| We Could See 17% Gains as This Sector Recovers | | By Brett Eversole | | Thursday, September 28, 2017 |

| Markets overreact...

It's a not-so-fun fact about investing... Stocks often soar further than is reasonable on good news, and they fall further than imaginable when news is bad.

But this fact has a positive side. You can profit from these overreactions. They often lead to major opportunities.

That's exactly what's happening, right now, in a specific area of the U.S. market.

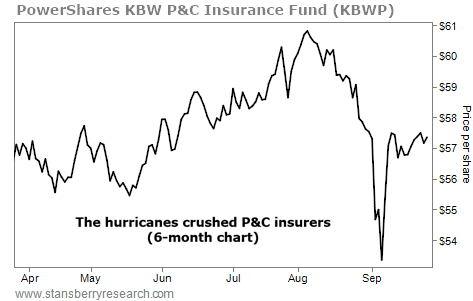

Hurricane season sent property and casualty ("P&C") insurance companies plummeting. But history says the market is overreacting... And the reversal could mean gains of 17% over the next year.

Let me explain...

----------Recommended Links---------

---------------------------------

Last month, Hurricane Harvey flooded Houston. Earlier this month, Hurricane Irma devastated many parts of Florida – including where I call home. Hurricane Maria followed, doing awful damage to Puerto Rico.

The real harm inflicted on the people in these areas is the obvious tragedy of these storms. But hurricanes cause massive economic damage as well.

These days, a major storm can easily cost tens of billions of dollars. And who pays the bill?

Much of the loss falls on P&C insurers... And the sector absolutely tanked in the wake of these storms, which we can see in the PowerShares KBW Property & Casualty Insurance Fund (KBWP). Take a look...

The sector fell double digits in just a few weeks. But the reversal has already started, and history says big gains are likely from here.

You see, P&C insurers hit oversold levels based on their relative strength index ("RSI").

The RSI measures an investment's recent gains and losses. It signals when something is either overbought or oversold... which means a reversal is likely.

The P&C insurance sector hit an RSI of 22 earlier this month. That signals extremely oversold conditions... And it means big gains are likely to follow.

The table below shows what similar oversold levels have led to in the past, going back to 1989. Take a look...

| | 3-Month | 6-Month | 12-Month |

|---|

| After extreme | 8.7% | 12.0% | 17.2% | | All periods | 1.7% | 3.4% | 7.0% |

P&C insurers tend to soar after hitting oversold levels like we saw recently. Similar RSI levels have led to 9% gains in three months, 12% gains in six months, and 17% gains over the following year.

It's not unusual for P&C insurers to sell off after a major storm. But if the selling is overdone, it presents an opportunity to buy.

The sector is already recovering. It's up more than 7% since early September. But history says that's just the beginning.

These storms are devastating for our communities. But the financial markets are overreacting, based on history.

We could see a sustained rally from here. That recovery could result in double-digit gains over the next year... And shares of KBWP are a simple way to make the trade.

Good investing,

Brett Eversole |

Further Reading:

This year's violent hurricanes have caused economic destruction that goes beyond the insurance sector. The short-term effects are already rippling through the energy markets – with more changes ahead. Learn more here: How Hurricane Harvey Is Impacting This Critical Sector. |

|

A 'GLOBAL ELITE' POWERHOUSE BEATS EXPECTATIONS

Today's chart highlights a major player in its sector... Regular readers know we like investing in industry leaders that dominate their markets. Porter Stansberry and his team have dubbed these businesses the "Global Elite" – financial powerhouses that sell indispensable products. We can see this idea at work today with shares of agricultural titan Monsanto (MON)... We last checked in on Monsanto in April. This $53 billion company sells farming products like seeds, herbicides, and digital agricultural tools. It was one of the first companies to develop genetically modified organisms ("GMOs"), and its seeds are crucial to farmers strapped for water and nutrients. Recently, Monsanto reported better-than-expected profits for the third quarter... Soybean sales soared 29% to $896 million, boosting the company's impressive results. Porter recommended the stock to his Stansberry's Investment Advisory readers in December 2015. Back then, shares were cheap. Today, his subscribers are up 28%... And as you can see in the chart below, the stock is trading at fresh two-year highs. Congratulations to Porter on another great call! |

|

| A key player in the recovery from Hurricane Harvey... Companies that supply equipment and materials to the Hurricane Harvey recovery will see a boost in business. And Flavious Smith, our in-house commodities expert, believes one concrete maker will play an important role... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

For the first time ever, sign up for the FREE Stansberry NewsWire app, and you'll receive live updates and investment ideas, straight from the Stansberry Las Vegas Conference that's going on today. Download the app FREE here. |

| 'Never Stand in Line to Buy Anything,' and Other Contrarian Investing Lessons | | By Jim Grant | | Wednesday, September 27, 2017 |

| | I like to think that I've become a knowledgeable student of "Mr. Market." I've lived through and analyzed manias and crashes... I've seen the stock market sawed in half, and I've seen stocks rise far above any sane measure of valuation... |

| | You STILL Haven't Missed the 'Melt Up' Yet! | | By Dr. Steve Sjuggerud | | Tuesday, September 26, 2017 |

| This tells me you haven't missed the Melt Up yet – the final months when the more speculative names start to blast off... |

| | Our Favorite Ideas Today – Live, From Your Couch | | By Dr. Steve Sjuggerud | | Monday, September 25, 2017 |

| | Once a year, we gather the best minds we know and ask them to share their best ideas. (We have some good fun, too...) |

| | A Massive $34 Trillion in Stimulus... What Has It Done? | | By Justin Brill | | Saturday, September 23, 2017 |

| | The "great unwind" is here... |

| | The Simplest Way to Protect Your Money From Wall Street Scams | | By Dr. David Eifrig | | Friday, September 22, 2017 |

| | Accountants can mess with a company's books in all kinds of ways, but they can't fake a cash payment... |

|

|

|

|