|

| |

| California became the first U.S. state to require all school employees be vaccinated or undergo weekly testing for Covid-19 while federal officials stepped up calls for pregnant women to get shots. The World Health Organization, which is still reviewing Russia’s Sputnik drug, said India’s Bharat vaccine may get final evaluation in September. Five other candidates will be reviewed starting this month, including the Novavax shot from India and the Sinopharm vaccine from China. On Wall Street, the two companies most associated with the battle against the coronavirus just took a huge hit. Shares of vaccine pioneers BioNTech and Moderna dropped for the second day in a row, losing roughly $60 billion in combined market value despite skyrocketing infections driven by the delta variant. Here’s the latest on the pandemic and your markets wrap. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic worldwide.

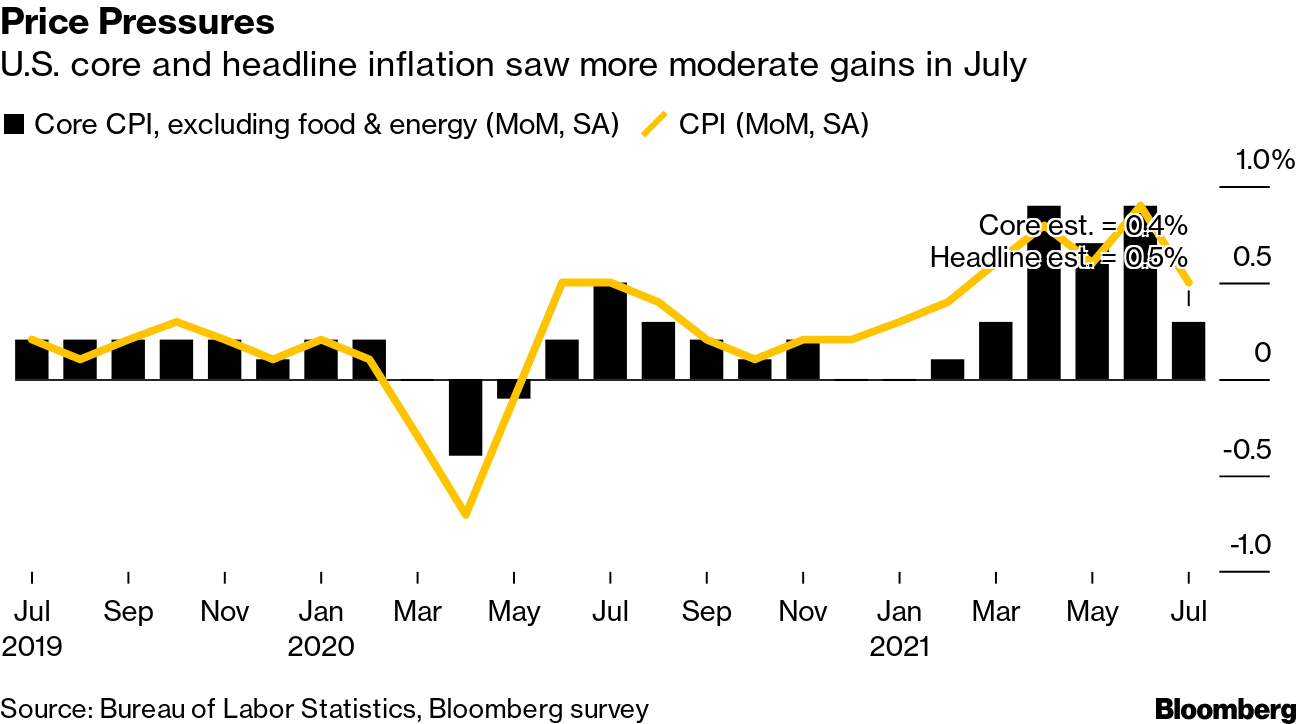

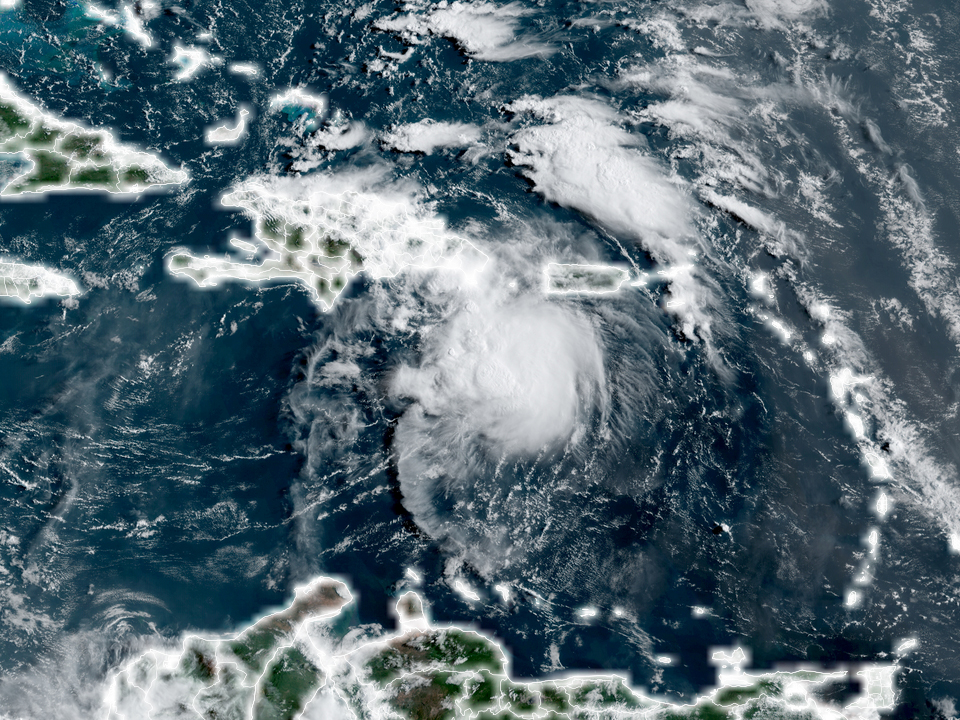

Just as the United Nations warns that humanity is out of time when it comes to cutting fossil fuel use, U.S. President Joe Biden urged OPEC to open the spigots wide. As for energy companies, they’re trying to pitch the idea that planet-warming natural gas can be erased if villagers are paid to protect forests. Welcome to the mathematical fantasyland of “carbon neutral” fossil fuel. Maybe the Fed was right. Prices paid by U.S. shoppers climbed at a more moderate pace last month, with the Consumer Price Index increasing only 0.5% from June, according to the Labor Department. Excluding the volatile food and energy components, the so-called core CPI rose just 0.3%. So what’s going on?  For months, a visitor to the website of the largest U.S. cryptocurrency exchange—Coinbase—would see it offering a stablecoin with a simple premise: For every dollar offered to investors, there’s $1 “in a bank account” to back it. That’s a key promise, since unlike Bitcoin the stablecoin has a set price and can be redeemed for regular currency. There was one problem with Coinbase’s pledge, however. It wasn’t true. Senate Democrats took a major step toward the biggest expansion in decades of federal efforts to reduce poverty and protect the environment (among many other things) by passing a $3.5 trillion budget framework. They aim to pay for it all by hiking taxes on corporations and the rich. Now comes the hard part. Tropical Storm Fred, the sixth named Atlantic storm of the year, is bringing heavy showers and high winds to the Dominican Republic before it heads west to threaten Cuba and Florida.  A tech billionaire recently paid $95 million for a home. A Taiwanese family with a grocery empire paid $216 million for an entire condo development. In Singapore, the ultra-rich are driving a $24 billion feeding frenzy. The credit-card rewards wars are back. JPMorgan revamped its popular Sapphire cards as the fight to win rich customers escalates.

MGM Resorts plans to sell 11 Picassos that could bring in as much as $104 million. The sale, which will take place live at the Bellagio, will include paintings, works on paper, and ceramics. “Our collection has evolved over time,” said Ari Kastrati, MGM Resorts’ chief hospitality officer. “Our goal with our collection has always been to evolve it further, and focus on diversity, and give voice to underrepresented artists. We’ve done a great job with that over the years, and we believe now is a time to double down on it.”  Picasso’s Buste d’Homme (1969) behind the bar at the Picasso restaurant at the Bellagio. Courtesy Sotheby’s & MGM Resorts. 2021 Estate of Pablo Picasso / Artists Rights Society (ARS), New York Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters What's moving markets in Asia? Sign up to get the latest in your inbox each morning, Hong Kong time. |

| Follow Us | ||||

|

|

|