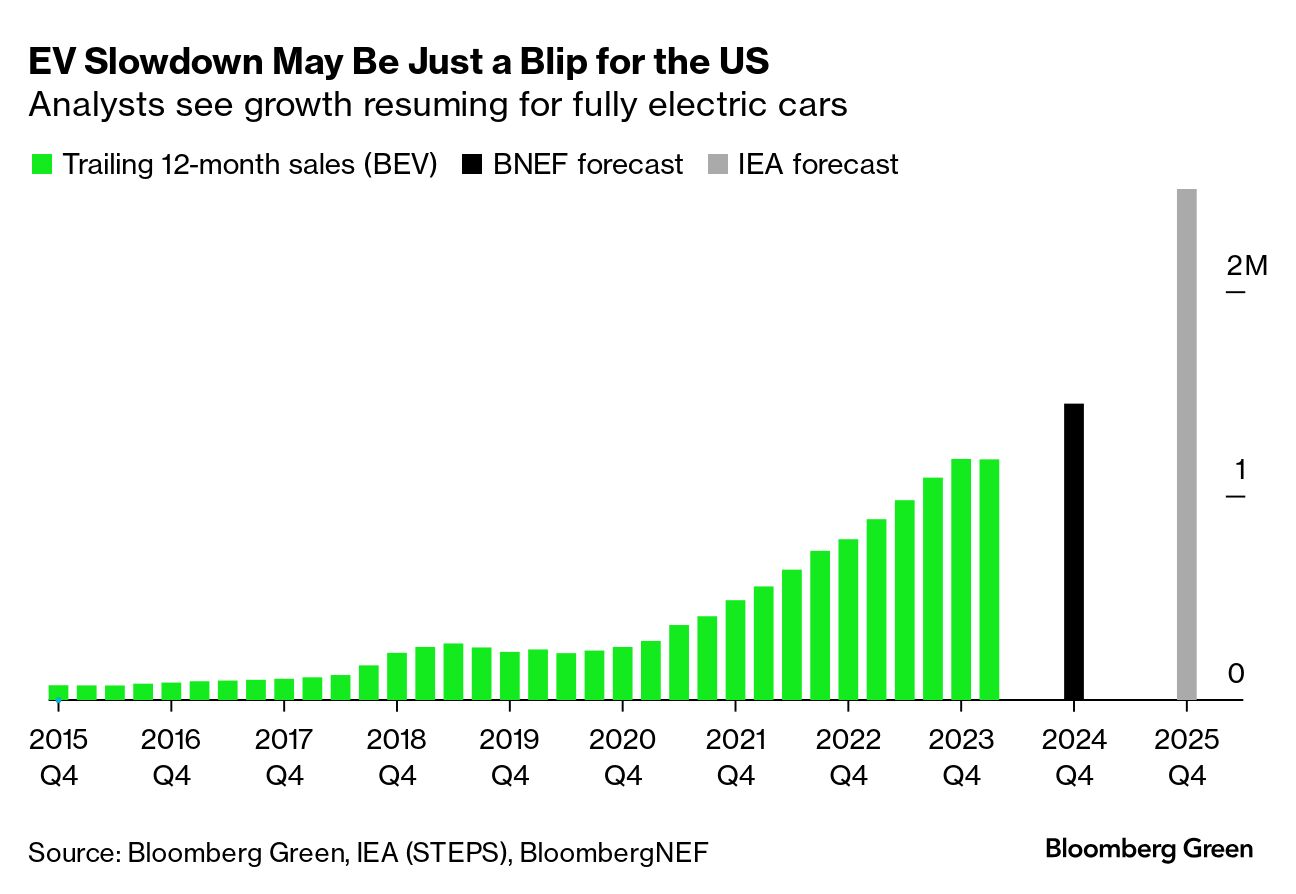

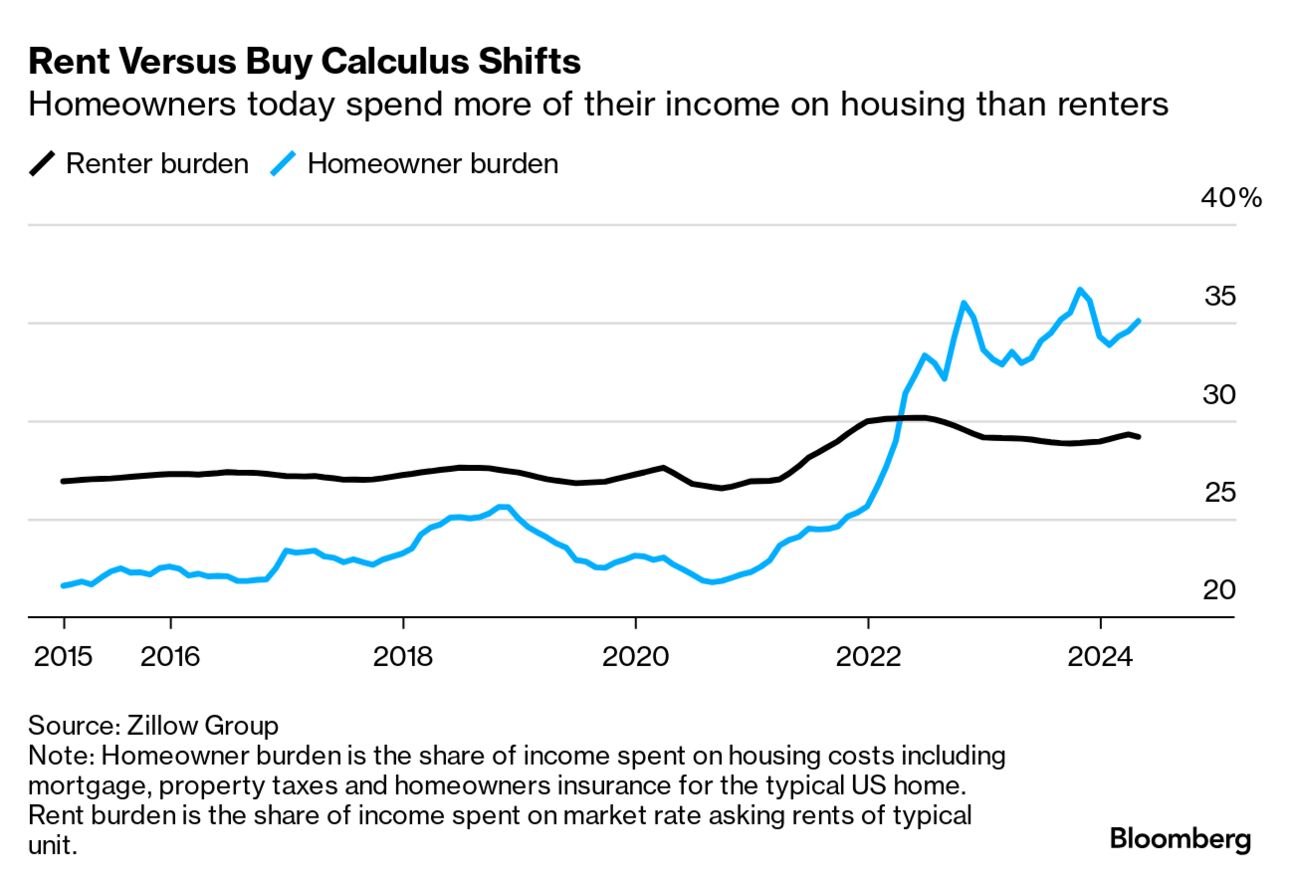

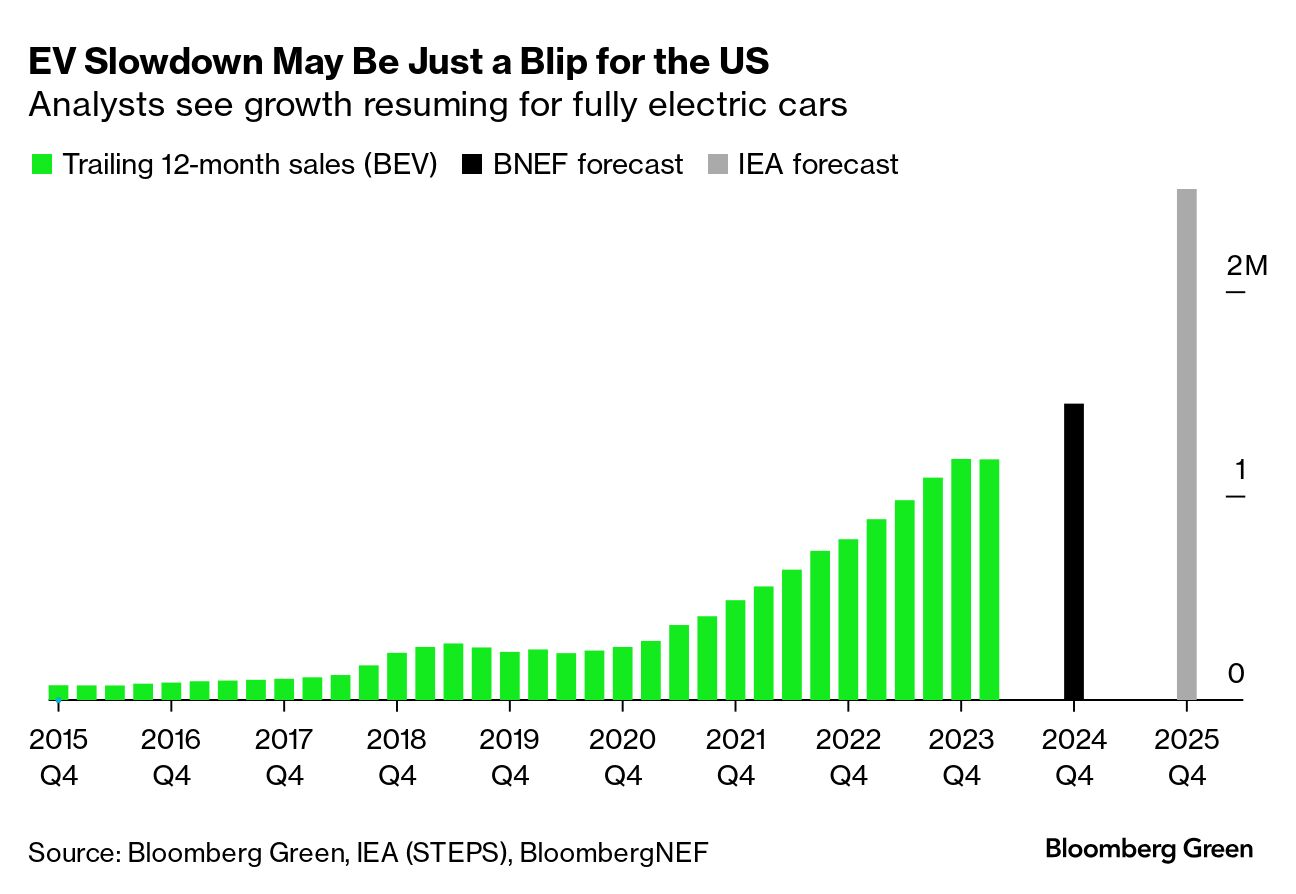

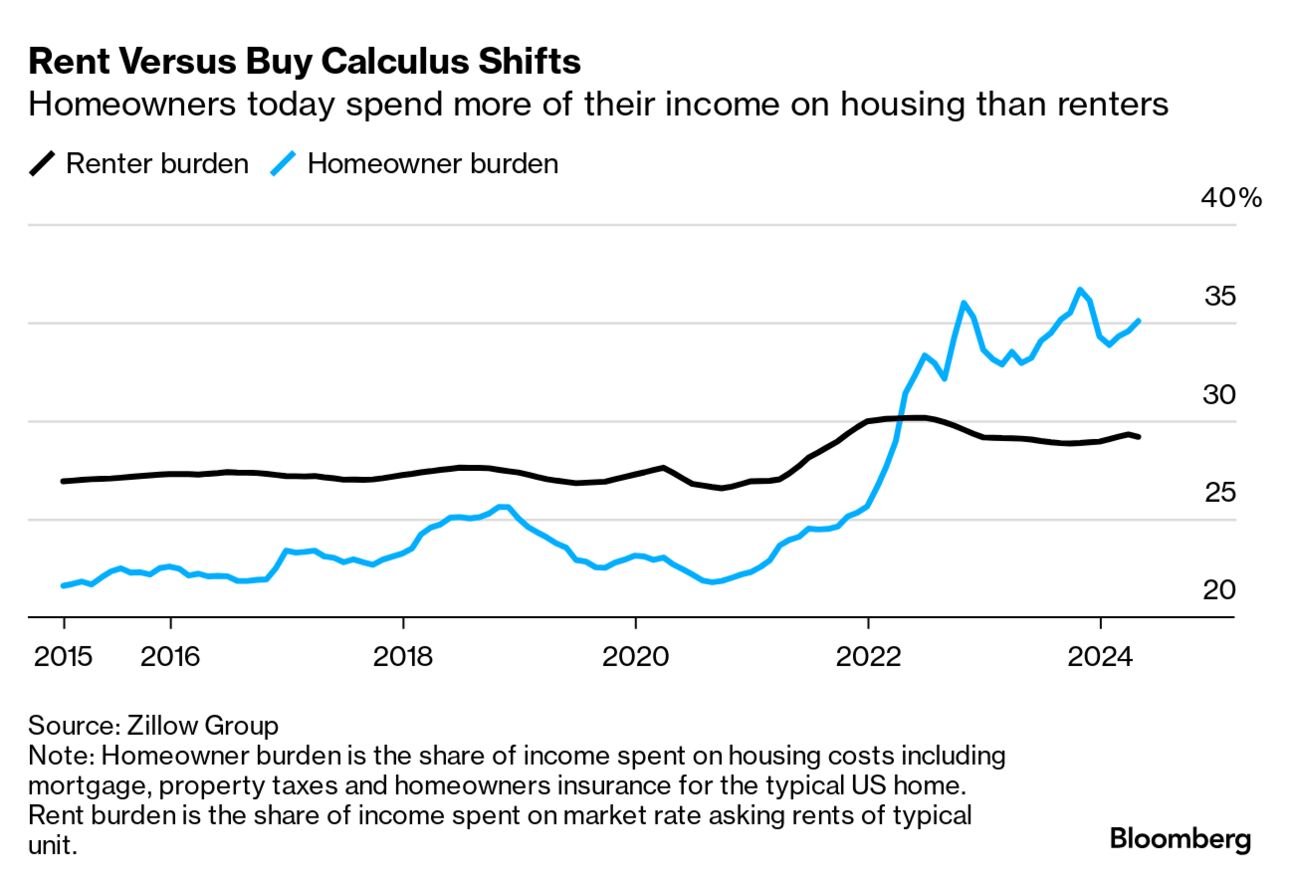

| The US stock market is finally as fast as it was about a hundred years ago. That was the last time share trades in New York settled in a single day, as they will from now on under new Securities and Exchange Commission rules. The change—halving the time it takes to complete every transaction—also occurred in jurisdictions including Canada and Mexico. The switch to the system known as T+1—abandoned in the earlier era as volumes became unwieldy—is ultimately intended to reduce risk in the financial system. Yet there are worries about potential teething issues, including that international investors may struggle to source dollars on time, global funds will move at different speeds to their assets and everyone will have less time to fix errors. —David E. Rovella For electric vehicle makers in particular, and humans hoping to escape the worst of global warming in general, there may not actually be a reason to panic about EV sales just yet. Sure, sales were flat in the first quarter, Ford dramatically scaled back expansion plans and Elon Musk fired 10% of Tesla’s employees. But for every sign of a slowdown, another suggests an adolescent industry on the verge of its next growth spurt. In fact, for most automakers, even the first quarter was a blockbuster. Six of the 10 biggest EV makers in the US saw sales grow at a scorching pace compared to a year ago—up anywhere from 56% at Hyundai-Kia to 86% at Ford. And a sampling of April sales came in hot, too.  One of the biggest worries would-be EV owners have is something called range anxiety—finding a charging station before your battery runs out on a long drive. Well, China EV giant BYD seems to have made some progress on this front, at least for hybrids. It unveiled a new hybrid powertrain that’s capable of allowing a car to travel more than 1,250 miles without recharging or refueling. The upgrade means some of BYD’s dual-mode plug-in electric hybrid cars can manage the equivalent of New York to Miami, or Munich to Madrid, on a single-charge and full tank. The milestone marks BYD’s latest achievement in slashing fuel consumption over five generations of hybrids since their first debut in 2008. Jim Chanos, the short seller who made his name and fortune on Enron’s demise, was sued by a partner that accused him of embezzling company funds for his personal use and enriching his girlfriend in the process. Conlon Holdings, which invested in Chanos & Co. in 2020, claims that he used his firm, previously known as Kynikos Associates, as a “piggy bank.” Chanos, who disputes the claims, closed his hedge funds late last year after almost four decades. The suit, filed in New York State court over the weekend, involves $10 million of outstanding loans that Chanos borrowed from his companyover more than a decade.  Jim Chanos Photographer: Victor J. Blue/Bloomberg Hess shareholders approved Chevron’s $53 billion takeover of the company despite reservations among several prominent investors. The affirmation is a major win for Chevron and Chief Executive Officer Mike Wirth, who sought to secure a stake in the biggest oil discovery of the past decade by acquiring Hess and its 30% interest in a Guyanese field. In the final days leading up to the vote, John Hess, the longest-serving major oil boss, personally lobbied shareholders to back the deal. The transaction still needs to get past the US Federal Trade Commission, not to mention an ongoing arbitration case brought by Exxon over control of Hess’ interest in the Guyanese field. The former chief executive of FTX’s Bahamas subsidiary was ordered to serve 7 1/2 years in prison, the first of Sam Bankman-Fried’s close associates to be sentenced in the wake of the cryptocurrency exchange’s implosion. Ryan Salame dropped his head as Judge Lewis A. Kaplan sentenced him in a Manhattan courtroom Tuesday, eight months after he reached a plea deal with federal prosecutors over the multibillion dollar collapse of FTX. While he was not accused of helping Bankman-Fried steal about $10 billion from customers, investors and lenders, Salame’s efforts to circumvent campaign donation laws jeopardized the stability of political life in the US, Kaplan found. The prison term is more than prosecutors had asked for.  Ryan Salame Photographer: Stephanie Keith/Bloomberg American Airlines cut its profit guidance for this quarter as the carrier continues to grapple with high costs heading into the summer travel season. The carrier also reduced its operating margin forecast. The update came as American separately announced the departure of Chief Commercial Officer Vasu Raja, a leading proponent of the carrier’s domestic-focused network strategy and a driver of a controversial change in dealing with corporate travel customers. A renter who hoped to buy a home has resigned himself to rent forever. A first-time buyer who had hoped to refinance a 7% mortgage is pulling back spending everywhere else to keep up. And a young couple is making a painful tradeoff for their family. As interest rates in the US remain higher for longer, the American Dream of affordable homeownership is unattainable for longer—and maybe for good.  Source: Zillow Group In Paris, a great meal can consist of a baguette, brie and fresh figs—or a three-Michelin star restaurant, with the difference being about 500 euros. While you’d think the same would be true of hotels, the city has never quite perfected affordable stays. But now it seems a new clutch of boutique hotels are changing the old dynamic. During the past year or two, they’ve proved that you don’t have to sacrifice on location, air conditioning or square footage to get a good deal. Despite their starting prices—all under $550 per night—they may be leading the charge when it comes to such perks as great restaurants and fresh design across Paris.  Deluxe Vue at Madame Rêve in Paris Photographer: Jerome Galland/Madame Rêve Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Big Take Asia: Every Tuesday on the new Big Take Asia podcast, Bloomberg reports on the critical stories at the heart of the world’s most dynamic economies, delivering insight into markets, tycoons and businesses driving growth across the region. You can also listen daily to powerful Bloomberg deep-dives on the original Big Take podcast and hear fresh takes on what’s going on in Washington every Thursday on the Big Take DC podcast. |