Click here for full report and disclosures

Click here to request a call about this note.

Financial markets can be extremely skittishâ¦

Ever since the COVID-19 pandemic struck in the UK in March 2020, the Bank of England (BoE) governor, Andrew Bailey, has maintained that the BoE will consider âall optionsâ in its response to the unfolding crisis, including ânot ruling outâ a negative bank rate. Financial markets, until recently not discouraged by BoE policymakers, had taken the guidance on negative rates to imply that such a move was merely a matter of time.

With the BoE bank rate unchanged at 0.1% since April 2020, such expectations have thus far proven to be misplaced. Until a strong intervention by the BoE last week, the market consensus had continued to view negative rates as a likely near-term outcome, with markets pricing in a cut below zero by mid-2021.

A watershed moment for market expectations

The minutes from the 4 February Monetary Policy Committee (MPC) meeting, and the governorâs opening statement, signalled in no uncertain terms that a negative rate is not on the cards any time soon: âThe Committee was clear that it did not wish to send any signal that it intended to set a negative bank rate at some point in the future.â

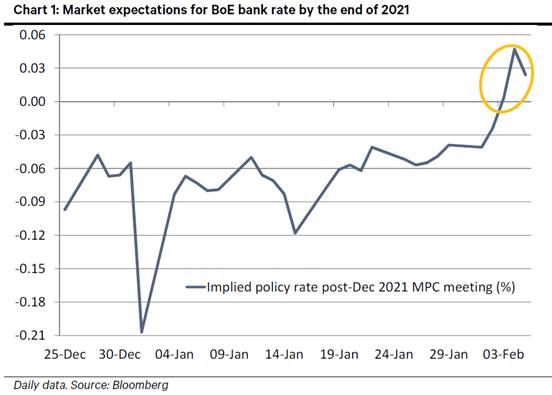

The guidance had a decisive impact on market pricing. Financial market expectations for the bank rate turned positive for the first time this year, according to overnight index swap (OIS) curves for December 2021 (see Chart 1).

In this note we address the following questions:

â Why did financial markets misjudge the policy outlook?

â Why did BoE policymakers intervene to close the gap between the likely path for policy and market expectations?

â What future conditions may merit a negative policy rate?

Conference call: We would like to invite investors to a call on 11 February to discuss these and other topical issues. To register, please contact Eleni Papoula, our financials specialist salesperson, at eleni.papoula@berenberg.com or on +44 7824 393 220.

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Analyst

+44 20 3465 2681

peter.richardson@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659