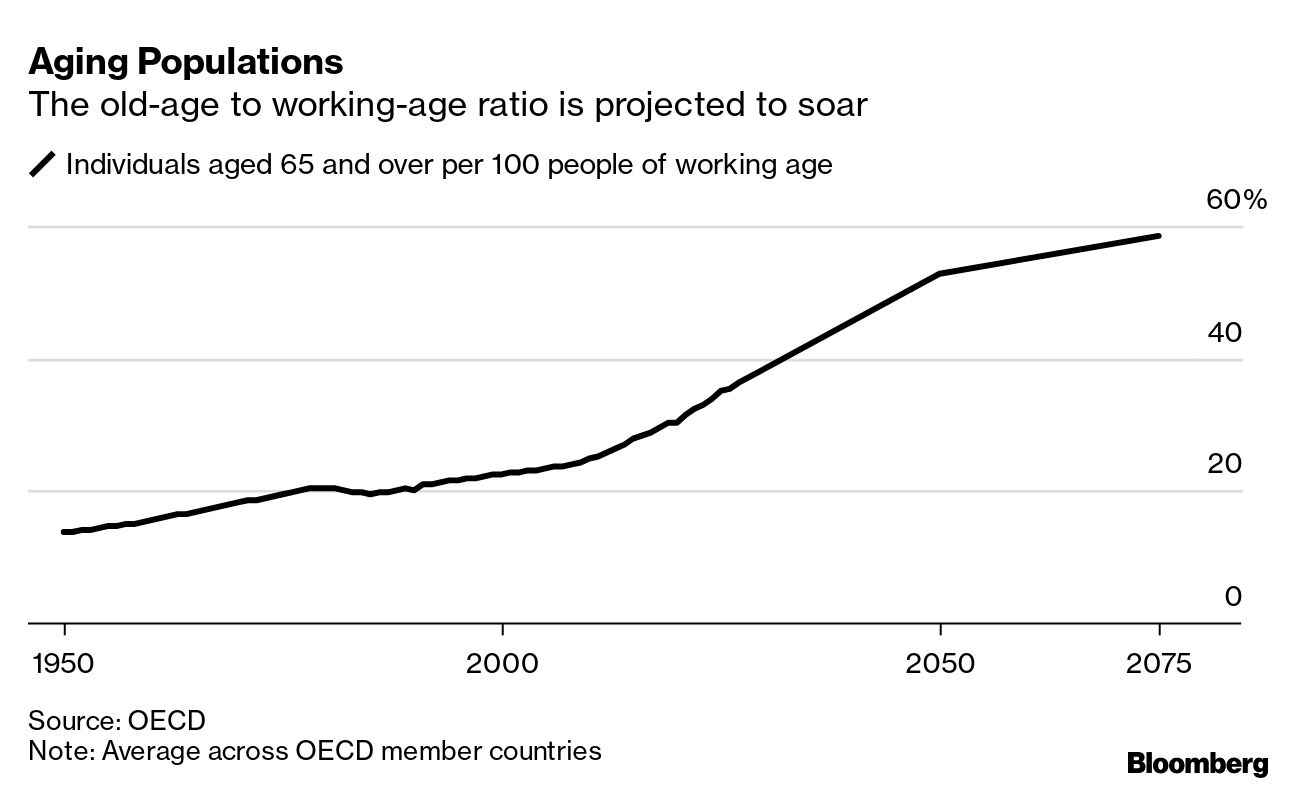

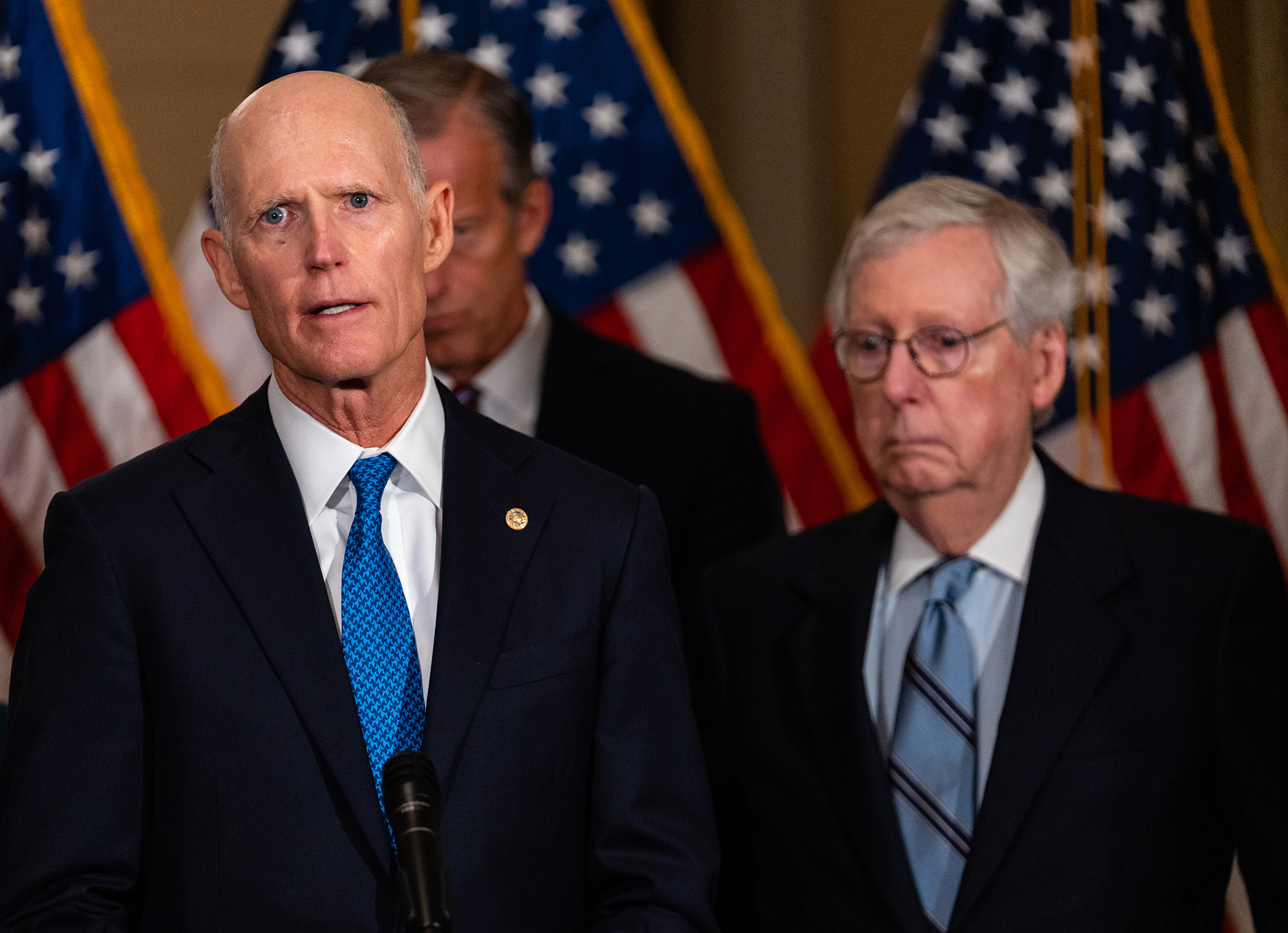

| Crypto businesses don’t properly safeguard customer assets and often mix them with their own funds. This according to US Securities and Exchange Commission Chair Gary Gensler, who was especially blunt in his assessment of the embattled asset class and its proponents. “This is largely a noncompliant field,” Gensler said in an interview with Bloomberg Television. “They’re commingling customer funds with their businesses.” The negativity from the SEC chief is nothing new. For months he’s been warning of the potential dangers posed by the industry. The regulator has asserted that many tokens and crypto products are really just securities that trade on the blockchain and should be registered with the agency. Gensler took particular issue with how crypto exchanges often play multiple roles. He suggested their business models can create significant conflicts of interest. “We don’t let the New York Stock Exchange also run a hedge fund and trade on the exchange.” he said. “Why would we do it here?” —David E. Rovella Fossil fuel giant ExxonMobil, having spent a decade advertising its efforts to produce environmentally friendly fuels from algae, is now quietly walking away from its most heavily publicized climate solution. And it’s not the only member of Big Oil jettisoning green promises.  Photographer: Patrick T. Fallon/ US President Joe Biden ordered the military to shoot down another object in US airspace, this one flying over Alaska, the White House said Friday. The move came less than a week after an F-22 fighter jet shot down an alleged Chinese surveillance balloon over the Atlantic Ocean. Relatedly, the US is poised to add Chinese companies to an export blacklist over what the administration argues are links to a military-backed global balloon espionage program. Biden said the first incident didn’t materially hurt US-China relations, but that it was a violation of US sovereignty. Russia launched its biggest barrage of missile attacks so far this year in its war on Ukraine after President Volodymyr Zelenskiy completed a visit to European capitals, where he sought more weapons to fend off Vladimir Putin’s invasion. Kyiv authorities say they downed scores of the Kremlin’s cruise missiles. Moscow said it plans to cut oil output by 500,000 barrels a day next month, following through on a threat to retaliate against western energy sanctions. The move threatens to renew turmoil in the oil market, which had so far taken disruption to Russian supplies in stride. It also further tightens supply constraints from OPEC+, which signaled it won’t take any action to fill in the gap.  Young men in Saint Petersburg walk past a billboard promoting Russian army service in September. Since then, thousands of Russian conscripts, enlistees and inmates have died in Ukraine. More are being thrown into battle as part of a winter offensive, according to Ukrainian authorities. Photographer: Olga Maltseva/AFP Citigroup has been dropped from the group of banks poised to handle the biggest-ever municipal-bond transaction from Texas—some $3.4 billion—after the state’s attorney general’s office determined the firm “discriminates” against the gunmakers, barring it from underwriting most government borrowings in the state. As it moves through its plan to terminate 10,000 workers, Microsoft on Thursday cut jobs in units including Surface devices, HoloLens mixed reality hardware and Xbox. The company is among an increasing number of tech firms that have been dispensing with employees by the tens of thousands. Apple, however, isn’t one of them. This is why. The GOP fallout from Biden’s State of the Union speech continues. Senate Minority Leader Mitch McConnell renewed his feud with Rick Scott, criticizing the Florida Republican’s proposal to put expiration dates on federal programs like Social Security and Medicare.  Rick Scott, left, and Mitch McConnell Photographer: Eric Lee/Bloomberg Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. In the past it was the case; soon it may be again. Public finances are buckling as retirement promises made to previous generations collide with the realities of an aging population. State pension costs in developed economies, often the biggest single area of government expenditure, are projected to soar even more. Back in 1980, pensions consumed about 5.5% of GDP, and by 2040 that could top 10%. Yet despite near-universal agreement from economists that we’ll all need to work for longer, save more or receive less, reform efforts are in trouble. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg’s Intelligent Automation Briefing: Join us as top business and IT experts explore ways in which intelligent automation can offset economic pressures and enhance stakeholder value. The briefing features in-depth conversations about designing and implementing high-value projects, building teams that embrace automation and making the business case to top management. Roadshow cities include Atlanta on Feb. 28; Chicago on April 13; New York on May 4; San Francisco on June 20; London on Sept. 20; and Toronto on Oct. 19. Register here. |