Click here for full report and disclosures

â Rising risks trigger policy reaction: Amid the growing economic risks from COVID-19, we need to consider what a bad-case scenario could look like in the event of a major outbreak in the UK and, in turn, how policymakers are likely to react before any such risks could begin to materialise.

â Full-blown crisis ahead? Unlikely. The risk that an acute period of economic stress could turn into a full-blown crisis remains low. The UK is well placed to deal with a significant shock. With the right policy response to buffer the short-term temporary disruption, the UK should rebound once the virus shock fades.

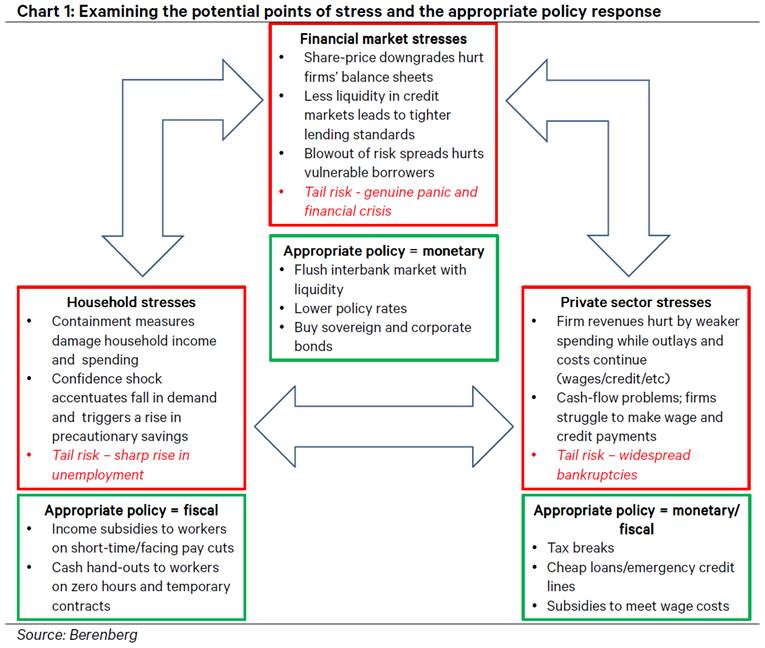

â Broad policy response: The forthcoming monetary and fiscal response will be focused on supporting the parts of the economy facing the most stress. In Chart 1 we highlight three such areas: financial, private and household. An effective policy response can contain the risk that problems in one area could spill into another and create negative feedback loops – see green boxes.

â BoE eases: We now expect the BoE to cut the bank rate by 25bp to 0.5% at its upcoming 27 March meeting. It will also probably signal that it could begin to buy bonds (QE – quantitative easing) if economic risks increase further. Further out, we see a 40% chance that the BoE could announce a further rate cut at the 7 May meeting. If the BoE does not announce any QE alongside its rate cut on 27 March, any further cut in rates in May would probably be reinforced by a round of QE.

â Fiscal help at the budget: We expect Chancellor Rishi Sunak to announce a series of emergency measures at the upcoming 11 March budget to help households and firms hurt by the virus disruptions. The measures are likely to be focused on maintaining employment and incomes through tax breaks and direct subsidies.

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659