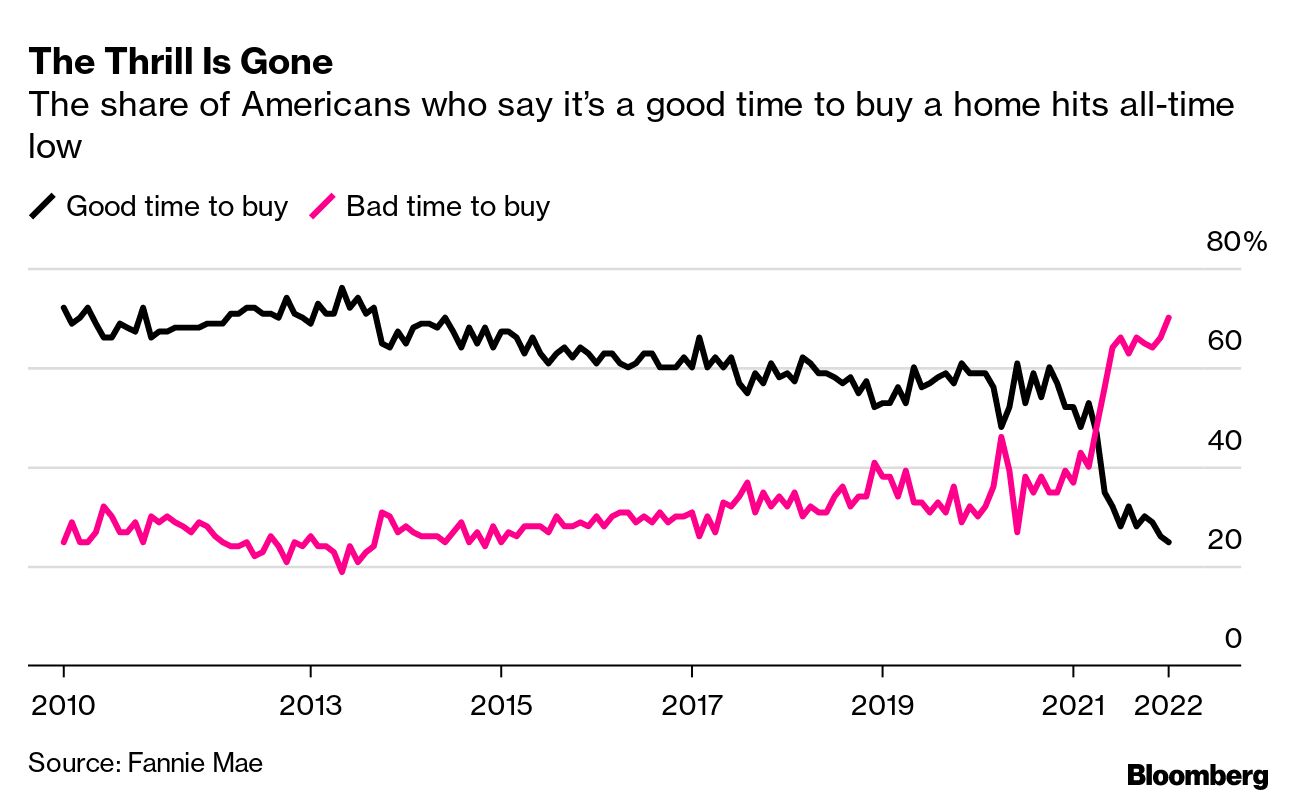

| U.S. stocks fell late Monday amid a renewed decline by big tech firms. The tech-heavy Nasdaq 100 ended near the day’s low, led downward by Facebook-parent Meta, Google-parent Alphabet and Microsoft. Wall Street is squirming at the prospect of the steepest monetary tightening cycle since the 1990s, with markets pricing in more than five quarter-point Federal Reserve interest-rate hikes in 2022, especially given last week’s strong U.S. jobs report. Here’s your markets wrap. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. What’s safer than short-duration bonds? Even-shorter duration debt. As investors brace for an increasingly aggressive Fed, billions of dollars are flooding into cash-like exchange-traded funds, seen as relatively less vulnerable to interest-rate risk. An Oxford scientist who worked on the AstraZeneca Covid-19 vaccine says he thinks scientists and politicians “probably killed hundreds of thousands of people” by damaging the reputation of the drug. While the latest wave of the coronavirus races across Asia, with Korea, Indonesia and Hong Kong witnessing new surges, European nations and some states in the U.S. (like New Jersey) are lifting precautions. In Canada, authorities are beginning to crack down on noisy anti-vaccine truckers. Here’s the latest on the pandemic. Frontier Group Holdings agreed to buy Spirit Airlines for $2.9 billion in cash and stock, uniting two ultra-low-cost carriers that are targeting the recovering U.S. leisure-travel market. The fortunes of Manhattan’s office market are coming down to old versus new. Glassy skyscrapers that popped up in recent years are luring companies seeking new space and preparing for the hybrid-work era. Left behind are countless older buildings that haven’t been modernized in the past decade.  Goldman Sachs’s former headquarters at 85 Broad Street in Lower Manhattan got an upgraded lobby, bike racks and wellness rooms as part of renovations after Hurricane Sandy struck in 2012. Still, the tower has a vacancy rate of roughly 20%. Photographer: Mario Tama/Getty Images North America Jeff Currie, the closely-followed head of commodities research at Goldman Sachs, says he’s never seen commodity markets pricing in the shortages they are right now. “I’ve never seen markets like this,” Currie said. “We’re out of everything.” A cocaine-smuggling Bulgarian wrestler and briefcases stuffed with banknotes are the latest problems dogging scandal-weary Credit Suisse. The bank has suffered no shortage of bad headlines over the past two years, and the near-future may not be any different: A former client relationship manager is on trial for failing to stop money laundering by customers working with the fighter-turned-criminal. If you ask Americans how the real estate market is doing, the resounding answer is there’s never been a worse time to buy a home. Blame the surge in housing prices, concerns about job stability and rising mortgage rates. And the rental market isn’t helping, either. It was the first glimmer of hope for the beleaguered travel sector when locked-down citizens started doing something new amid the pandemic: not working from home, but working from anywhere. Now, a new version of the trend is emerging—and it could prove a serious boon for the industry.  The pandemic may have reshaped the way people travel forever. Photographer: Weerasak Saeku/Moment RF Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Bloomberg Power Players Summit brings together senior executives, world-class athletes and other powerbrokers to discuss the game-changing shifts of the $600 billion-dollar global sports business. Join us Feb. 11 as the most influential industry leaders in sports convene for networking and candid conversations on the intersection between business, technology and culture. In person at the iconic Sheats–Goldstein Residence in Los Angeles or virtually. Register here. |