US 2020 Presidential Election: Implications for Policies and Economic Performance

The potential implications of the Presidential election for US and global economic policies and performance are potentially highly significant. This paper provides details on the themes presented by Mickey D. Levy at the 9th Annual Berenberg-Goldman Sachs German Corporate Conference on September 21 (The US economic and political landscape, September 24, 2020).

The potential implications of the Presidential election for US and global economic policies and performance are potentially significant. The presidential campaign has been a referendum on three issues that have dominated the political and economic landscape: President Trump’s erratic, divisive and decidedly anti-establishment behavior; the desired size and role of the government in the US economy with a specific focus on income and wealth inequality; and the US’s approach to international diplomacy and economic issues. Democratic candidate Vice President Joe Biden’s proposes dramatic shifts in tax, spending, regulatory which would result in a greatly expanded scope and role of government and a return to more conventional, conciliatory approach to international policies.

At the risk of over-simplifying, if President Trump were re-elected, his behavior would not change and his administration would continue its recent themes. The first Trump Administration promoted increased spending and relatively low taxes that raised deficits; reductions of burdensome regulations; high tariffs and trade wars with China; and adversarial relations with allies as well as foreign foes, and a distain for established global and domestic institutions. Trump’s earlier tax cuts and thrust toward deregulation stimulated business expansion and investment, but his tariffs and unpredictable and divisive announcements have generated uncertainties that have harmed global trade and economic performance.

In sharp contrast, according to Biden’s official campaign platform (chttps://joebiden.com/joes-vision/), Biden Presidency would promote a dramatic expansion in spending, taxes and regulations with a significant focus on income and wealth redistribution and infrastructure, and an international theme of diplomacy toward allies and a shift away from disruptive tariffs and trade barriers. Under the Biden proposals, both taxes and deficits would increase significantly, and the government would play a much larger role in regulating labor markets and economic activities. Internationally, a Biden Administration would take a conciliatory, friendly approach to the US’s allies and global organizations, while maintaining a tough stance on China.

A critical uncertainty in assessing the economic impacts of a Biden presidency is how much of his announced platform would become a reality. The outcome would depend on two factors: 1) whether Democrats achieve a majority control in the Senate, and 2) whether Biden actually pursues the expansive policies in his platform or instead scales them back to a more moderate agenda. Biden’s platform largely reflects the agenda of the progressive left, which has gained significant power in the Democratic Party, and is to the left of Biden’s historic stances on some policy issues. The actual policy outcomes are highly uncertain. The margin of victory is unlikely to affect policy outcomes. Modern history is divided on whether presidents follow their campaign platforms. Sometimes they do and sometimes not, but rarely is the result halfway in between.

Setting the stage for the election

Trump’s decidedly adversarial behavior has been a lightening-rod since he was elected in November 2016. The Trump Administration’s actual economic policies have been an uneven mix of some traditional Republican characteristics—support of a more limited scope of government, including lower taxes and reductions in burdensome regulations--along with some decidedly un-Republican characteristics, including legislation that has added to deficit spending, and anti-trade policies, particularly onerous tariffs.

In contrast to Trump’s divisiveness, erratic and un-Presidential behavior, actual economic performance prior to the Covid-19 pandemic was generally solid but not outstanding, while financial performance was strong. Surprisingly healthy gains in employment contributed to 50-year lows in unemployment for virtually all socioeconomic groups and real (inflation-adjusted) wages were increasing; productivity gains had risen; and business profits had increased to all-time highs. However, in 2018-2019, the costs and uncertainties of Trump’s trade wars with China and China’s own economic slump combined to weaken global industrial production, business investment and international trade, and the US industrial sectors also suffered.

The US’s economic and social makeup is complex, and during the Trump Administration, beyond the macroeconomic data, there were many conflicting trends. The pace of technological innovation and entrepreneurship in a wide array of US industries and efficiency gains were robust, and the US’s world-dominant high tech and social media firms grew in size and power. The stock market rose, fueled in part by the Federal Reserve’s easy monetary policies. These factors accentuated wealth inequality trends already established especially since the Financial Crisis and drew attention to them. Social and racial tensions flared, divides widened and the public debate became increasingly polarized. Trump’s tweets and actions accentuated the polarization. Internationally, Trump’s policies toward China and his antagonistic treatment of historic US allies stirred controversy and undercut the US’s role as leader in the standardly accepted global international order.

The early stages of the 2020 presidential campaign involved a wide array of Democratic contenders, ranging from hard-left candidates Bernie Sanders and Elizabeth Warren who promoted socialist agendas to moderates like Michael Bloomberg. Biden emerged, supported by the Democratic establishment, largely as the other candidates faltered and the Democratic Party leadership helped to push aside the leftist candidates that it believed could not defeat Trump. Trump’s behavior generated gapping divides in the Republican Party, its leadership and its constituency.

The Economic platforms of Trump and Biden

While Trump has not spelled out a formal economic platform for the campaign, Biden provides a detailed and expansive platform. Typically, two-term Presidents accomplish their most significant policy achievements in their first terms, and the agendas of incumbent Presidents running for the second term are simply a continuation and cleanup of their first term achievements.

Biden’s official platform poses a significant uncertainty for the economic and financial outcomes because it proposes the most expansive tax and spending policies and regulations in modern US history. If enacted, they would significantly raise the hurdle rate for investment and distort labor markets in ways that would reduce sustainable potential growth. However, Biden’s platform is decidedly to the left of what he has stood for historically, so the actual policies proposed and economic effects are uncertain.

The Biden platform proposes the most dramatic spending increases since the Great Society programs of the mid-1960s, very large tax increases ever for corporations and high income individuals, and expansive regulatory initiatives that would dramatically increase the size and role of the government. Going back through his long tenure as a Senator, Biden was an ardent supporter of labor and “the small guy” and higher taxes on higher income and wealthy individuals, but generally a moderate Democrat who was a “follower” on most issues. As Vice President, he followed President Obama’s lead on virtually every issue. This leaves open the issue of how closely Biden would follow his platform if elected. More on that later.

Without a formal economic policy agenda for a second term, Trump most likely would maintain the thrust of his earlier policies. Domestically, tax policy would be unchanged and his Administration would continue to streamline government regulations. Presently, the Administration proposes another pandemic fiscal stimulus package, although decidedly smaller than what Democrats are proposing. Under either plan, persistently high budget deficits would push up debt.

Trump’s international economic policies would involve confrontational dealings with China on trade, international diplomacy and national security issues. However, the probability of renewed increases in tariffs on Chinese imports seems relatively low, based on their earlier ineffectiveness. Trump’s adversarial behavior toward allies, including threats of tariffs, would likely continue. It seems unlikely that Trump would materially ease restrictions on immigration.

Biden spending proposals. On the spending side, Biden officially proposes $7.5 trillion in new spending. He supports the current Democratic Party legislation that proposes additional $3 trillion pandemic and government shutdown related spending, including another round of $1200 payments to most individuals, extended unemployment benefits (and extending the $600 per week income support payments), and roughly $1 trillion of Federal grants to states. He also proposes the New Green Deal https://joebiden.com/joes-vision/), which involves $2 trillion in spending over the next four years, and new spending on education, health care and housing totaling over $2.7 trillion. If fully enacted, these initiatives would constitute the largest spending increases since the Great Society programs of the mid-1960s and add significantly to government debt. Combined, these proposals would boost government spending by over $1 trillion per year (approximately 4% of GDP per year) in each of the next four years. Note that because these are proposals and not pending legislation, the Congressional Budget Office has not conducted any official budget estimates of the programs.

Biden tax proposals. Biden proposes significant increases in taxes--$5.5 trillion over the 10-year budget projection—assessed primarily on capital, higher income individuals and businesses. The highest rate on individual taxes would rise to 39.6%. Capital gains would be taxed as ordinary income for higher income individuals, raising their effective rate from 23.8% to 42.8%. Payroll taxes would be raised 0.4 percentage points for all workers and dramatically for higher income earners by eliminating the taxable maximum wage against which payroll taxes are assessed. Estate taxes would be increased by lowering the exclusion below which taxes on estates are not taxed, and very importantly, eliminating the “step-up in basis” at death (that is, for the first time ever, the beneficiaries of estates would pay taxes on the appreciation of asset values prior to death).

Corporate and business taxes would rise significantly by raising rates and placing minimum effective taxes on select corporate income. Biden proposes raising the corporate tax rate to 28% from 21% (Trump’s Tax Cuts and Jobs Act of 2017 reduced then from 35%) and eliminating the 20% tax cut for privately-owned businesses, also provided by the TCJA. It is noteworthy that privately owned businesses employ over 40% of total US workers.

The current US corporate tax structure is very inefficient: official rates are high, but effective taxes paid are low because businesses take advantage of an array of deductions, credits, deferrals and other provisions. Biden proposes significant increases in effective corporate taxes paid, particularly by multinational corporations, by establishing a minimum 15% effective tax on “book income” on all corporations and a minimum 21% tax on income earned overseas, with that minimum applied to each country the business operates.

Biden proposals on regulations. In sharp contrast to the regulation-reducing initiatives during the Trump Administration, Biden proposes a wide array of new government regulations, with several primary thrusts: pro-labor and rules that constrain business; pro-“green initiatives” that encourage renewable energy and punish non-renewables including oil and fossil fuels; and pro-immigration policies. Biden would incentivize unionization and collective bargaining while punishing non-union employers, including precluding them from government contracts. Biden proposes abolishing right-to-work states such that all states must allow unions to collect dues and fees from non-union workers. Formal regulations would enhance and protect public (government), domestic and farm workers.

Biden has officially rejected shareholder capitalism and supports the vision of stakeholder corporations that are required to serve broader issues and interests. At this point, it is uncertain the extent to which Biden would pursue this objective or the regulations that would be involved. Potentially, it may significantly alter the role and operations of businesses, their fiduciary responsibilities to stockholders and business-employee contractual agreement and relations. The issues remains highly uncertainty.

At the top of Biden’s regulatory proposals are Federal minimum wages.

Biden’s New Green Deal would involve an array of regulations that would set goals for and are intended to force a rapid shift to reliance on renewable energy sources and away from non-renewable fossil fuels. Biden would outlaw new drilling on Federal lands and block development of oil pipelines. However, Biden has publicly stated that he would not ban fracking, which in any case would require an act of Congress.

A sizable portion of Biden’s $2 trillion New Green deal would involve urban renewal and infrastructure spending. All of these would involve tight regulations, including government contracts only to union employer firms and guides for contract fulfillment and employment.

Biden proposes to reverse Trump’s restrictive immigration policies, including establishing a roadmap for US citizenship of 11 million undocumented people and an easing of Visas for foreign students and select workers.

International economic policies. Biden is very similar to Trump in his stated goal to bring manufacturing jobs back to the US, protecting US interests and workers, and being tough on China, but his approach would be dramatically different. Unlike Trump’s go-it-alone adversarial approach that eschewed established organizations and channels of diplomacy and dismissed the concerns of traditional US allies, Biden would re-establish friendly relations with historic allies. Biden would attempt to build an international coalition that stands up against China’s unfair and aggressive economic and diplomatic practices. This coalition would involve Europe, the UK, Japan and Australia at its core. The Biden Administration would embrace international organizations like NATO and the World Health Organization, dropping the criticisms of the Trump Administration.

While Biden has said this is the wrong time to reduce tariffs, his Administration would not use tariffs as a lever. While it is uncertain whether these efforts would work—efforts to rein in China through establishment organizations and channels during the Administrations of Presidents Clinton, Bush and Obama failed to rein in China—it is also clear that Trump’s strategy has failed.

Economic Effects

Currently, the U.S. economy is recovering solidly and will continue to do so, driven by ultra stimulative monetary and fiscal policies, as long as the pandemic continues to subside. The election outcome will significantly—and perhaps dramatically—influence U.S. and global economic and financial performance for years to come. As emphasized, if Biden wins, the actual policy outcomes and impacts depend on whether Congress remains split or whether Democrats take control of the Senate, and whether the Biden Administration pursues policies that are moderately progressive or as expansive as his full platform. Importantly, an assessment of the economic and financial effects are just one dimension; many other issues affecting social well-being are equally if not more important and must be considered.

A Trump victory would bring disappointment overseas, particularly by historic allies harmed by tariffs and Trump’s undiplomatic treatment. Ongoing uncertainties would dampen global trade and business investment. From China’s viewpoint, the election brings a potentially new challenge: while China detests Trump’s tariffs, threats and unpredictable, undiplomatic behavior, it also fears the prospects of dealing with a coordinated international coalition of nations that may emerge under a Biden Administration.

A Trump victory would also bring great disappointment domestically, further deepening the social schism. It would elicit significant public demonstrations that very likely spill over into scattered violence and disrupt normal economic activities, particularly in large cities. Although such unfortunate responses would be temporary, they would harm US prestige and likely contribute to a weaker US dollar. A Trump victory would have little impact on the US economy from its current trajectory.

A Biden victory with a spilt Congress

If Biden wins and Republicans maintain control of the Senate, the Biden Administration’s spending and tax proposals would be significantly scaled back, but it would achieve large portions of its pro-labor and climate change/green objectives through Executive Orders, administrative rulings and regulations that could be imposed independently of Congress. The same would be true of Biden’s proposed shifts in international economic and diplomatic policies.

It is critically important to understand that while there are check and balances on US fiscal policy, Presidents Obama and Trump greatly strengthened the power of the president through avenues and procedures that circumvented Congress, frequently deviating from the wishes of Congress and undercutting its power. The Biden Administration would follow in this path.

Biden’s less contentious global policies and his efforts to rebuild reliable diplomatic relations with allies would reduce the uncertainties that have dampened global trade. Calming international tensions would definitely help. However, global trade will continue to be constrained by slower potential growth in China, the downsizing of global supply chains efforts by many national corporations to increase reliance on locally-sourced products, and weaker global business investment. Global trade volumes are now recovering from deep contraction, but following the recovery, they are expected to lag global growth (“The decade-long deceleration of global trade: sources and implications,” Berenberg Capital Markets, January 13, 2020).

Even with a split Congress, a smaller version of Biden’s spending and tax proposals likely would be enacted, as some initiatives will be attractive to moderate Republicans, including more spending on infrastructure improvement and Federal grants to states. Also, some form of a tax on carbon is possible.

Biden would aggressively impose a broad web of pro-labor regulations and constraints on businesses. There will be some controversial issues. While Biden strongly favors banning right-to-work states (27 such right-to-work states allow non-union workers to avoid paying union dues), his Administration would use the Federal government’s financial power and leverage to force some states to ban right-to-work provisions.

The network of labor regulations that Biden proposes would harm businesses by raising operating costs and/or altering production processes and labor inputs that reduce inefficiencies and productivity. Depending on the industry and the macroeconomic environment, the incidence of these impacts are likely to raise consumer prices, narrow margins and profits, lower capital spending, and reduce employment from what it would be otherwise. Of note, if Biden is able to make headway in banning right-to-work states, this may work against his goal of bringing manufacturing jobs back to the US.

Biden’s proposals to ease many restrictions on immigration policy would contribute positively to longer-run economic growth. While Biden could ease some immigration restrictions including modifying Visa requirements for students and select skilled workers could be achieved through Executive Orders. These changes would benefit educational institutions and increase the supply of labor with important skill sets. Establishing a pathway to US citizenship for roughly 11 million undocumented people would provide a modest lift potential growth, but such a sweeping change would require Congressional approval. Although these people are already in the workforce, a pathway to citizenship would provide more mobility and supply of labor.

Similarly, Biden would be able to use executive powers, the legal system and regulations to achieve much of his climate change objectives and accelerate the transition to renewal energy while punishing non-renewables. The big exception would be a carbon tax, which requires passage by Congress. A carbon tax that reflects the value (including external costs) of carbon is by far the most efficient policy to accelerate the transition from reliance on fossil fuels to renewable energy sources. A properly designed carbon tax would be attractive to some Republicans, although it is uncertain whether the parties can agree. Instead, relying on regulations would generate distortions that would offset some of their intended benefits of the Biden green agenda and result in mixed impacts on the economy.

Overall, the economic effects of a Biden victory and split Congress that results in enactment of a modest portion of Biden’s spending and tax proposals and most of his regulatory agenda and his proposed international policies would be fairly neutral for near term GDP growth, with sizable offsetting effects, and modestly negative for longer-run potential growth. Sensible policies on international trade and immigration would lift growth while the wide web of regulations would distort labor markets and economic activity, and dull business confidence and investment.

A Biden victory and Democrats control Congress

If Biden wins and Democrats gain control of the Senate, there is a high probability that the new Administration would push to enact his full spend, tax and regulate agenda, but because of concerns about negative economic and market implications, the full package may be initially scaled back with smaller tax and spending increases. Even with a trimmed back fiscal policy, there is a very high probability that Biden would pursue his entire regulatory policy agenda.

Biden’s expansive spending programs that would be heavily skewed toward income support, health care and education and urban renewal would support consumption (with a higher share allocated to health services) and government-financed public infrastructure. But Biden’s attempt to aggressively redistribute income and wealth to low income households financed with dramatically higher taxes on capital and high wealth individuals, combined with a greatly expand role of government, would reduce productivity and business investment, and lower sustainable potential growth. Thus, if fully enacted, Biden’s platform would significantly shift economic activity toward current consumption and government-sponsored activities and away from investment and sustainable healthy economic growth. Financial markets would anticipate these impacts, driving the stock market lower.

A critical question is how the Biden Administration would deal with this probability, and maybe dial back its proposals. The progressive wing of the Democratic Party, which dominates its social agenda and has gained significant power over economic policies, would push ahead with the full package. They want to reduce the power of businesses and believe the economy would benefit by distributing the assets of the wealthy to lower income individuals. They assume that higher taxes on businesses and the wealthy will not have negative impacts.

Moderate influencers in the Democratic Party would urge some restraint in the magnitude of the policy proposals, wishing not to jar confidence, the stock market or the economy. Some with experience in economic policymaking and financial markets would be more cautious and open to downside risks. Political favoritism and corporate leverage would also influence policy outcomes. For example, wealthy donors and privately-owned businesses would weigh in on the negative implications of the proposal to eliminate the step up in basis at death in estate taxes, the near doubling of capital gains taxes and eliminating the 20% tax cut available for privately-owned businesses. Multinational businesses would emphasize the downside implications of minimum effective taxes on overseas income.

The outcome is uncertain. Several factors point eventually toward a more progressive agenda if Biden and Democrats sweep. First, in the deeply divided and rancorous (and vindictive) Washington DC political environment, even a narrow margin of victory would likely be seized as a political mandate for enactment of sweeping changes and full repudiation of Trump. Second, in light of the mounting leftward shift of the Democratic Party, Biden’s historic role as a relatively passive follower on many issues tilts the probability toward a more progressive agenda.

The biggest economic positives of a Biden victory would stem from his more sensible approach to international diplomacy with allies and backing away from Trump’s tariff threats and anti-trade stances, and his easing of immigration restrictions. Both of these objectives could be accomplished largely through Executive Orders and regulations, independently of Congress.

The biggest economic negatives, and virtually certain to outweigh the economic positives for the US economic performance, would be the aggressive imposition of new regulations combined with the sharply higher taxes on capital. These would reduce actual and expected after-tax rates of return on investment, raise business uncertainty and undercut investment and entrepreneurship, and reduce potential growth. History shows consistently that higher taxes on capital and heightened regulatory burdens distort economic behavior and depress capital spending. Importantly, business confidence and investment are affected by government regulations as much as taxes, if not more so.

The New Green Deal would generate some clear improvements in infrastructure and innovations in energy usage and conservation, but spending $2 trillion in four years as Biden proposes is far too ambitious and would result in much waste. Attempts to achieve too many objectives as outlined in Biden’s platform, including urban renewal, jobs and income support for disadvantaged deemed harmed by the environment is a recipe for significant waste and misallocations. That was a clear lesson from President Obama’s “shovel ready” infrastructure program (a key component of the American Recovery and Jobs Act of 2009). Biden’s New Green Deal states that 40% of the total, or $800 billion, would be allocated to disadvantaged communities. However well intended, spending this amount so quickly would likely be in various forms of income support and temporary jobs rather than projects that really add to productive capacity. This is particularly true in light of the web of government regulations that would control the allocation of fund, including requirements that all government subcontractors to be unionized and other restrictions.

Inflation and Financial issues

Critical questions about the US fiscal policies revolve around the implications of soaring government debt for inflation, the government’s debt service costs, interest rates and exchange rates. These issues involve sizable risks and uncertainties. Even before Trump took office, persistent deficit spending pushed up debt and projections based on current policies pointed to sharp sustained increases debt relative to GDP. The Trump Administration’s policies added to the deficit spending, and so has the government’s pandemic-related spending. Biden’s proposals would further increase deficit spending and government borrowing. Nobody knows with any reliability the limitations or implications of this trend.

Since the Financial Crisis of 2008-2009, inflation has remained moderate and interest rates have receded near historic lows. Inflation has remained low (below the Fed’s 2% target) despite the unemployment rate reaching a 50-year low for a simple reason: there has been only modest excess demand relative to productive capacity, which has constrained business pricing power and wages. Nominal GDP, the broadest measure of current dollar spending in the economy, has grown at an average 4% annual rate, which has resulted in 2.3% real growth and approximately 1.7% inflation (the PCE price index averaged 1.6% annualize while the CPI averaged 1.8%). The Fed has not been successful in lifting inflation to its 2% target because its unprecedented monetary ease has failed to generate any sustained acceleration in economic activity relative to productive capacity (“Money supply spike: sources and implications”, Berenberg Capital Markets, July 1, 2020).

Although ever-mounting government debt is potentially inflationary—by stimulating excess demand, misallocating resources in ways that suppress productive capacity, suppressing the US dollar or forcing the Fed to monetize deficit spending or otherwise drive up inflationary expectations—the deficit spending to date has had little apparent impact on inflation.

Inflation temporarily dipped in response to the pandemic and government shutdowns, and has begun to drift up as economic conditions have improved. Inflation risks are now to the upside (“Temporary moderate deflation, despite aggressive monetary expansion”, Berenberg Capital Markets, April 25, 2020). The massive amount of monetary and fiscal stimulus—if it works as expected—will generate a sustained acceleration in economic activity, creating a situation of excess demand that lifts inflation. However, while inflationary expectations may rise in the near term, the risks of higher inflation are for 2022 and beyond, when GDP rises above its pre-pandemic level.

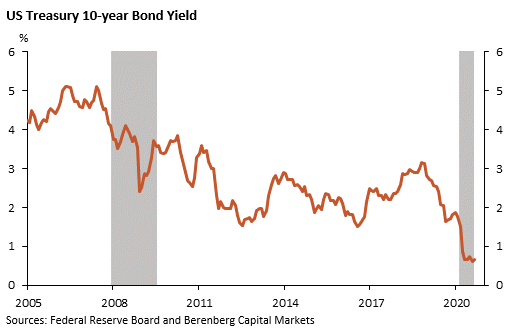

Bond yields have hovered near historic lows even as the economy recovery continues and inflation edges up (Chart 1). 10-year bond yields are 0.7%, a full percentage point below market-based measures of inflationary expectations. The Fed’s anchoring the Fed funds rate to 0% and its massive purchases of Treasury securities and Mortgage-Backed Securities (MBS) are constraining the government’s debt service costs. Fed now holds roughly 20% of all outstanding publicly-held debt and has pledged to purchase at least $80 billion per month. The government’s debt service costs would rise significantly if interest rates were to rise.

The risks of higher bond yields are decidedly to the upside. Yields are still roughly 50 basis points below their pre-pandemic level and several factors could lead to higher yields. First, the Fed’s ultra-easy policies and its forward guidance that these policies will continue are clearly suppressing yields. However, once the economy begins to approach normal, the Fed will signal that it will gradually begin to normalize its policies, and this will lead markets to adjust expectations about future Fed policy. Second, real rates should rise as the economy rebounds. Even though the Fed’s assessment of the natural real rate of interest (so-called r*) has declined, it is certainly not negative. Also, inflationary expectations may rise with any indication of higher inflation, pushing up bond yields. Note the recent decline in the US dollar will boost import prices.

Third, high debt may exert upward pressure on yields through different avenues. The US Treasury will be selling more and more debt securities. The critical issue is: Will US and foreign buyers continue to buy these bonds, and at what price? As long as the economy continues to grow, the rising government debt will not threaten the US’s creditworthiness, and concerns about the US dollar losing its reserve currency status are invalid at this time. Simply put, there are no attractive substitutes. US rates are much more attractive than negative yields on government bonds of Japan, Germany and Switzerland, although adjusted for inflationary expectations US real yields have fallen. Foreigners will demand higher yields if they expect the US dollar will weaken further (“The US dollar to fall further”, Berenberg Capital Markets, August 2, 2020). If foreign holders reduce their positions, the Fed may feel compelled to respond, which eventually could lead to bad outcomes.

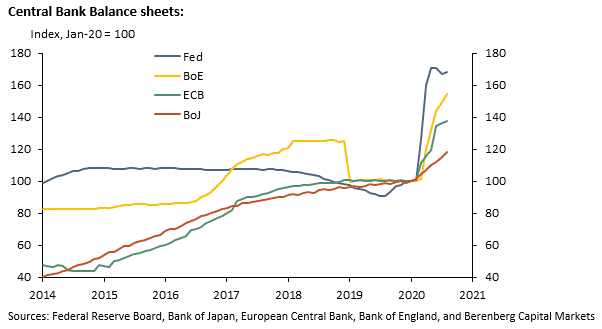

US dollar has depreciated against the currencies of major nations reflecting several factors: ex ante real rates on US bonds have fallen relative to overseas real yields, and the Fed has been much more aggressive in expanding its balance sheet than other leading central banks (Charts 2 and 3). Also, the narrative on the European economy has brightened significantly while China has allowed the yuan to appreciate significantly.

Any US policy shift perceived to be negative for the US economy would contribute to a weaker US dollar that could raise inflationary expectations and bond yields.

Chart 1.

Chart 2.

Chart 3.

Real 10-year government bond yields, adjusted for inflation expectations

Sources: Bloomberg and Berenberg Capital Markets

Mickey Levy, mickey.levy@berenberg-us.com