|

|

To investors,

The President of the United States will be elected tomorrow. It is unclear how long it will take for ballots to be counted, but we will definitively know who is the next President by the end of the week.

There is a lot of uncertainty before we get that answer though.

We saw multiple polls conflict each other over the weekend. The famous Selzer poll in Iowa has Trump behind by 3 points, but the Emerson poll for Iowa has Trump ahead by more than 10 points. Which should you believe? I have no clue.

This is what feeds into the uncertainty. The “experts” on both sides are highly confident they are right, which means almost no one has any clue what is going to happen on Tuesday. This is a big reason why politics dominates the news cycle around election season.

People would be much less interested if we knew the answer to “who will be the next President of the United States?” But with that media coverage comes an immense amount of noise for investors.

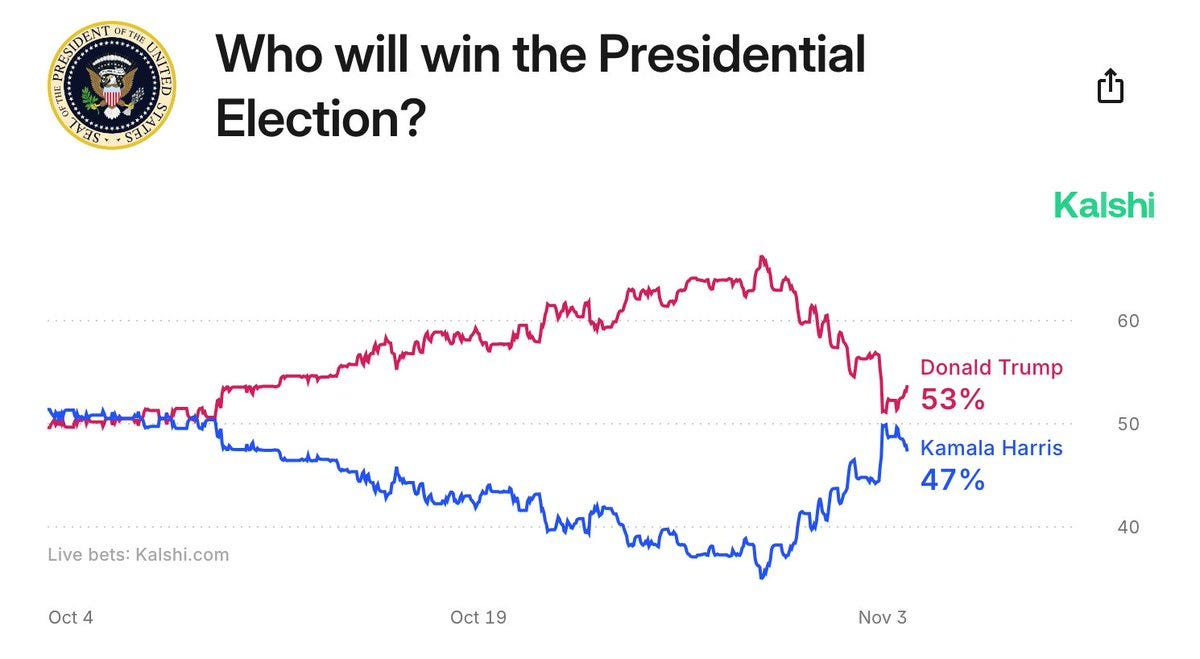

Take prediction markets as an example. Trump was leading by 30 points last week. Trump was behind over the weekend. And Trump was back to winning by 6 points as of last night. That type of volatility can be excruciatingly painful for investors trying to make short-term decisions with their portfolio based on an unknowable event.

The prediction markets are not the only place where volatility is showing up. Bitcoin has been trading in a range between $50,000 and $70,000 for the last 6 months and the asset has only appreciated by about 7% during that half-year period.

Bitcoin was trading at ~ $60,000 on October 11th. It traded at more than $73,000 on October 30th. It trades at under $69,000 as of last night. Again, uncertainty brings volatility. Volatility brings noise.

So what are investors doing to prepare for this uncertainty?

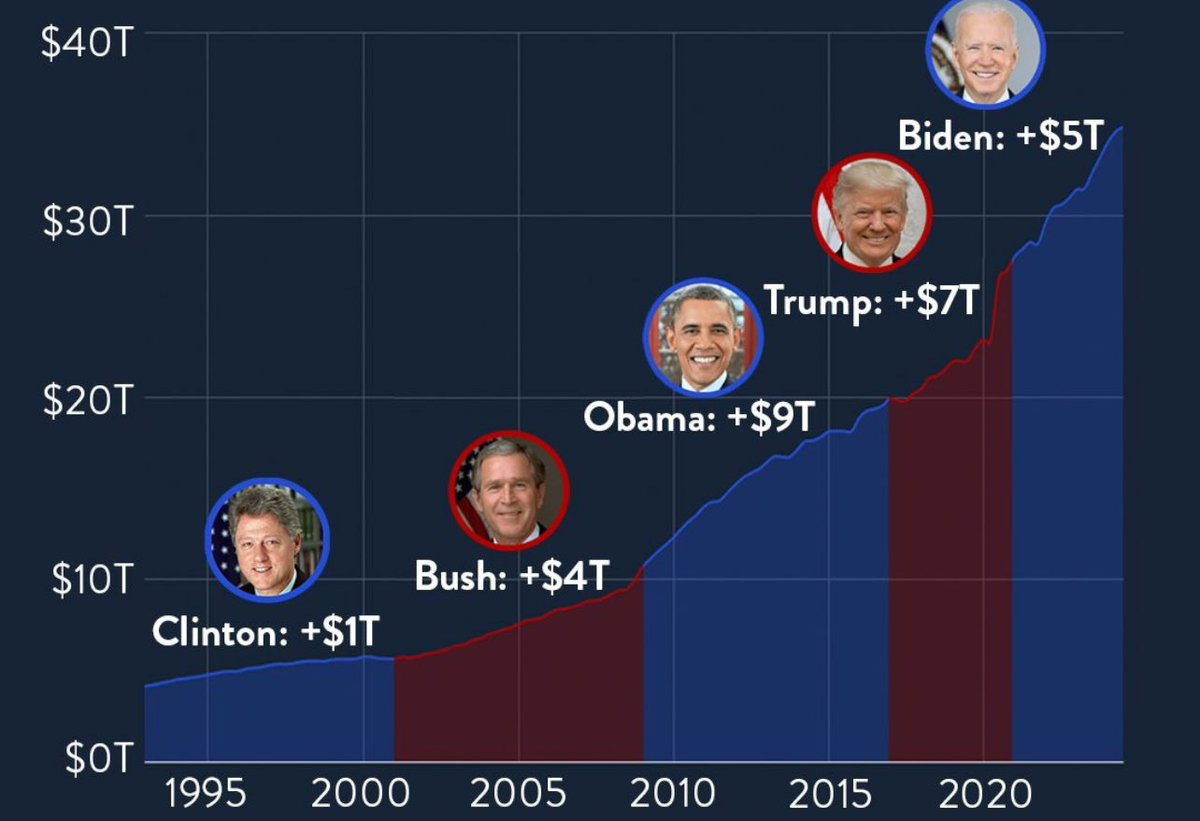

Famed investors Paul Tudor Jones and Stanley Druckenmiller are both betting on things they believe to be certain — the increasing national debt and the debasement of the US dollar.

Each investor has given an interview in recent weeks to tout their investments in various stocks, gold, or bitcoin. They are concerned about inflation and the necessity of the US government to inflate away the debt. In a world of uncertainty, Paul and Stanley are trying to find the sure bets. And both political parties continue to increase the national debt.

Warren Buffett is taking a different approach. He has been selling off large portions of his investments in Apple, Bank of America, and other holdings. Berkshire Hathaway now has more than $325 billion in cash and the company holds more treasuries than the Federal Reserve.

Many commentators have taken the surging cash pile to signal Buffett’s belief that a market downturn could be right around the corner. While that may be part of the reason that Buffett is selling investments, there is another argument which may explain it even better — Warren Buffett is worried about taxes?

Based on Buffett’s answer from the Berkshire annual meeting about prior Apple sales, it may suggest so. Click this video and it will auto-play at the relevant part of the video.

Buffett points to the current fiscal situation as reasoning for his belief that higher taxes “are quite likely.” I don’t see many people equating this worry about future tax hikes to the increasing cash on Berkshire’s balance sheet.

Again, there is no single culprit for the selling, so it is important to understand as many reasons as you can.

Uncertainty rules the day. Investors are trying to navigate the noise.

But here is a nuanced view of the situation we find ourselves in today — stocks will be higher in 10 years, bitcoin will be higher in 10 years, real estate will be higher in 10 years, and bonds will keep losing value.

You have to study history to understand this view. I read a great book called The Gatekeepers over the weekend. The author, Chris Whipple, breaks down the Chiefs of Staff for every President since Richard Nixon. As you read the book, it becomes clear that each President faced crisis and daunting odds. Critics constantly predicted the demise of the United States or our economy under the leadership of the incoming President.

Thankfully, it never happened.

America is incredibly resilient. It thrives due to the geographical, economical, and demographical advantages. Structural advantages and trends rule the day.

How can you use this information today? Stop worrying about the President’s impact on your investment portfolio. It is unlikely that any one candidate can be destructive over the long run. Instead, focus on the long-term trends that are going to persist under both candidates.

The devaluation of the US dollar is probably the easiest trend to bet on moving forward. There are many ways to do it. How you choose to play it will determine the return you capture or the risk you fall victim to.

Buckle up your seatbelts. We are in for a bumpy week.

Hope you all have a great start to your Monday. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Founder & CEO, Professional Capital Management

🚨 READER NOTE: I am co-hosting a conference with Lance Lambert and ResiClub on residential real estate in NYC this Friday, November 8th. We have many industry experts speaking about the housing market, impact of interest rates, effects on the US economy, and what investors should know moving forward.

The event has been quite popular, so remaining tickets are limited. If you would like to attend, please grab your tickets: Click here

Bitcoin’s Future Under Donald Trump and Kamala Harris

I sat down with Phil Rosen, co-founder and Editor-in-Chief of Opening Bell Daily, to discuss the Presidential election’s impact on various financial assets. We walk through the various candidates, their economic plans, and how it should impact stocks, bitcoin, and bonds.

Enjoy!

Podcast Sponsors

Blockstream Mining Note 2 (BMN2) is an EU registered and issued Bitcoin mining security token designed to outperform BTC returns. Learn more and view live analytics on our performance dashboard.

Gemini - The future is being built today. Go Where Dollar’s Won’t. With Gemini.

BetOnline is your #1 source for all your crypto sports and politichttp://gemini.com/gowheredollarswonts betting! Use our promo code POMP100 to receive a 100% matching bonus up to $1,000 on your first crypto deposit.

Xapo - Xapo Bank is the only way to bank with Bitcoin.

Polkadot is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

ResiClub - Your data-driven gateway to the US housing market.

Professional Capital Management - Anthony Pompliano’s asset management firm is now on Linkedin. Please subscribe by clicking here.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.