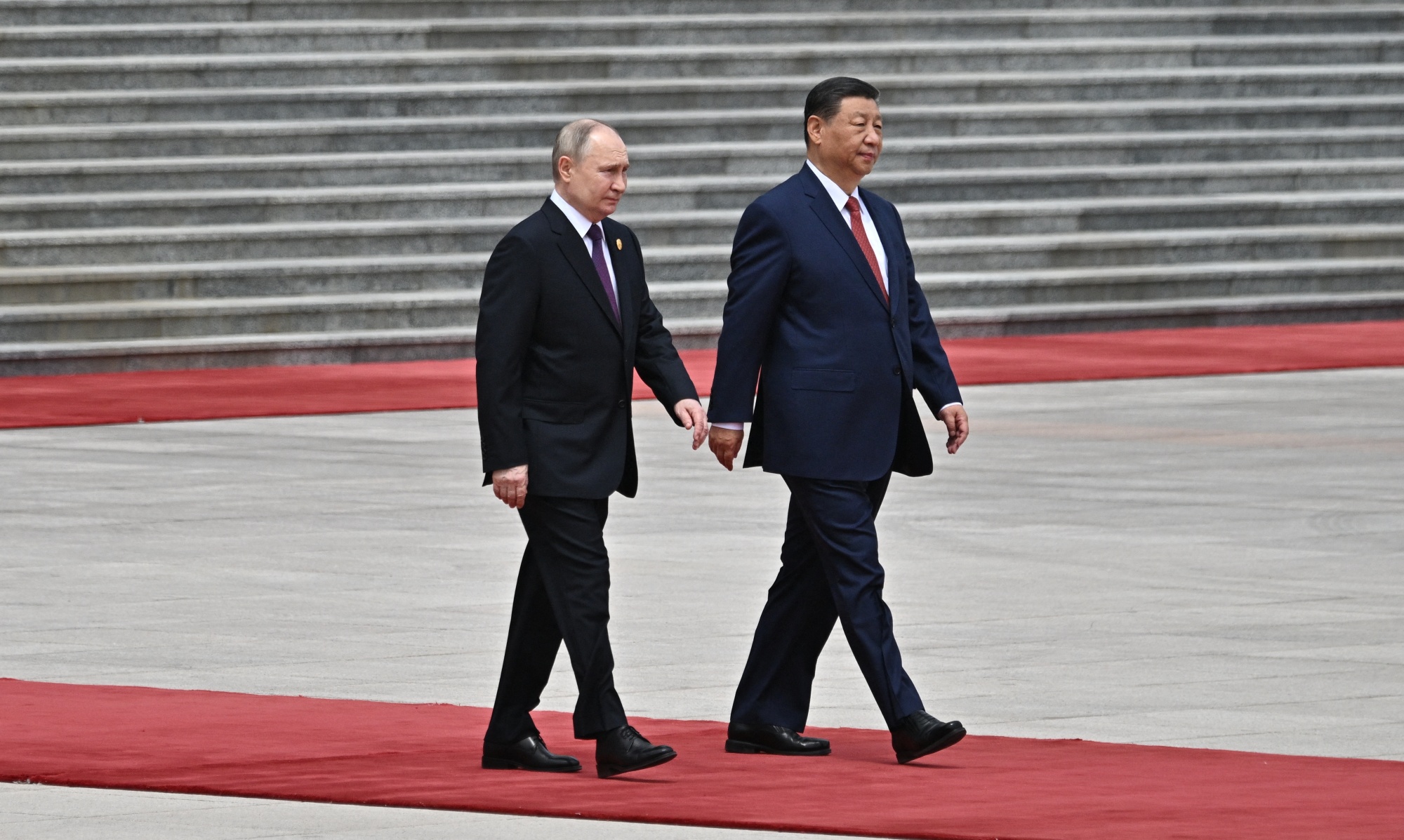

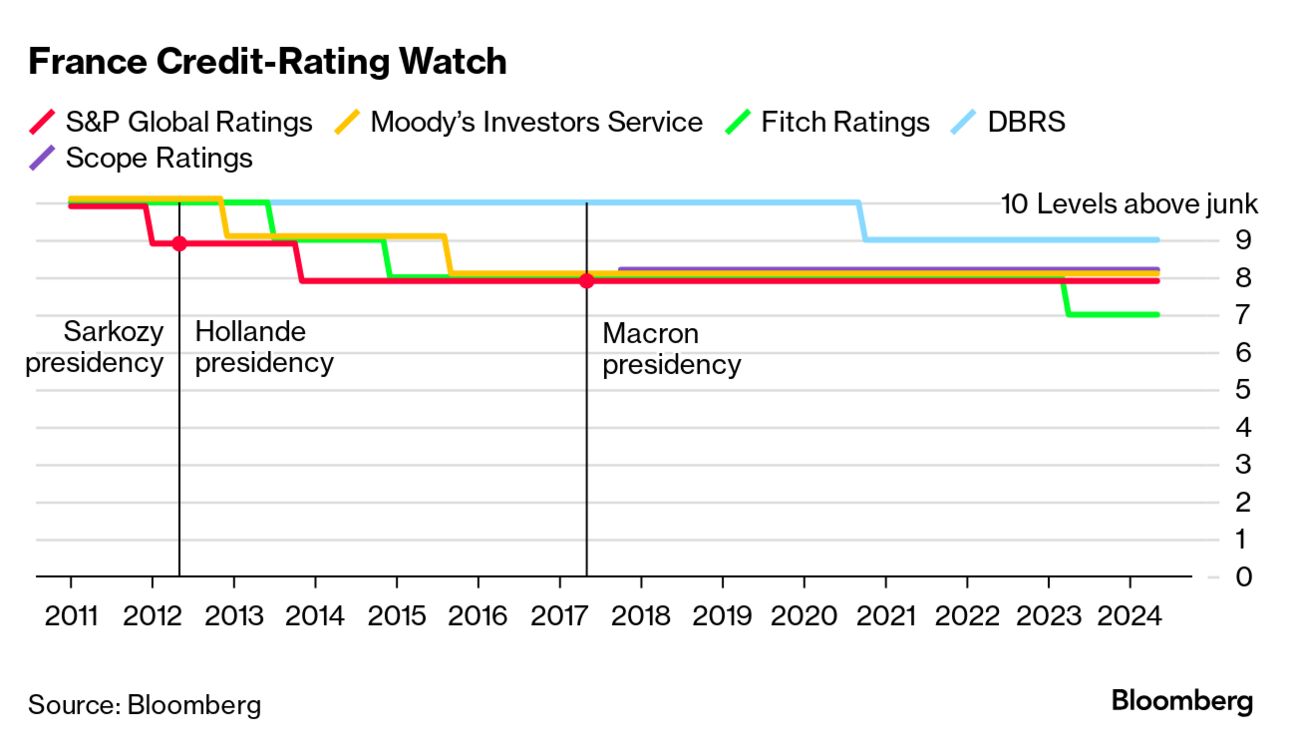

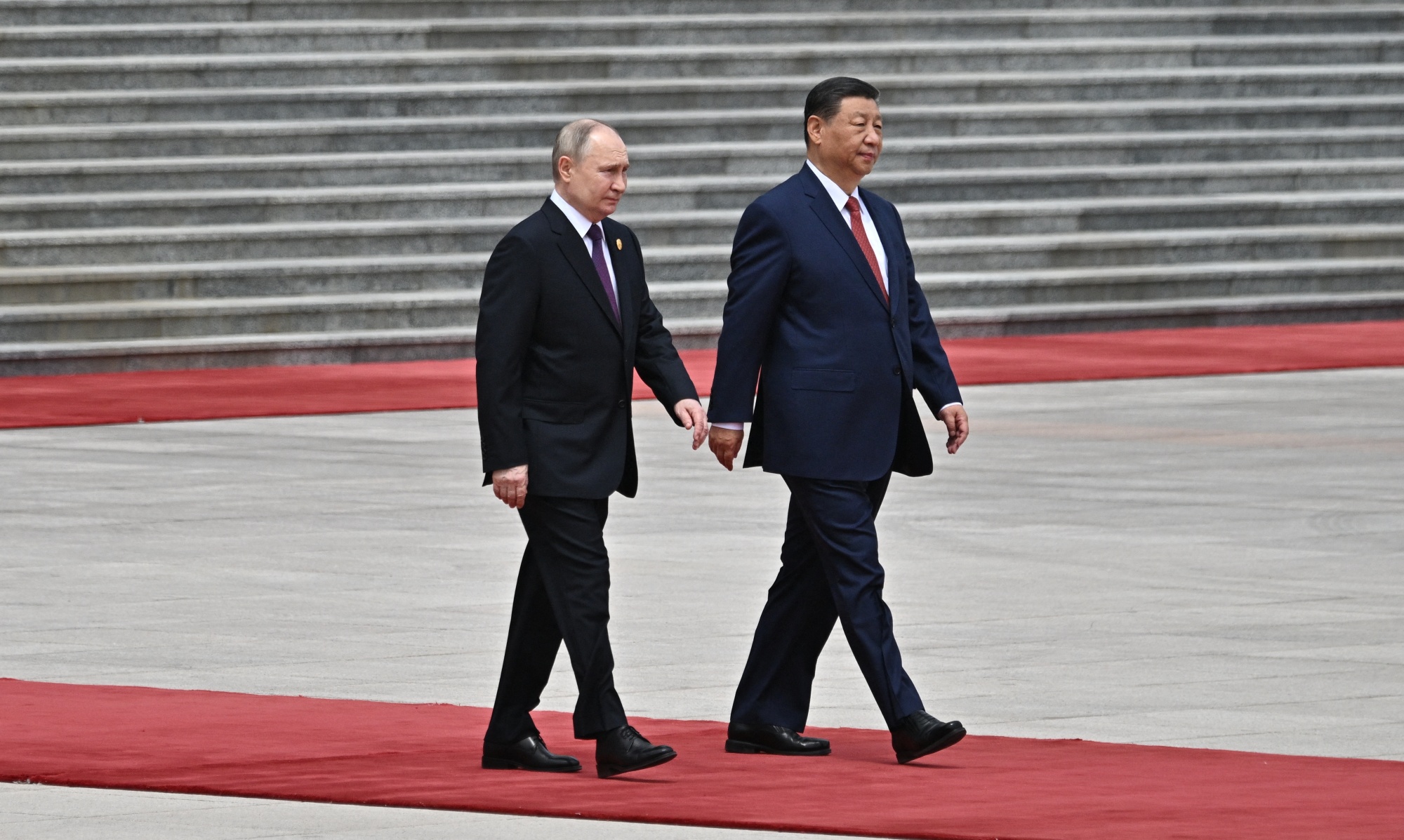

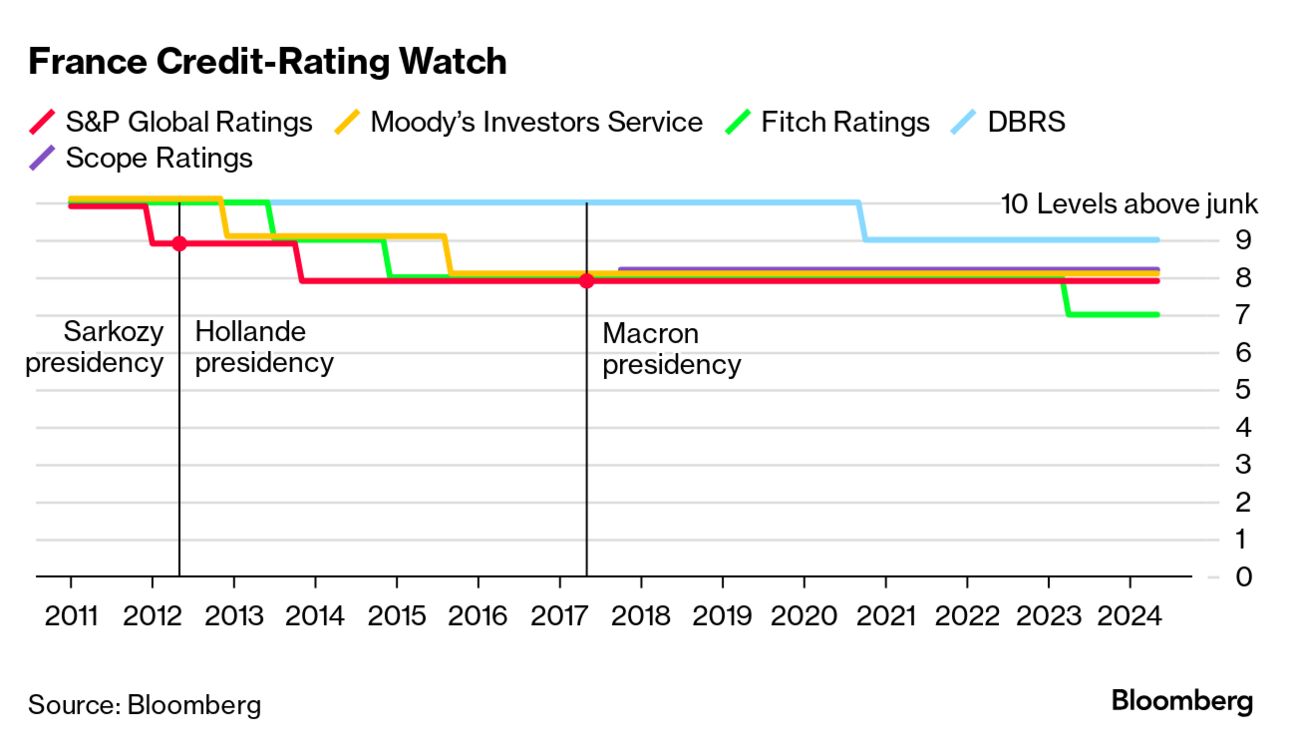

| A renewed bout of volatility gripped US stocks in the final stretch of May, with the market finishing higher amid a rotation between technology and other industries. After dropping almost 1% amid weakness in tech megacaps, the S&P 500 rose about as much to notch its biggest monthly advance since February. But investors betting that technology giants will continue to power gains could be in for a rough ride when other sectors start to catch up, according to strategists at Bank of America. They said the outperformance of value over growth as market breadth improves could be the next “pain trade.” —David E. Rovella The felony conviction of Donald Trump marks a meaningful victory for the beleaguered American legal system and a win for truth over falsehood, Noah Feldman writes in Bloomberg Opinion. Three other criminal trials involving Trump have bogged down for various reasons. Two impeachments by the House of Representatives ended in partisan votes against conviction in the Senate. But in an ordinary New York courtroom, Feldman says, 12 men and women considered the evidence, weighed Trump’s various defenses and concluded beyond a reasonable doubt that he was lying.  A news ticker displays a headline about Donald Trump’s criminal trial verdict in Manhattan’s Times Square on Thursday Photographer: Yuki Iwamura/Bloomberg The US will coordinate with allies to punish Chinese firms that are helping Russia bolster its military-industrial base, including potential sanctions against financial institutions, two senior US officials said on Friday. Under scrutiny are Chinese firms “that have been involved in a systematic way in supporting Russia,” Kurt Campbell, deputy secretary of state and President Joe Biden’s former Asia policy czar, said. The warning comes a day after it was revealed that Biden is buttressing his support for Kyiv by allowing it to use US weapons to strike Russian territory from where attacks on Ukraine originate. Russian nationals have been arrested in Germany on charges of planning to attack military facilities. English prosecutors claim that Russian agents set fire to a warehouse containing aid for Ukraine. Sweden is investigating alleged Russian-sponsored acts of sabotage. The Czech government accuses Moscow of sabotaging its railways. Estonia, meanwhile, has reportedly uncovered a host of Russian plots on its soil. Russian ships are suspected of targeting communications cables and wind farms in the North Sea. Now, Moscow may be involved in suspicious fires including one that engulfed a shopping center in Poland. The roster of allegations goes on and on, Hal Brands writes in Bloomberg Opinion. Vladimir Putin’s shadow war on Europe is intensifying.  Vladimir Putin and Xi Jinping in Beijing on May 16 Photographer: Sergei Bobylyov/AFP Elon Musk had inside knowledge of a miss on Tesla production and delivery numbers when he sold $7.5 billion in stock in 2022, a shareholder claimed in a lawsuit. Tesla’s chief executive had nonpublic information that Tesla would miss the fourth-quarter targets that year when he sold the shares, Tesla investor Michael Perry alleged in a complaint filed Thursday in Delaware Chancery Court. “Musk profited from his misconduct and his exploitation of material and adverse inside information,” the suit alleged. Perry asked a judge to order Musk to return the profit from his allegedly improper trading to the company. S&P Global Ratings downgraded France, tarnishing President Emmanuel Macron’s record for debt management as his government struggles to get a grip on public finances in the wake of the Covid pandemic and energy crisis. The credit assessor said that although reforms and a recovery in economic growth will allow the country to reduce its budget deficit, the gap will remain above 3% of gross domestic product in 2027. The downgrade to AA- from AA puts France on a par with the Czech Republic and Estonia.  Paramount Global directors evaluating a bid for the film and TV giant are said to have endorsed a takeover offer by independent producer David Ellison, moving the storied Hollywood studio closer to a sale. As part of a multistep deal, Ellison’s Skydance Media is offering to purchase Shari Redstone’s National Amusements, the family company that holds a controlling stake in Paramount. Skydance then plans to merge with Paramount, offering more than $3 billion to that company’s other investors in the form of cash and debt repayment. Michael Dell’s wealth tumbled the most in a single day after the computer company he founded posted results that disappointed investors. Dell’s net worth dropped $11.7 billion to $107.1 billion on Friday as shares of Dell Technologies fell 18% in New York—the most on record. While the company reported its first quarterly revenue increase in two years, it wasn’t enough to impress investors with high expectations for its artificial intelligence server business.  Michael Dell Photographer: Bridget Bennett/Bloomberg Lately, famous men have been embracing outsize jewelry for their biggest public moments. Whether it’s chunky gold necklaces draped over colorful suits at the NFL draft or diamond brooches pinned to tuxedos at the 2024 Academy Awards, male celebrities are going bold—and the world’s biggest jewelry makers are betting everyday shoppers will soon follow. David Yurman, John Hardy and Louis Vuitton were among a host of brands this year that unveiled new fine- and high-jewelry collections with precious metals and gemstones.  Source: Louis Vuitton Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Big Take Asia: Every Tuesday on the new Big Take Asia podcast, Bloomberg reports on the critical stories at the heart of the world’s most dynamic economies, delivering insight into markets, tycoons and businesses driving growth across the region. You can also listen daily to powerful Bloomberg deep-dives on the original Big Take podcast and hear fresh takes on what’s going on in Washington every Thursday on the Big Take DC podcast. |