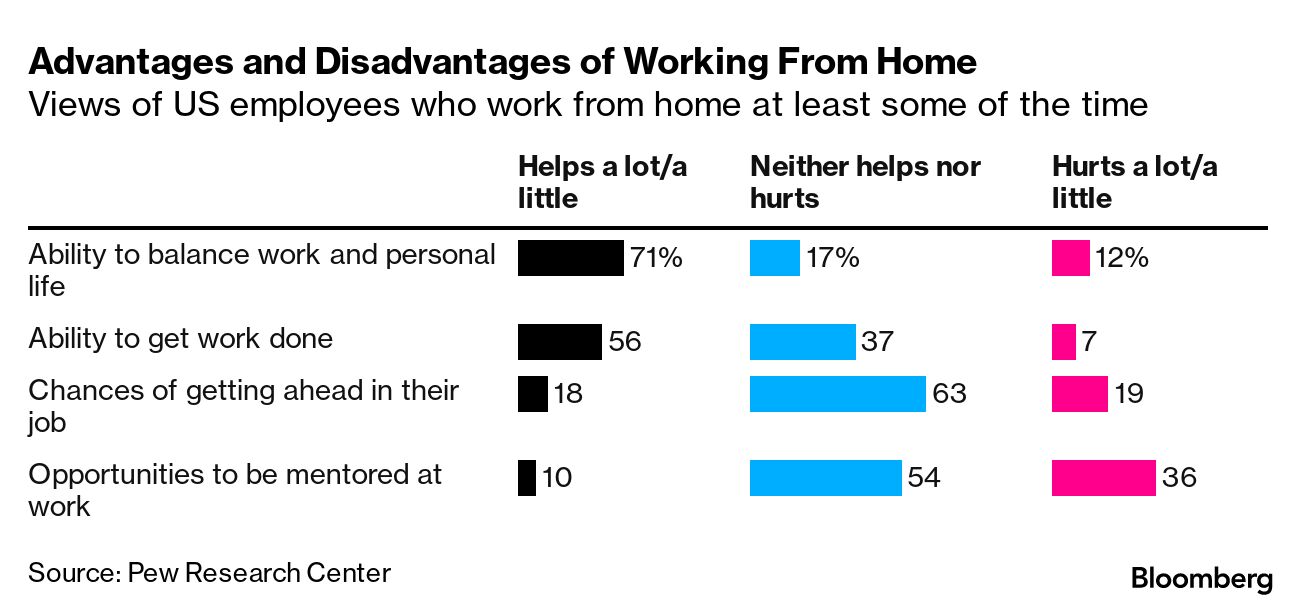

| The global fight against pandemic-era inflation has prompted seesawing projections ranging from recessions to soft landings. Now, with the rate-hike endgame in sight for many central banks, some investors are yet again betting on a US downturn. Seen as the eventual cost of aggressive monetary tightening to slow price surges, such predictions have so far fallen flat. With inflation falling, the US Federal Reserve this week paused rate increases to assess the effect of its campaign. Chair Jerome Powell made a point of flagging potential further increases in the coming months, saying taming prices with such a robust American employment picture will require “below-trend growth and some softening of labor-market conditions.” Across the Atlantic, European Central Bank chief Christine Lagarde said another quarter-point step there is “very likely,” with the inflation outlook uncertain for Euro-area countries. Among the pessimists is Citadel’s Ken Griffin, who says his giant hedge fund firm is increasingly focused on credit trading as he foresees a potential US recession. And even though consumers have been resilient despite perpetually rising prices, they’re finally pushing back, writes Leticia Miranda in Bloomberg Opinion. They’re “fed up and showing it after two years of absorbing spiraling prices as retailers and food suppliers passed on the costs,” she says. Russia fired missiles toward Kyiv just as a delegation of African leaders arrived in Ukraine for talks on the latest initiative to end Vladimir Putin’s war, Ukrainian officials said. The flooding from the destruction of the Kakhovka dam—which Ukraine has blamed on Russia—is receding, and the new terrain that’s emerging could create opportunities for Ukrainian forces in their slow-moving counteroffensive. NATO countries are making progress on developing a set of security commitments for Ukraine, even amid divisions over how to help Kyiv gain membership. As for Putin, this week he’s watched his economic forum, a supposed rival to Davos, shrivel toward obscurity, yet another measure of Russia’s deepening isolation.  Satellite image of the blown-up Kakhovka dam in southern Ukraine on June 6. As the reservoir recedes, Ukraine may be able to take advantage of the destruction it blames on Russia. Source: Planet Labs PBC US Secretary of State Antony Blinken is traveling to Beijing this weekend, becoming the most-senior American official to visit in five years. Blinken said the trip is part of the Biden administration’s effort to make sure the rivalry between the US and China doesn’t erupt into open conflict. The remarks come after a Chinese fighter jet recently cut in front of a US reconnaissance aircraft and a Chinese naval vessel subsequently did the same with an American destroyer in international waters. “Intense competition requires sustained diplomacy to ensure that competition does not veer into confrontation or conflict,” Blinken said. Chinese leader Xi Jinping just met with Bill Gates, saying he was “the first American friend I’ve met in Beijing this year.” Beijing’s relations with its more populous neighbor to the south aren’t that great, either. China expelled the last Indian journalist in the country, part of a tit-for-tat between the two rivals. Corporate return-to-office mandates are multiplying, and they’re coming with new requirements. But impatient bosses know these ultimatums, while welcomed by a few lonely workers, will likely mean losing staff. Fifty percent of people who work in finance would rather quit than spend more time in the office, according to a Bloomberg Market Live Pulse survey, while just 20% of respondents said they prefer being back on the cube farm. Indeed, for some companies, RTO could be a way to constructively fire their employees. AT&T, for example, told 60,000 managers to return to work in person but to a sharply reduced number of offices, requiring many to relocate or quit.  Tesla, fresh off a winning streak for its stock, has started offering three months of free fast-charging in the US with the goal of clearing inventory of Model 3 sedans before the end of the quarter. Tesla Chief Executive Officer Elon Musk has been traversing Europe, meeting with political leaders and even sharing a power lunch with Bernard Arnault. And for those ready to move to electric vehicles but not wanting to fully part with the past, Toyota has built a prototype Lexus UX 300e with a gear shifter and clutch pedal that mimics the manual-transmission experience. If you subscribe to the “more is more” school of thought when it comes to your house, check out this $204 million mansion in Dubai. Inspired by Versailles (because of course), the home is decked out in gold leaf and called, with truth in advertising, the “Marble Palace.” Quaint by comparison is this $65 million estate in Houston—the most expensive listing in Texas. On the other side of the coin: Rent prices in New York City are growing at almost twice the rate of entry-level salaries, making living in the Big Apple out of reach for many recent college graduates.  This mansion in the Emirates Hills neighborhood of Dubai is being shopped around for $204 million. Photographer: Luxhabitat Sotheby's - The US marks Juneteenth, commemorating emancipation.

- Jerome Powell gives his semi-annual testimony before Congress.

- Central banks in England, Turkey and Switzerland hold policy meetings.

- German Chancellor Scholz hosts Chinese Premier Li Qiang in Berlin.

- US President Joe Biden throws India’s Narendra Modi a state banquet.

Just a year ago, Microsoft didn’t rate in the public artificial intelligence discourse. But the technology giant is the largest shareholder of OpenAI, creator of ChatGPT, its biggest financial backer and key technology partner. Microsoft is now largely responsible for turning ChatGPT’s buzz into a real business, and it’s looking to cash in.  OpenAI Co-Founder Sam Altman Photographer: Joel Saget/Getty Images Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. The Bloomberg Sustainable Business Summits return to London on June 28 and Singapore on July 26. Join us in person or virtually for programs featuring solutions-driven discussions and community building, convening business leaders and investors globally to drive innovation and scale best practices in sustainable business and finance. Speakers include leaders from AIA, Allbirds, Nissan, Temasek, Unilever, Virgin Atlantic and many more. Register now to secure your spot in London and Singapore. |