ensure that hospital capacities do not become overwhelmed, the UK government has ordered the closure of schools, non-essential shops, restaurants (apart from takeaway services) as well as entertainment and recreational venues. Yesterday, Scotland announced similar measures that come into force today.

â  How long will the lockdown last? As the recent spike in the UK is mainly due to a new variant of the SARS-CoV-2 virus, which UK government epidemiologists estimate is up to 70% more transmissible, the timeline for the new measures is uncertain. A lot will depend on the pace of ongoing mass inoculation. The restrictions are likely to remain in place until the government has vaccinated the vast majority of the most vulnerable as well as frontline healthcare and social workers (15m), which will significantly reduce the risks to the healthcare system. Yesterday, Johnson aims to achieve this key stage of inoculation by the middle of February. As our base case, we expect a gradual re-opening from early March onwards, with faster progress of normalisation thereafter as more people are vaccinated and springtime heralds the natural remission of seasonal respiratory viruses.Â

â  Forecast changes: After rebounding at the start of the December after the November lockdown ended, UK economic activity had already started to soften again ahead of Christmas following the closure of restaurants and non-essential shops in key economic hubs such as London. But as retail, production and housing activity largely beat expectations in late 2020, we raise our Q4 2020 call to -3.5% qoq from -4.0%. However, following the new lockdown, the near-term outlook now looks much worse than before. Instead of a gain of 3.0% qoq in Q1 2020, we now project a 2.0% decline that is largely offset by faster catch-up growth in Q2 (9% versus 6% qoq), Q3 (4.5% versus 2.3%) and Q4 (1.3% versus 0.9%). On an annual basis, we now project an 11.5% decline in 2020 followed by gains of 6.0% in 2021 and a 6.5% gain in 2022 (previously -11.6%, 7.3% and 4.9%, respectively). Despite the near-term hit, the UK medium-term outlook remains positive. With much less Brexit uncertainty and strong gains in global demand ahead, UK real GDP can still recover to its pre-pandemic level by the end of 2022 as previously expected. Â

â  Extended policy support: For two reasons, the challenge of providing policy support to cope with the new lockdown is smaller than during earlier waves of the virus. First, financial markets and businesses can see the light at the end of the tunnel â mass vaccination should bring a decisive end to the pandemic this year. Second, both HM Treasury and the BoE are already providing markets, business and households with ample policy support. Fiscal policy tools such as the various coronavirus business loan schemes as the well as the furlough scheme (due to end 30 April) may need to be extended once again to further support private sector cash-flow and jobs. Chancellor Rishi Sunak today announced new grants for eligible businesses in the hard-hit retail, hospitality and leisure sectors. While markets may begin to price in a higher chance that the BoE will soon cut the bank rate below zero, it remains unlikely, in our view. To support confidence, the BoE may announce an increase in the pace of ongoing asset purchases â it has plenty of scope to achieve this within its current plan to buy £150bn of gilts until the end of 2021.

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659