Very Strong Employment Report for October: Rapid Job Gains and Higher Wages

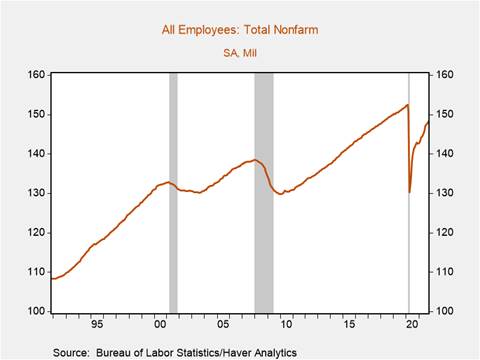

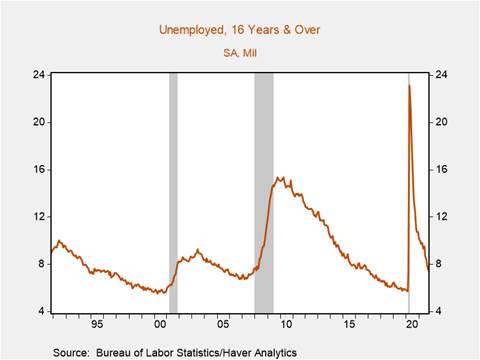

* Labor market conditions improved markedly in October following significantly upward revised job gains in August and September, with a robust 531,000 rise in establishment payrolls and another significant 255k decline in unemployment in the Household Survey that reduced the unemployment rate to 4.6% (Charts 1 and 2). Wage pressures continued. The job gains were buoyed by accelerating job gains in services as the impact of the delta variant ebbs. Total nonfarm employment is now 3.9 million below its pre-pandemic level. These metrics suggest the labor market recovery has picked up pace following its softer trajectory over the last few months.

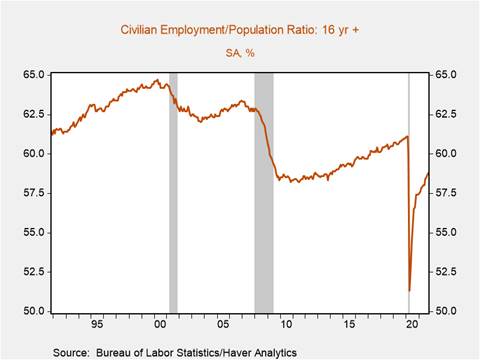

* The labor force participation rate was flat at 61.6% but the strong gains in employment pushed up the employment-to-population ratio to 58.8% while the prime age (25-54 years old) employment to population ratio edged up to 78.3%, only 0.9 percentage points below its March 2020 level (Chart 3).

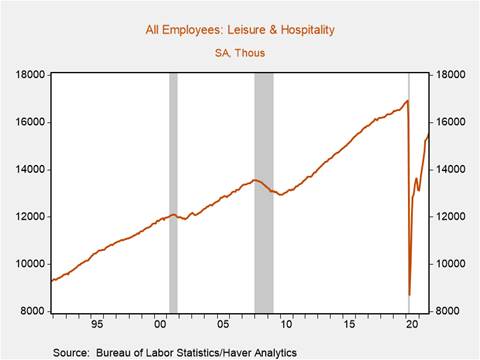

* Employment rose rapidly across both goods producing and private service providing industries, rising 108k and 496k, respectively. Employment gains were notable in construction and manufacturing (+44k, +60k) and reflect anticipated strong product demand. Service sector employment was bolstered by the +164k rise in leisure and hospitality reflecting the drop in daily COVID-19 cases from 140k to 90k in October (Chart 4). Transportation and warehousing employment rose +54k, lifting its 4-month increase to +235k as businesses strive to meet distribution needs amid strong product demand heading into the holiday retail season. State and local education registered large declines in employment, largely reflecting seasonal adjustment factors; despite flush finances driven by strong tax receipts associated with the rapid recovery, state and local governments have been slow to rehire educators.

*The decline in the unemployment rate reflected an increase of 104 k in the labor force and the 255k decline in unemployment. Unemployment has declined 2.05 million in the last four months. The labor force remains 3 million below its January 2020 level, suggesting that employment gains largely reflect flows from unemployment into employment rather than gains from workers returning to the labor force. Labor supply has begun to tentatively respond to the incentives of increasing nominal wages as household cash balances and personal savings are drawn down following the expiration of pandemic unemployment insurance, while the return to in-person schooling has in part relieved responsibilities for childcare that have held some individuals out of the workforce. A critical question going forward is how pandemic induced early retirements and potential structural labor market changes will impact measures of maximum employment.

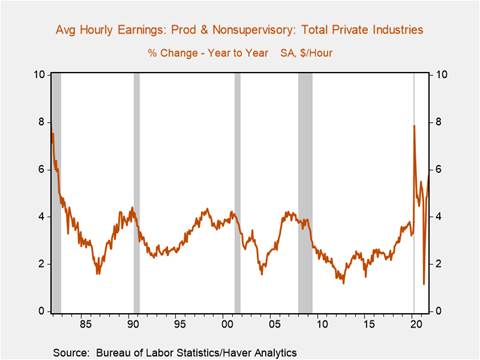

* Nominal wage growth accelerated in October as average hourly earnings of production and non-supervisory private non-farm employees increased 0.4% m/m lifting its yr/yr increase to 5.8%, their highest level since 1982 (Chart 5). Wage gains were particularly pronounced in leisure and hospitality, in which wages soared 1% m/m, lifting its yr/yr rise to 12.4%. We expect nominal wage growth will continue to accelerate reflecting elevated labor demand relative to labor supply, and as nominal wages ‘catch up’ to inflation and inflationary expectations influence wage setting behavior. In addition to accelerating wage growth, aggregate weekly hours rose 0.3% m/m and 4.3% yr/yr, in part reflecting increased employment. Increased hours worked and wages should translate into rising disposable income and consumption in October, although the positive thrust of these factors on consumer spending will be partially offset by high inflation and the expiration of pandemic unemployment insurance.

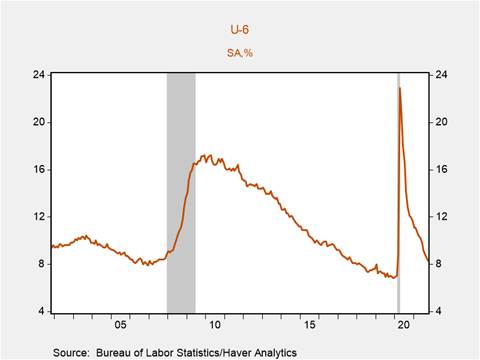

* Inclusive measures of employment also generally improved over the month. U-6, a broad measure of underemployment that includes part time and marginally attached workers ticked down to 8.3%, the Hispanic unemployment rate fell to 5.9%, while the Hispanic labor force participation rate held steady at 65.7% (Chart 6). The black unemployment rate was flat at 7.9%, but the black labor force participation rate and employment to population ratio fell to 61.1% and 56.3%, respectively. These inclusive measures have recovered to levels achieved at mature stages of prior expansions, but remain shy of their pre-pandemic levels (Labor market stresses amid “substantial progress” toward the Fed’s employment mandate).

* Although employment growth in October has moderated relative to the pace of employment growth in June-July, it nevertheless bodes well for the economic outlook in Q4. Labor demand remains strong and service sector employment grew solidly as the infection rates of the delta variant subside. Disposable income and consumption are likely to rise driven by rising wages and employment, while labor supply has begun to rise albeit slowly. If employment gains continue at this pace, total employment would return to its pre-pandemic level in approximately eight months, right around the time the Fed indicates it plans to end its asset purchases. If inflation remains elevated in 2022 as we expect (Inflation Watch), the stage would be set for interest rate normalization.

Chart 1: Total Non-Farm Employment (millions)

Chart 2: Total Unemployment (millions)

Chart 3: Employment to Population Ratio

Chart 4: Payroll Employment Leisure and Hospitality (millions)

Chart 5: Average Hourly Earnings of Production and Non-Supervisory Employees (yr/yr % change)

Chart 6: U-6 Rate

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.