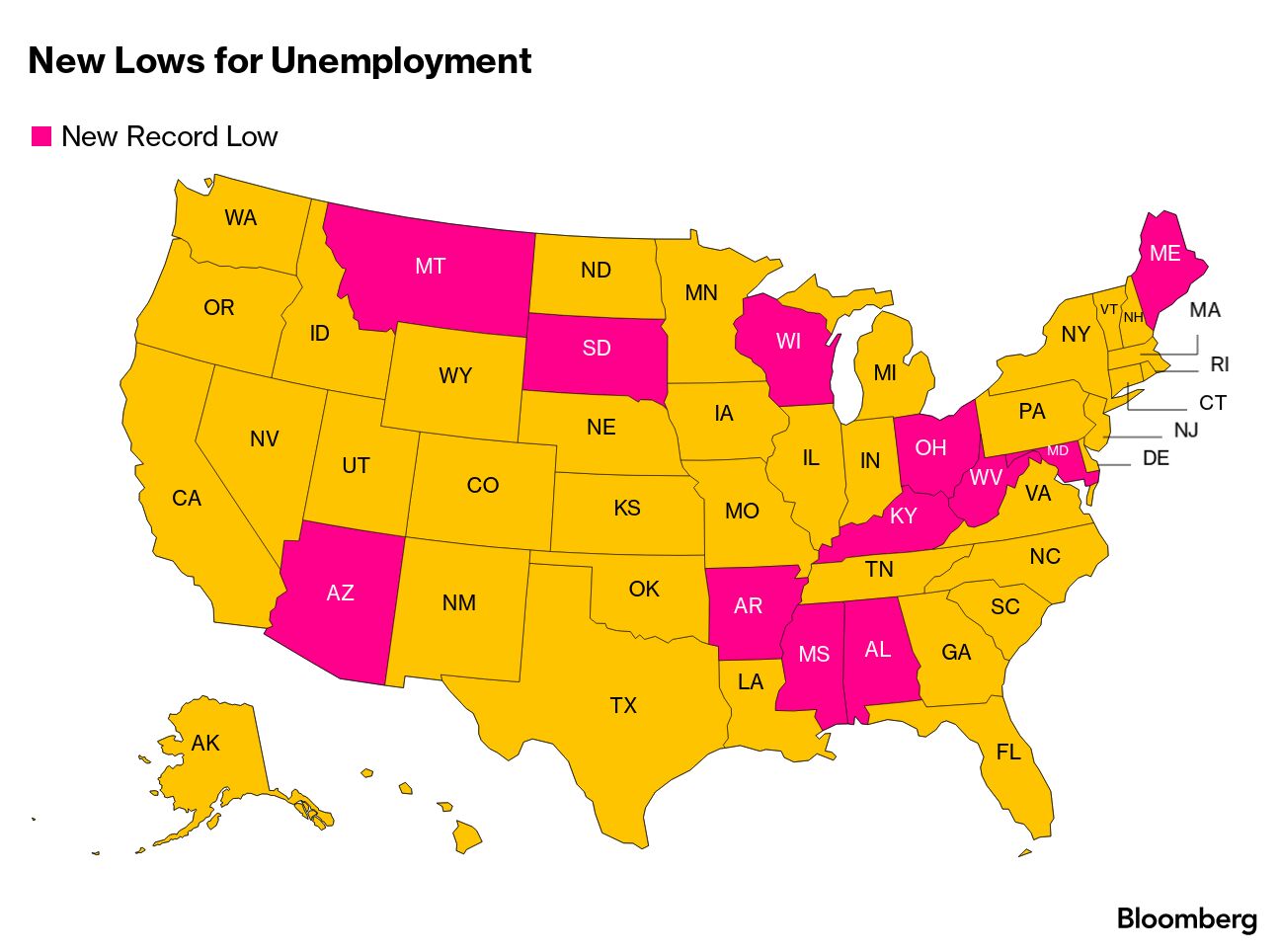

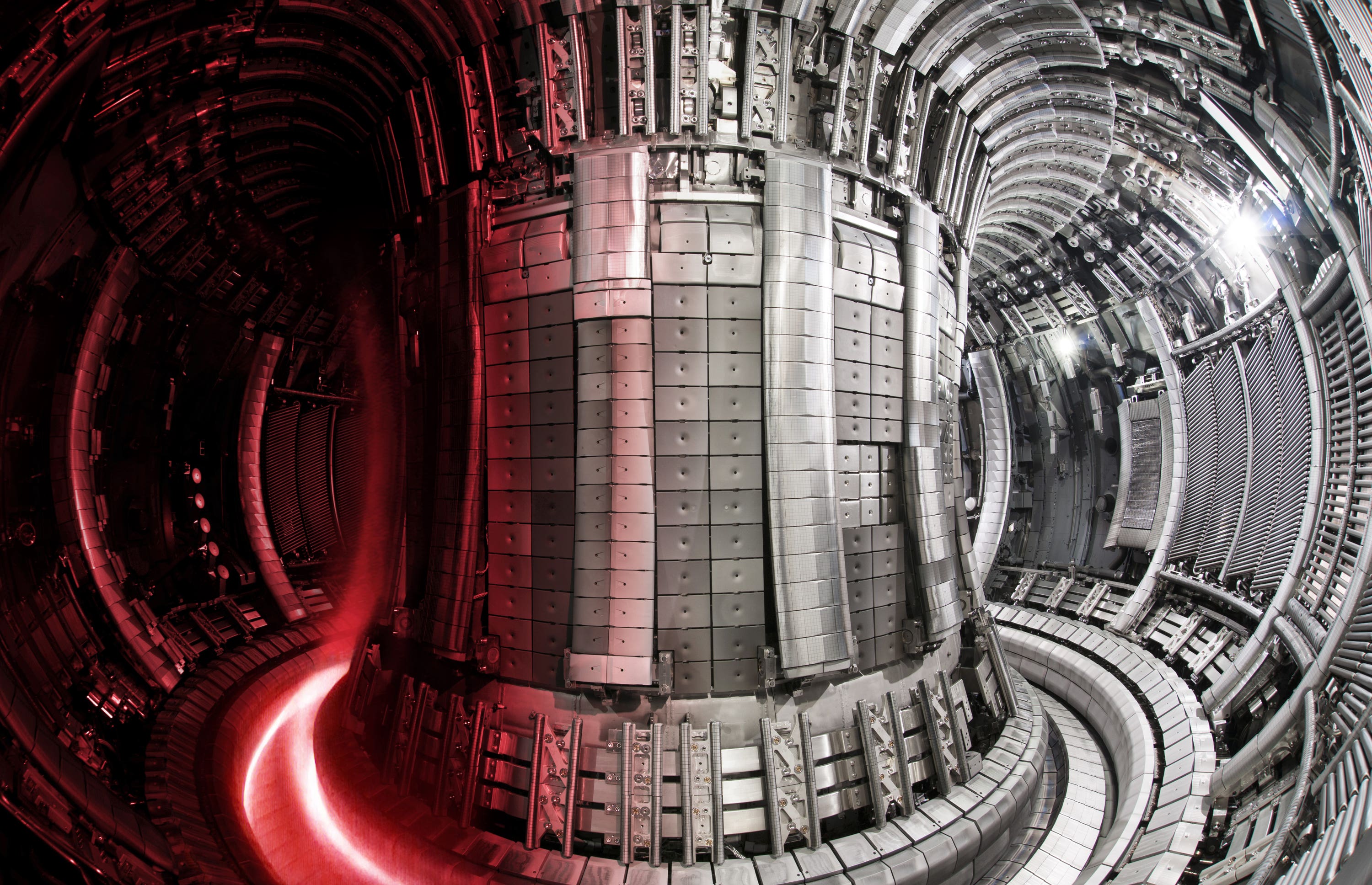

| Battered regional banks got a vote of confidence from the one-time king of the bond world. In his investment outlook published Friday, Bill Gross, the former chief investment officer of Pacific Investment Management Co., said he’s purchased stocks including Western Alliance Bancorp, Synovus Financial and PacWest as well as the SPDR S&P Regional Banking ETF. Following a series of bank failures in early March, shares of small lenders have slumped, trading at a discount of about 60% of the value of their net assets. That, together with a return-on-equity of around 10%, provides “an enticing long-term investment,” according to Gross, who retired from asset management in 2019. “I’ve always told myself and close friends that I wish I could start a bank,” wrote Gross. “It’s a license to make money.” —David E. Rovella A broad-based measure of inflation expectations compiled by the Federal Reserve fell last quarter to its lowest level in almost two years. Developed by Fed board economists in late 2020, the index comprises more than 20 indicators measuring the attitudes of consumers, investors and professional forecasters toward future price increases. While Wall Street handicaps whether the Fed will overshoot on rate hikes, the central bank has been seeing evidence that its inflation-fighting strategy is working. There are growing indications of a slowing US economy. But still, American unemployment continues to however at historic lows. Ride-hailing company Lyft plans to fire at least 1,200 people in a fresh round of job eliminations as the company struggles to reach profitability and compete with bigger rival Uber. The latest reductions could affect 30% or more of Lyft’s 4,000 employees and come after the company already terminated some 700 people last year. Day traders are paying a price for their newfound love for one of the hottest trades in the equity market. Rushing to join the trading frenzy in options with ultra-short lifespans, small-time investors find themselves struggling to make it work. By one estimate, amateur investors took a billion-dollar bath dabbling in stock options during the pandemic boom. It’s the holy green grail and perhaps the only way to avoid the worst of our self-inflicted planetary destruction. Nuclear fusion is something scientists have humorously referred to as decades away for decades now. But here are seven companies that just might make it happen. America’s best-known lawyer, a couple of fraudsters and a pariah government joined forces to sue the world’s largest commodities trading firms. The evidence is explosive, but the bungled lawsuit has so far come to nothing. This is the brazen plot to rig oil auctions that cost Venezuela billions of dollars. Sudan’s army and a rival paramilitary group declared a cease-fire following seven days of conflict that has claimed hundreds of lives and brought the northern African nation to the brink of civil war. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. Europeans are gearing up for their beloved summer vacation season, and they’re prioritizing a new trip-planning requirement: A lack of crowds. After pleasant weather and attractive deals, they say the next most important criteria for choosing a destination on the continent is that it not be overrun. Battling it out for beach umbrellas on Pampelonne Beach in St. Tropez or pushing past American vacationers on Place du Trocadéro in Paris during the busier summer months has become too much to bear.  An ice cream van sells bottled water to tourists in the Castelo district of Lisbon, Portugal, last July. Photographer: Goncalo Fonseca/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Design + Make: How are the world’s most creative minds responding to a world in flux? On April 25 in London, those on the cutting edge of design, manufacturing and entertainment shine a light on innovative solutions that can make the world better, smarter and more sustainable. Speakers include executives from Ingka Group and Foster + Partners. Join in person or virtually. Learn more here. |