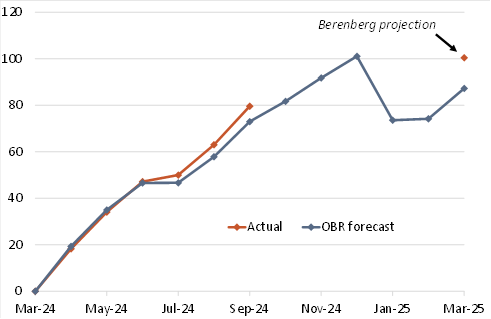

Spending too much: The new Labour government has continued to spend much more than the previous government planned in its final (unrealistic) budget in March 2024. As a result government borrowing continued to overshoot the Office for Budget Responsibility (OBR) forecast, coming in at £16.6bn in September versus a forecast of £15.1bn according to the UKâs monthly public finance data â see Chart. Higher government spending than expected was the culprit. In the tax year-to-date, the government has spent 2% more than anticipated due to a 5.6% overspend on goods and services. The Office for National Statistics attributes that to pay rises and inflation increasing running costs. If that overspend is sustained, government spending on goods and services would be £23bn higher than expected in the fiscal year 2024-25. That overspend is what Chancellor Rachel Reeves has dubbed a âblack holeâ.

Positive developments elsewhere: Higher borrowing than the OBR forecast comes despite strong tax revenues due to elevated pay growth and savings from means testing pensionersâ winter fuel allowance. As winter fuel payments are recorded on an accruals basis in September, those savings helped total benefits spending to come in £2.9bn lower than the OBR expected in September. Meanwhile, pay growth is on track to be close to 5% yoy in Q4 whereas the OBR thought it would have slowed further to 3.5% yoy. That has boosted income and national insurance tax receipts, lifting total tax receipts 1% above the OBRâs forecast in the tax year-to-date.

Budget bark should be worse than its bite: Based on current trends, government borrowing would come in at £100bn (3.5% of GDP) this year compared to the OBRâs forecast of £87bn (3.1%). Borrowing £13bn more than anticipated is at odds with the £22bn overspend figure being used by the FT among others. Thatâs because it does not account for the savings the government has announced to partially offset it, or revenues coming in stronger than expected. The latter is why we think that tax rises will be limited to about £20bn in the budget, a more modest increase than press reports about wide-ranging tax increases would suggest. See our budget preview, âpay windfall limits the need for tax risesâ, for more detail.

Year-to-date government borrowing (2024-25, £bn) |

|

Cumulative public sector net borrowing since March 2024. The tax year runs from April to March. OBR forecast from the March 2024 budget. Sources: OBR, Haver, Berenberg |

Andrew Wishart

Senior UK Economist

+44 20 3753 3017