Link to full report and disclosures

*Last month, we analyzed an enhanced labor market dashboard that had built upon the dashboard of 12 indicators originally developed by former Federal Reserve Chair Janet Yellen to assess progress toward the Fedâs employment objective established in its new strategic plan (âAn expanded labor market dashboard for assessing progress toward the Fedâs maximum inclusive employment objectiveâ, July 15, 2021). We concluded that, while labor markets had improved significantly, shortfalls from the pre-pandemic conditions remained and emphasized that, without any numeric guidelines, the Fedâs assessment of improvement in labor markets was subjective.

*The robust data provided in the Employment Report for July and the JOLTs Report for June clearly suggest that the Fedâs criteria of âsubstantial further progressâ has been achieved and is no longer âa ways off,â as Fed Chair Powell characterized in his semi-annual testimony to Congress in July. While the recovery in labor markets has lagged real GDP, labor markets have recovered far faster than any recovery from recession in history, significantly exceeding earlier forecasts. The data are striking.

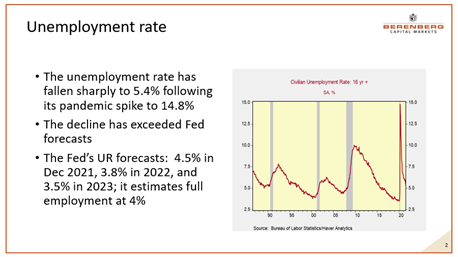

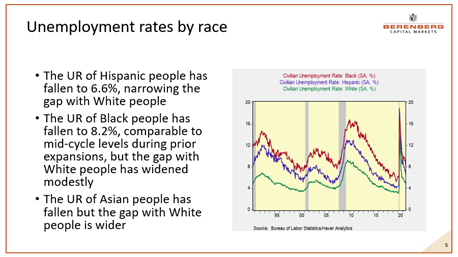

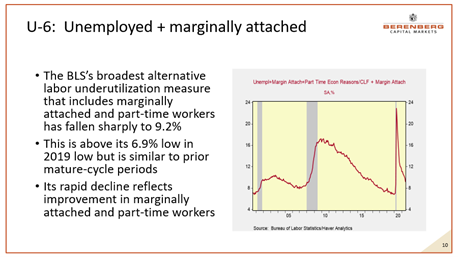

-The unemployment rate has fallen to 5.4% from its 14.4% pandemic spike. It is now well below its recent historical average and at or below levels of prior mid-to-late expansions. Household unemployment has fallen to 8.7 million, an 83.2% retracement of its March-April 2020 spike, and is modestly above its pre-pandemic low. U-6, the broadest unemployment measure that includes marginally attached and part-time workers, has fallen to 9.2 from its 22.9% peak. Unemployment rates of Black people (8.2%) and Hispanic people (6.6%) have fallen commensurately.

|

Source: Bureau of Labor Statistics, Haver Analytics |

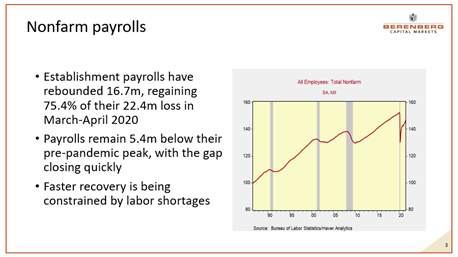

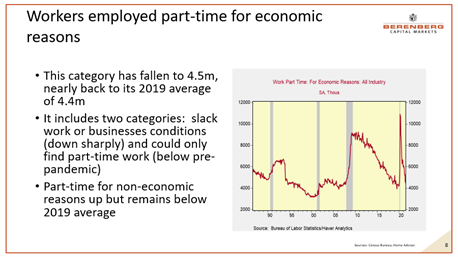

-Establishment payrolls have regained 75.5% of their March-April 2020 declines. Monthly job gains have averaged 680,000 in the last six months as the economy has reopened. Further normalizing of activities is widely anticipated to restore employment to its pre-pandemic level. Workers employed part-time for economic reasons have fallen back nearly to their 2019 lows. Aggregate hours worked have risen materially above pre-pandemic levels.

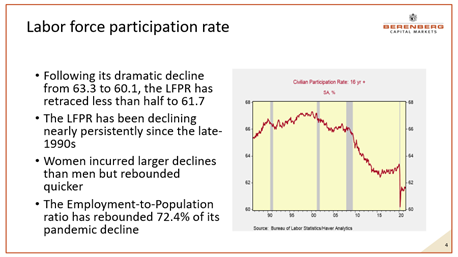

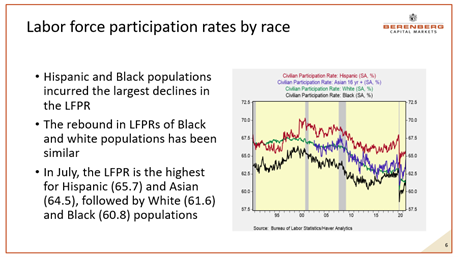

-The labor force participation rate has recovered over half of its decline, and the employment-to-population ratio has risen to 58.4, a 72.4% recovery. Improvements by Black people and Hispanic people have been commensurate.

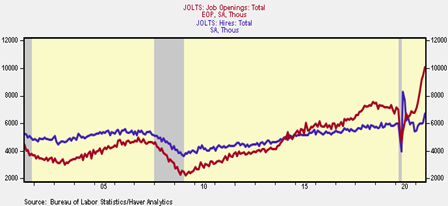

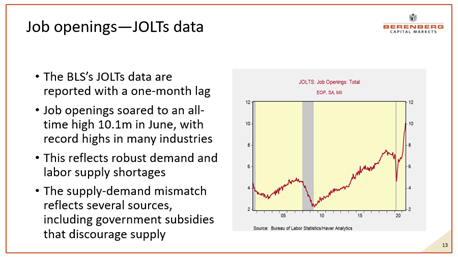

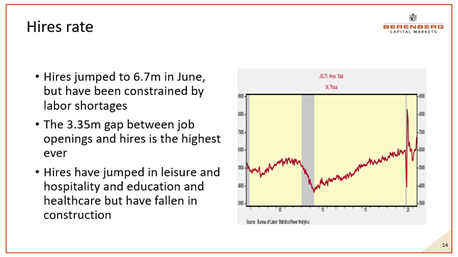

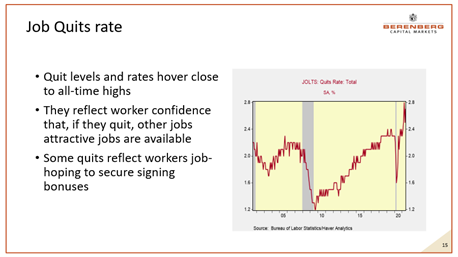

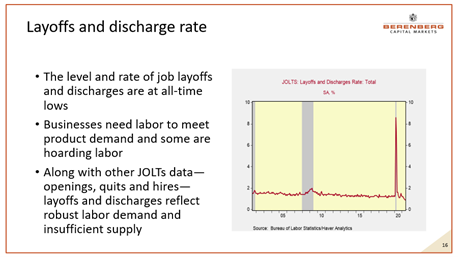

-Job openings have spiked to all-time highs (10 million) while monthly hires have risen sharply to 6.7 million but have been constrained by supply shortages. Job quits hover near all-time highs, reflecting worker confidence in labor markets. Overall, the June JOLTs report signals ongoing strength in labor markets and points toward further job gains and lower unemployment.

|

Source: Bureau of Labor Statistics, Haver Analytics |

The Fedâs assessment. In its new strategic plan, the Fed prioritized maximum inclusive employment and favored above-2% inflation to make up for the lower inflation in prior years. Inflation has risen far above the Fedâs earlier forecasts and outside of the Fedâs acceptable range. Labor markets have exhibited substantial progress toward the Fedâs employment objective, even though most indicators in the expanded labor market dashboard are not yet back to the stellar levels that had been attained prior to the pandemic. In fact, in many ways, labor markets are exhibiting mature-cycle characteristics while the Fedâs monetary policy is still in emergency, recession-fighting mode.

A critical issue affecting the Fedâs assessment is whether it only looks at current conditions or considers its projections of likely future outcomes. In its June Summary of Economic Projections, FOMC members projected that the unemployment rate will fall to 3.8% by year-end 2022 and to 3.5% by year-end 2023, both well below the Fedâs estimates of longer-run full employment. Also, does the Fed consider the negative impacts of labor supply issues, which are clearly beyond the scope of monetary policy? The all-time high gap between job openings and hires reflects these supply-demand imbalances and points toward significant further hiring.

The conditions are in place for the Fed to announce that it will taper its asset purchases. An announcement on the near-term horizon is consistent with our earlier expectation (âStrong U.S. Growth, Inflation and the Fedâs Challengesâ, February 11, 2021).

The Fedâs far bigger challenge is normalizing interest rates.

The expanded labor market dashboard is below.

Chart 1: Unemployment rate |

|

|

Chart 2: Nonfarm payrolls |

|

|

Chart 3: Labor force participation rate |

|

|

Chart 4: Unemployment rates by race |

|

|

Chart 5: Labor force participation rate by race |

|

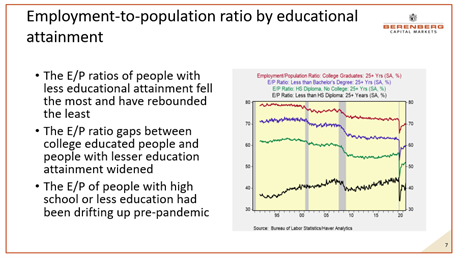

Chart 6: Employment-to-population ratio by educational attainment |

|

Chart 7: Workers employed part-time for economic reasons |

|

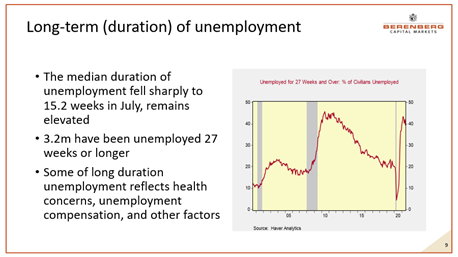

Chart 8: Long-term (duration) of employment |

|

Chart 9: U-6: Unemployed + marginally attached |

|

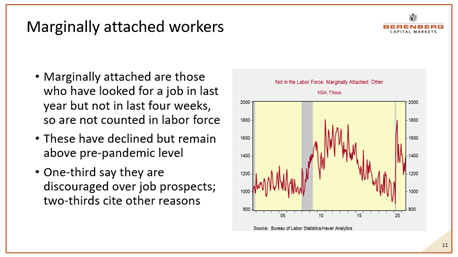

Chart 10: Marginally attached workers |

|

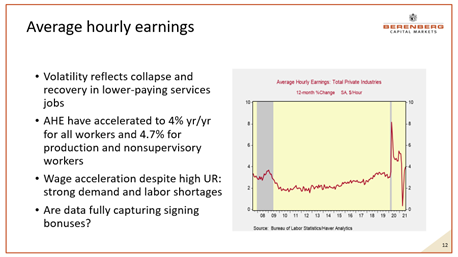

Chart 11: Average hourly earnings |

|

Chart 12: Job openings â JOLTs data |

|

Chart 13: Hires rate |

|

Chart 14: Job quits rate |

|

Chart 15: Layoffs and discharge rate |

|

Link to full report and disclosures

Mickey Levy, mickey.levy@berenberg-us.com

This document was compiled by the above mentioned authors of the economics department of Berenberg Capital Markets LLC (hereinafter also referred to as âBCMâ). BCM has made any effort to carefully research and process all information. The information has been obtained from sources which we believe to be reliable such as, for example, Thomson Reuters, Bloomberg and the relevant specialised press. However, we do not assume liability for the correctness and completeness of all information given. The provided information has not been checked by a third party, especially an independent auditing firm. We explicitly point to the stated date of preparation. The information given can become incorrect due to passage of time and/or as a result of legal, political, economic or other changes. We do not assume responsibility to indicate such changes and/or to publish an updated document. The forecasts contained in this document or other statements on rates of return, capital gains or other accession are the personal opinion of the author and we do not assume liability for the realisation of these.

This document is only for information purposes. It does not constitute a financial analysis, investment advice or recommendation to buy financial instruments. It does not replace the recipientâs procurement of independent legal, tax or financial advice.

This document has been classified as fair and balanced for the purposes of FINRA rules. Please contact Berenberg Capital Markets LLC (+1 646.949.9000), if you require additional information.

Remarks regarding foreign investors

The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions.

United Kingdom

This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers.

Copyright

BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (âBerenberg Bankâ). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCMâs prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC.