Click here for full report and disclosures

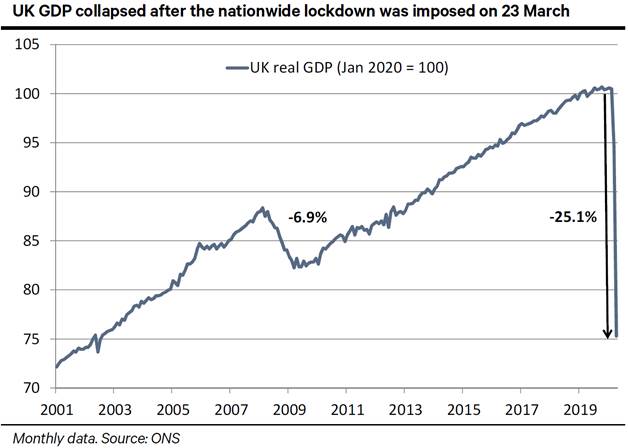

â Sudden stop: The global economic shock from COVID-19 is unprecedented. It far exceeds anything that happened during the financial crisis in 2008/2009– see chart. The lockdowns and social-distancing measures introduced across the world at various stages and to different degrees during the last few months have crippled demand and supply. Todayâs UK GDP data for April provides a first glimpse of the massive damage to major economies in Q2. UK GDP contracted by 20.4% mom in April. On top of the 5.8% mom drop in March, GDP in April was c25% below the January level.

â Tick-shaped rebound: As all of Europeâs major economies had nationwide lockdowns in place for most or all of April, the likely scale of the peak-to-trough contraction in the Eurozone could be similar to that of the UK. Due to harsher lockdowns, France, Italy and Spain likely suffered even more than the UK. With luck, however, April was the bottom of the COVID-19 mega-recession for much of Europe. We find tentative evidence in high-frequency energy, retail and ports data that the recovery in Europe started in May already. The continued progress containing the virus and aggressive economic policy action supports our call for a tick-shaped recovery.

â Broad-based shock: UK economic activity declined sharply in all major industries in the run-up to and after the nationwide lockdown on 23 March. Industrial production contracted by 20.3% mom in April with big differences across subsectors: manufacturing (-24.3%); mining and quarrying (-12.2%); energy (-9.5%) and water and sewerage (-5.3%). Services output declined by 19.0% with massive declines in accommodation and food services (-88.1%) and wholesale and retail (-27.0%) relative to a much smaller shock to insurance and finance (-5.3%). Construction output collapsed by 40.1%.

â Q2 overall will be a bit less bad than April: A tentative recovery probably started when the UK encouraged workers in construction and production to return to their sites of work on 13 May. Non-essential retailers in England will be allowed to open from 15 June, with a further opening-up of restaurants and some parts of the leisure and entertainment sector beginning in late June. With the easing of restrictions, economic activity should begin to gain further momentum in June. The headline GDP data for Q2 (expected: -c17%) will probably be less bad than the big drop from January to April.

â Watch the risks: For all advanced economies, the key risk to the outlook remains a potential second wave of the virus that requires nationwide lockdowns to contain it. Learning to live with the virus will remain a major challenge until better medicine becomes available. However, the UK faces the additional risk from the ongoing UK-EU negotiations about their future relationship. Negotiators seem to be stuck at an impasse and are far apart on key issues such as governance, level-playing-field rules, fishing and, critically, the Northern Irish border. On top of the huge economic and reputational damage from the badly handled pandemic, the tail-risk of disorderly exit from the single market presents an additional threat to the UK. While our base case is for a partly-managed hard exit, a fully disorderly exit could tip the UK back into recession in early 2021 in a worst-case scenario.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659