Click here for full report and disclosures

â Forecast change: Due to the plans for much higher government consumption unveiled in the budget, we raise our forecast for real GDP growth in 2025 from 1.5% yoy to 1.7%. With unemployment low, stronger demand will cause inflation to drift back up to an average of 2.6% yoy in 2025. The Bank of England (BoE) will have to lean against looser fiscal policy, likely by ending its rate-cutting cycle after just three more cuts at 4.25% in Q2 2025, rather than 4.0% in Q3, as we had previously expected.

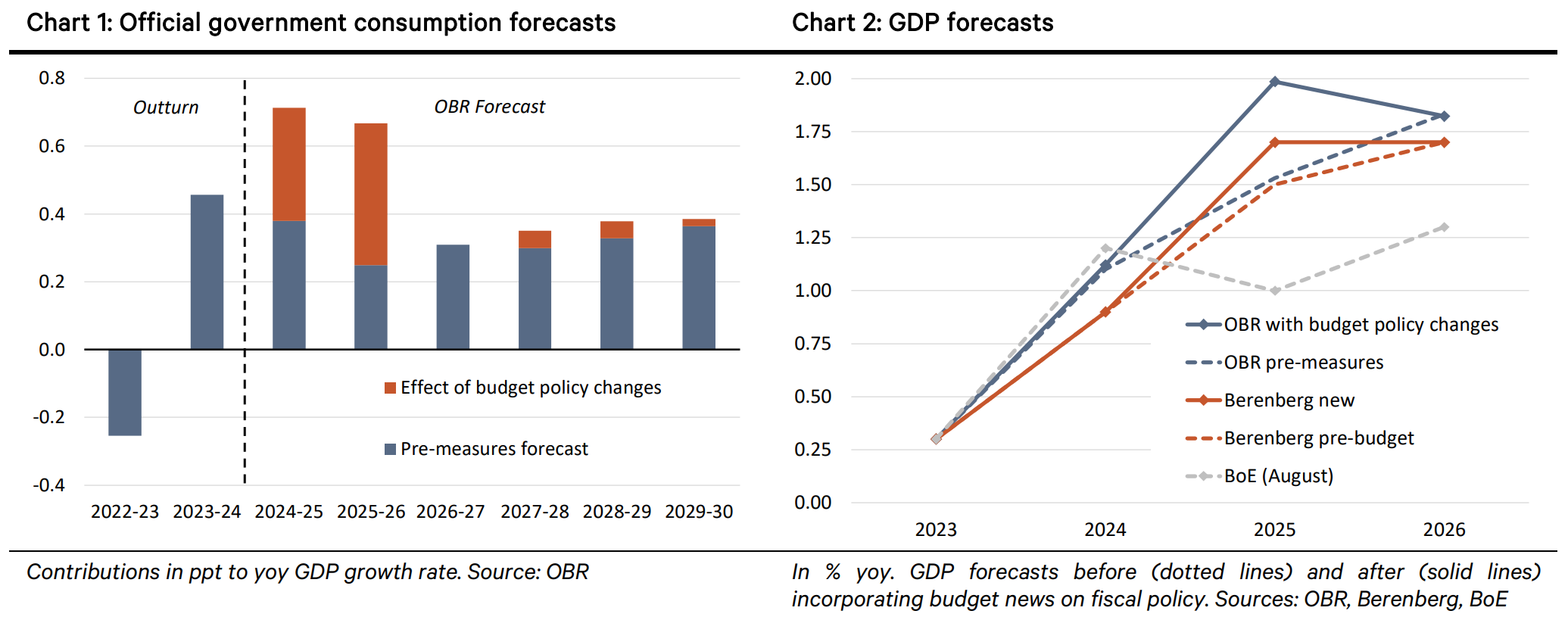

â Government spurs near-term growth: By front-loading spending while increasing tax revenue more gradually, the government will provide a large boost to growth in 2025. The Office for Budget Responsibility (OBR) has pored over the governmentâs new spending plans, so its forecast of future government spending is surely a good guide. The increase in spending announced in the budget caused the OBR to double its forecast of annual growth in real government spending over the next two years. The fiscal watchdog now expects it to contribute 0.7ppt to annual GDP growth 2025 â see Chart 1. We had previously expected support of just 0.1-0.2ppt.

â Twin boost: We continue to think that private consumption will pick up in 2025 on the back of rising real incomes and the relief of concerns about taxation. Despite the record-breaking tax increase in the budget, following four months of gloomy government messaging it was probably less severe than households feared. On top of higher government spending, that points to an acceleration in GDP growth from 0.9% yoy this year to 1.7% in 2025, above our previous forecast of a 1.5% yoy gain â see Chart 2.

â Overheating: We are sympathetic to the OBRâs outlook, in which stronger demand causes a renewed tightening in the labour market, sustaining high pay growth, and a return to above-target inflation. In this environment, higher labour costs stemming from the further increase in the minimum wage will put further upward pressure on prices, particularly in recreational and personal services. We raise our 2025 inflation forecast by 0.1ppt to 2.6%.

â Reeves confiscates dovesâ ammunition: The budget announcement was too close to the BoEâs 7 November meeting for the central bank to incorporate the policy changes into its forecast â so we have run the numbers ourselves. The Bernanke Review tells us that the BoE incorporates fiscal policy into its projections using the OBRâs costings and multipliers that are âbroadly similar to the multipliers used by the OBRâ.1 That implies the budget would raise the BoEâs 2025 GDP forecast from 1.0% to about 1.6%. Although the BoE forecasts the economy to cool below trend in 2025, it expects inflation to persist. In any case, our analysis of the central bankâs economic model suggests that variations in GDP growth have a consistent effect on the inflation forecast regardless of the output gap. An upward revision to its GDP call would raise its 2026 inflation forecast, currently 1.8%, significantly above the target to as much as 2.4%. That will make the argument for looser policy harder to make.

â OBR tells the BoE to sit up and take notice: It is customary for the BoE to brush off changes in fiscal policy, but it would have to be tone death to do that this time around. Monetary policymakers will surely have to take notice of the OBR explicitly raising its interest rate assumptions 25bp above market pricing to account for the likely market reaction to the change in the fiscal stance. By raising the 10-year gilt yield from 4.32% at the pre-budget close to 4.46%, financial markets have done as they were told. It is time for the BoE to follow. We cancel the August 2025 cut in our bank rate forecast, reducing the number of remaining rate reductions to three. We now expect the bank rate to reach a terminal 4.25% in Q2 2025, instead of 4.0% in Q3. The vote for a cut this Thursday is likely to be almost unanimous (perhaps eight for a cut versus one for a hold). However, the BoE should highlight fiscal policy as a reason to stick to a âa gradual approach to removing policy restraintâ: read one cut per quarter.

1Box A, Bank of England November 2022 Monetary Policy Report

Andrew Wishart

Senior UK Economist

+44 20 3753 3017

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659