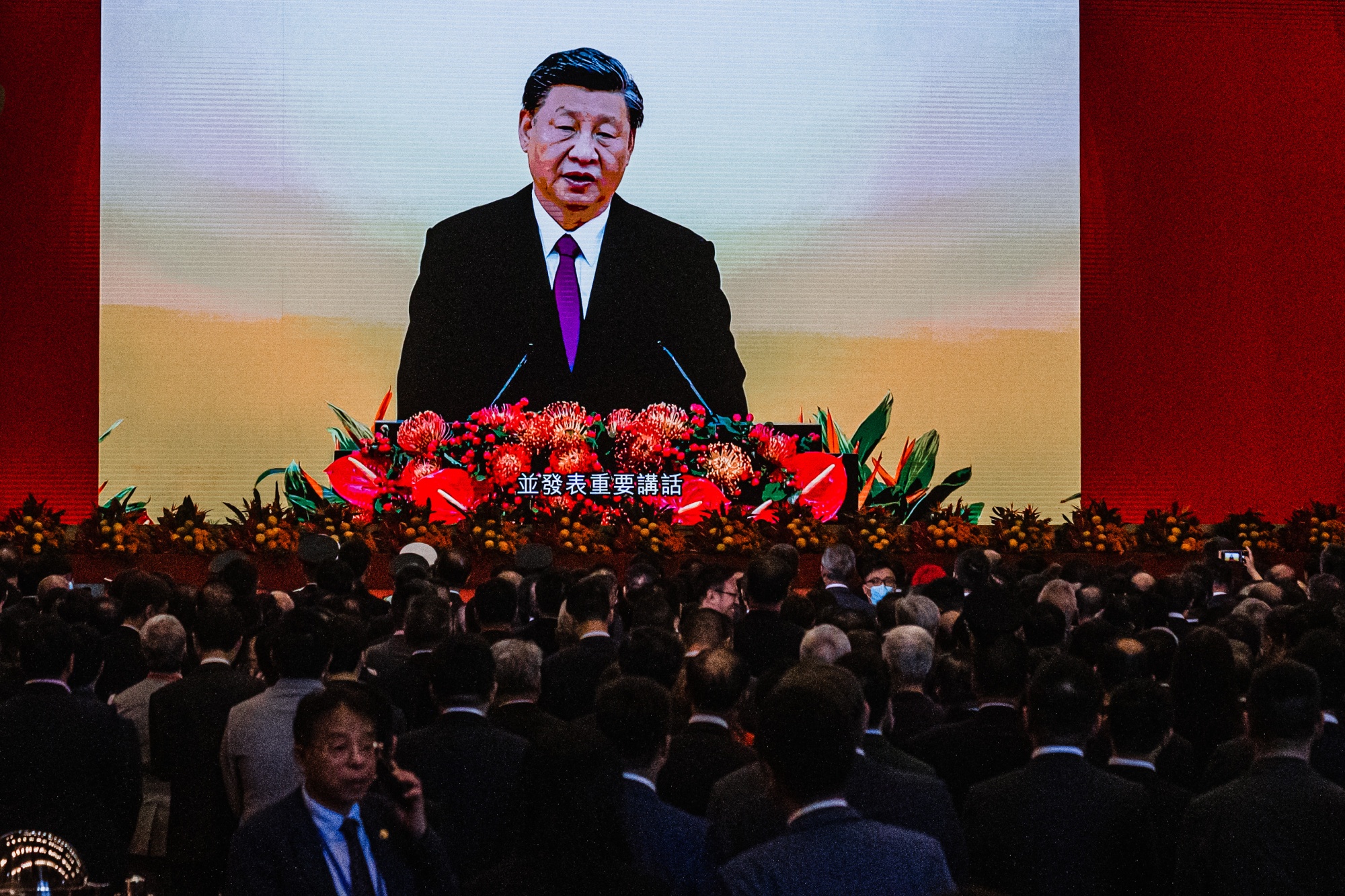

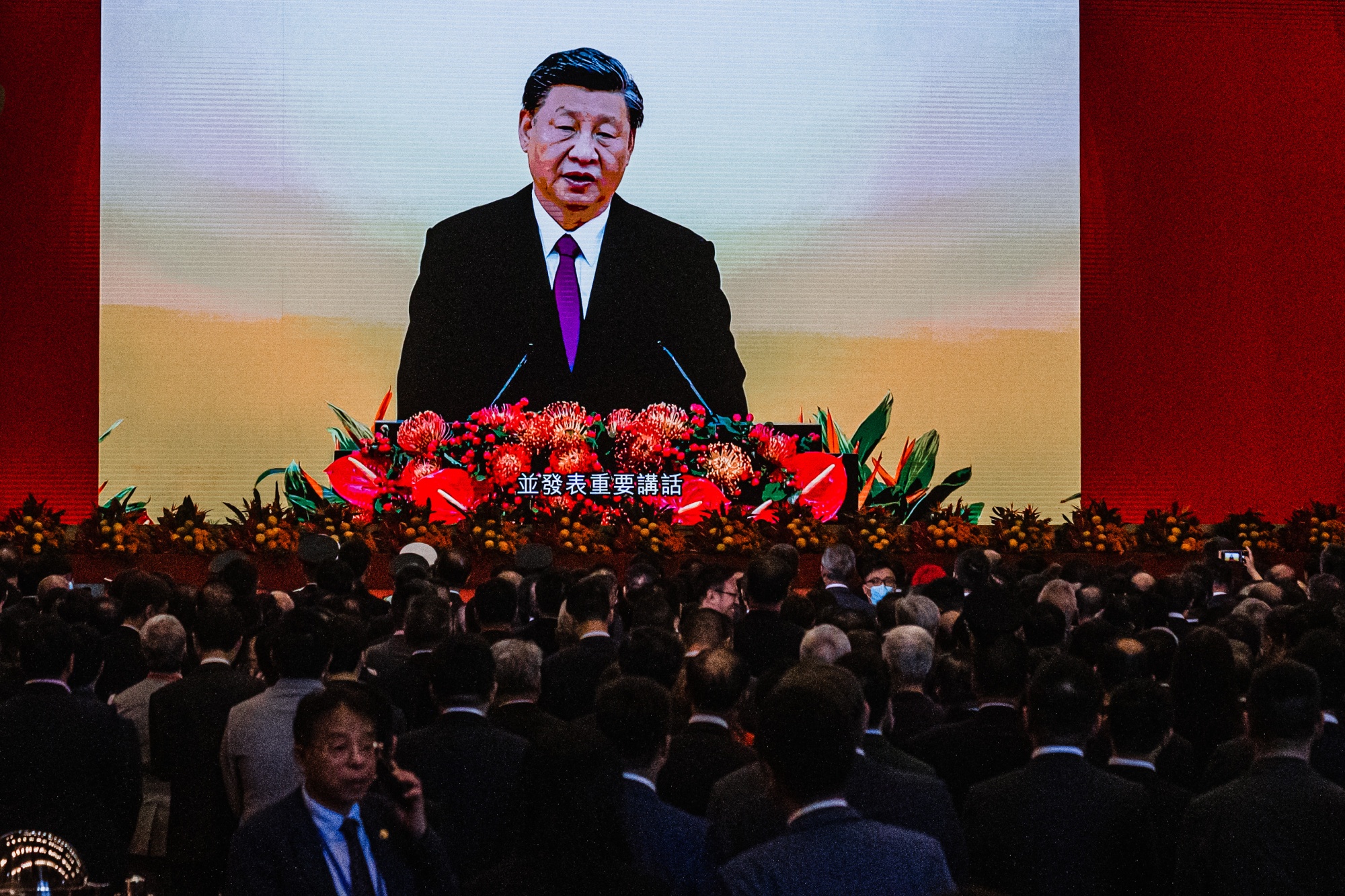

| The relocation of a small portion of the American financial industry from New York and California to the US South has been measured anecdotally, often one office at a time, over these past few years. Elliott Management decamped for West Palm Beach. AllianceBernstein to Nashville. Charles Schwab landed in suburban Dallas. But now, perhaps for the first time, there are hard numbers quantifying the scope of this nascent exodus. Both New York and California have in the past three years lost firms that managed close to $1 trillion of assets, Bloomberg calculated. The departures from the Northeast and West Coast have meant the loss of thousands of high-paying jobs, in turn straining city and state finances by sapping tax revenue. Commercial property markets also have lost valuable tenants just as they’ve been struggling with the new realities of hybrid work. Sure, the New York City area remains the most powerful center for asset management. But in the South, the new arrivals are fueling a boom. — Natasha Solo-Lyons Goldman Sachs is exploring a sale of an investment-advisory business it bought four years ago, undoing yet another signature deal under Chief Executive Officer David Solomon’s ill-fated push to manage money for a broader set of customers. A rally in big tech spurred a rebound in stocks, outweighing concerns over higher Treasury yields just a few days ahead of a much-awaited speech by US Federal Reserve Chair Jerome Powell. The S&P 500 finally climbed following its longest streak of weekly losses since February. The Nasdaq 100 was up about 1.5%, with Tesla halting a six-day losing run. Here’s your markets wrap. The wage floor for American workers is rising and recently hit a record high, according to a Federal Reserve Bank of New York survey. The lowest annual pay that workers would accept to take a new job increased to $78,645 in July, according to the New York Fed’s most recent Survey of Consumer Expectations. That’s up from about $72,900 a year earlier and $69,000 in July 2021. Xi Jinping’s quest to rewrite the playbook that drove China’s economic miracle for a generation is facing its sternest test yet. The $18 trillion economy is decelerating, consumers are downbeat, exports are struggling, prices are falling and more than one in five young people are out of work.  Xi Jinping is presiding over a decelerating Chinese economy Photographer: Bloomberg For most people with federal student loans, the US Supreme Court and its Republican-appointed supermajority dashed their dreams of debt relief. Still, some borrowers are beginning to have their balances wiped away. The Biden administration recently began forgiving $39 billion in student debt for more than 800,000 borrowers who enrolled in income-driven repayment plans and had made monthly payments for at least 20 years. The risk of new disease, disability and death remains elevated in some patients as long as two years after catching Covid-19, according to a large study showing the infection’s prolonged heath impact. People who were never sick enough to be hospitalized for acute Covid still had a higher risk than uninfected people of developing long Covid-related disorders such as dangerous blood clots, diabetes and lung, gastrointestinal and musculoskeletal disease two years later, according to a new study. The remnants of Tropical Storm Hilary pummeled the US West Coast with flooding rains Monday, disrupting flights and knocking out electricity. Tens of thousands lost power and more than 300 flights were canceled in California, Nevada and Arizona. Rescuers also pulled several people from swollen rivers, the Associated Press reported.  The remnants of Tropical Storm Hilary slammed into California, leaving tens of thousands without power. Source: Bloomberg The crowds of travelers filling airports in many parts of the world this summer are a telltale sign of what’s ahead for tourism. By 2033, travel is set to become a $15.5 trillion industry—accounting for more than 11.6% of the global economy. This represents a 50% increase over its $10 trillion value in 2019, when travel represented 10.4% of the world’s gross domestic product.  Photographer: Andrea Mantovani/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Intelligent Automation—Transformation in a Time of Uncertainty: Top business and IT executives will gather in a city near you to explore ways in which intelligent automation can offset economic pressures and help organizations thrive by enhancing operational efficiencies and stakeholder value. We'll feature in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management about investing in transformation. For London on Sept. 19, Register here; For Toronto on Oct. 19, Register here; And for Seattle on Nov. 8, Register here. |