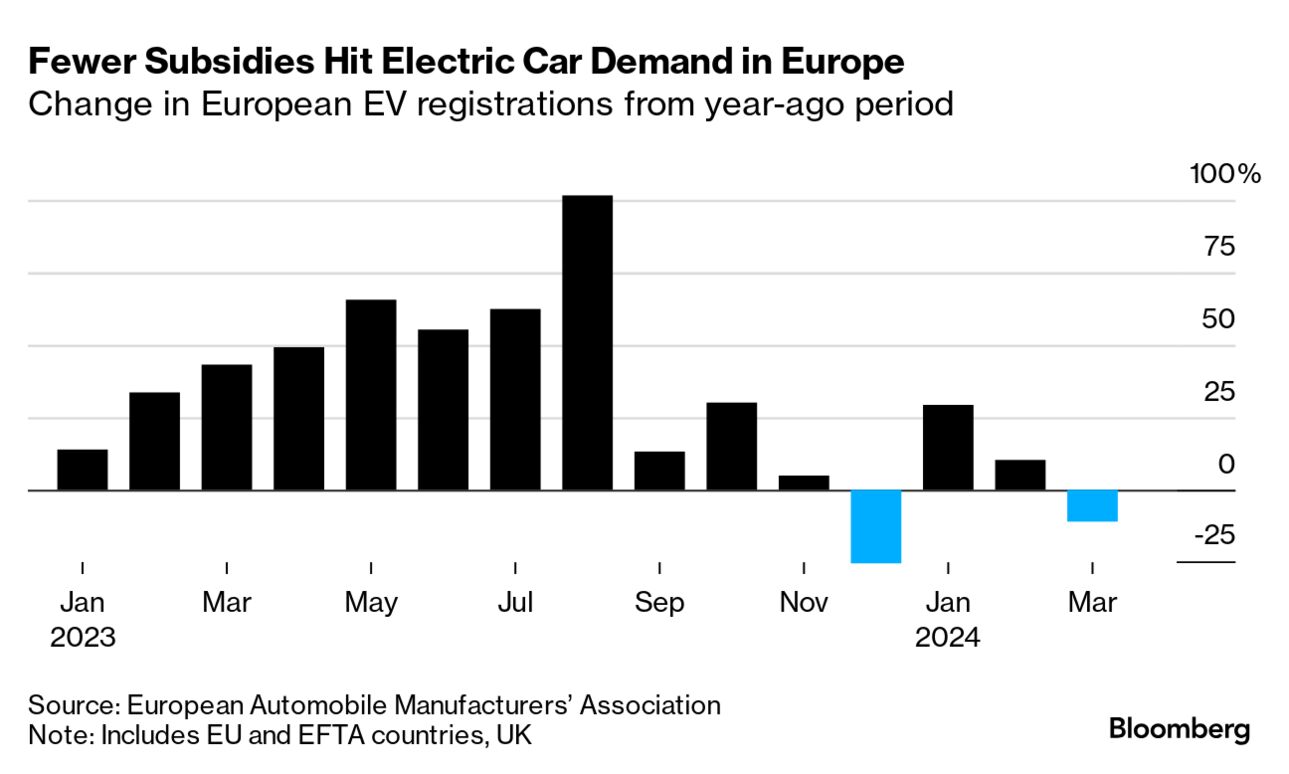

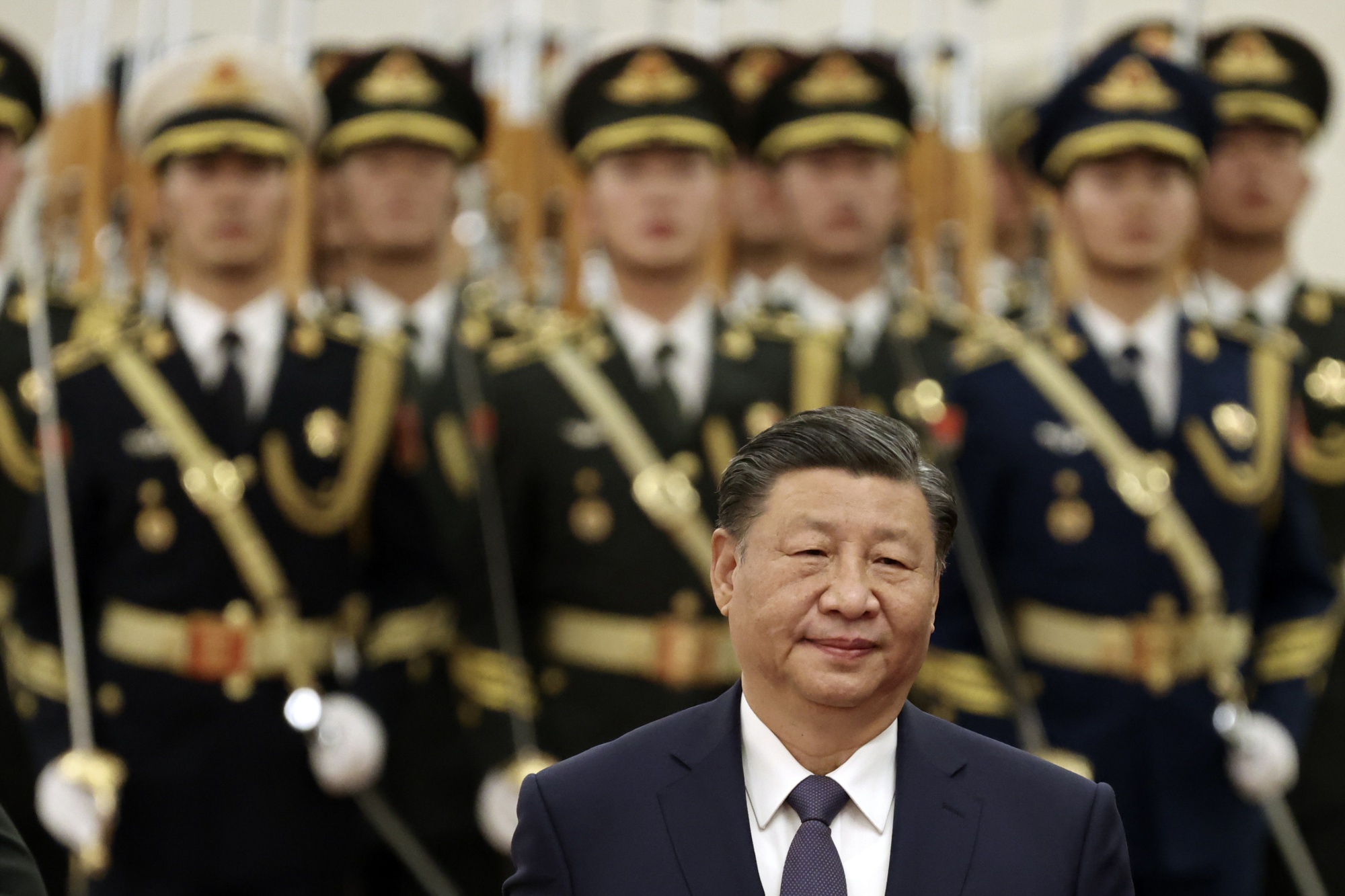

| US equities sold off sharply on Friday, sending tech stocks to their biggest weekly loss in 17 months. The S&P 500 closed down 0.9%, dropping for the third straight week and leaving it more than 5% below its closing high at the end of March. The Nasdaq 100 meanwhile declined 2.1%, recording its deepest weekly drop since November 2022. At the same time, the Cboe Volatility Index climbed close to 19. The market drop comes as the US Federal Reserve pushes back rate cuts, fear grows of a potential rate increase should inflation continue to stick, and the ramifications for oil prices amid further military escalation in the Middle East. “Geopolitical and political uncertainty join inflation, rates and the Fed in pressuring markets,” said Mark Hackett, chief of investment research at Nationwide. The combination is “driving a rapid and dramatic shift in the complexion of markets and the attitude of investors.” —David E. Rovella The tech sector was a big part of today’s crackup. Super Micro Computer and Nvidia plummeted, with the two AI favorites leading the broad-based tech selloff. Super Micro, a maker of equipment to handle artificial intelligence work, sank 23% in its biggest drop since August, closing at its lowest in more than two months. Chipmaker Nvidia’s 10% drop made for its steepest plunge session since the start of the pandemic in March 2020. It closed below its 50-day moving average for the first time since November. The slump erased nearly $212 billion off its market capitalization. “People seemed to think the AI trade would go up forever. It got crowded and now it’s unwinding something fierce,” said Dennis Dick, a proprietary trader at Triple D Trading. “This is just a tech wreck.” The bad news on Wall Street this week has some thinking the big boom of 2024 has come to an end. The rally looks close to unraveling as would-be bulls turn tail and run, and money is pulled out of equities and junk bonds at the fastest rate in more than a year. In some ways, investors face the same risks they chose to live previously thanks to resilient corporate earnings and fast economic growth. But this week the calculus seems to have shifted. Europe’s falling electric-vehicle sales may be proof the market isn’t ready to stand on its own, putting governments on notice for more support until affordable EVs become a reality. The glut is clogging up ports as factories are cutting production—a red flag for the region’s climate goals and the risk of more mass firings after Tesla terminated thousands this week. US financial watchdogs plan to take another crack at regulating Wall Street executives’ pay—an outstanding requirement of the 2010 Dodd-Frank Act that has repeatedly failed to materialize. The Federal Deposit Insurance Corp. is said to plan a vote on a measure in coming weeks. Still, the rules would have to clear a half-dozen regulators before taking effect. Two prior campaigns to do so ended unsuccessfully. Africa’s economic outlook has brightened, but still faces risks including a resurgent dollar and deadly droughts, the International Monetary Fund said. The region’s growth should nudge up four tenths of a percentage point to 3.8% this year and 4% in 2025, according to the IMF’s regional outlook. It heralded the resumption of access to capital markets, albeit at higher yields than before, following eurobond offerings by Ivory Coast, Benin and Kenya. Now that Israel has struck back at Iran, which last week struck back at Israel, which on April 1 struck at Iran’s Damascus consulate, this episode of tit-for-tat missile-messaging just might be over, Marc Champion writes in Bloomberg Opinion, judging by the “nothing to see here” response from Tehran. If so, and that’s a significant “if,” the critical questions to ask are what has changed and, equally, what hasn’t. Chinese leader Xi Jinping has ordered what amounts to the biggest reorganization of the nation’s military since 2015, in a move that affects the force in charge of cyber warfare. The restructuring comes as the world’s second-largest economy faces off with the US in a fight for global sway, with cyber a key battleground. The US, UK and New Zealand accused China last month of sponsoring malicious cyber activity in targeting democratic institutions.  Xi Jinping Photographer: Pool/Getty Images AsiaPac Greubel Forsey SA wants to put its unique watches on more wrists. That’s not the easiest thing for a Swiss brand that was used to making fewer than 110 timepieces annually. Its extraordinary marvels of mechanics come with meticulous hand-finishing and can cost 1 million Swiss francs ($1.1 million) each. But the watchmaker has started a campaign to make more products and at more affordable prices. Its old clients are a dedicated group of ultra high-net worth timepiece collectors, but there just weren’t enough of them to sustain any real growth.  The Greubel Forsey Balancier 3 Illustration: Vasya Kolotusha Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Wealth Summit: Can prosperity and instability comfortably coexist? Join us in Hong Kong on June 5 as we gather leading investors, economists and money managers for a day of solutions-driven discussions on wealth creation. Speakers include Hong Kong Monetary Authority Chief Executive Officer Eddie Yue and CPP Investments Senior Managing Director Suyi Kim. Learn More. |