| 'We Expect Over 100% Gains per Year' | | By Dr. Steve Sjuggerud | | Monday, August 14, 2017 |

| It sounded like an outrageous prediction when he said it...

"Uniphase is one stock you don't want to miss," my friend and colleague Porter Stansberry wrote. "We expect over 100% gains per year."

It might have sounded outrageous... But in hindsight, Porter underestimated how much the stock could go up – and how quickly...

----------Recommended Links---------

---------------------------------

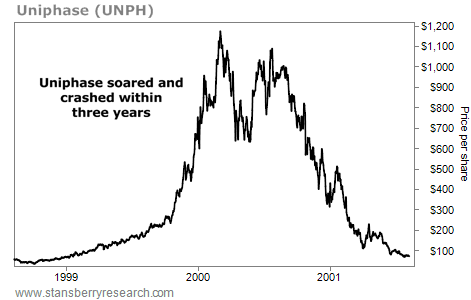

Porter wrote this on March 1, 1999. Uniphase soared from about $100 a share at the time to about $1,200 a share at its peak a year later.

"Uniphase is already growing its earnings at over 40% a year," Porter said. "But don't forget to watch your stop losses. We recommend using a 25% trailing stop. (If the stock falls more than 25% off its highs, sell it.) Remember what Bill Gates says about the high-tech world: 'Microsoft is always two years away from extinction.'"

Porter traded the stock in the best possible way. He recommended the stock around $100. It went to around $1,200. It then fell 25% to around $900... And he said to get out.

Readers who followed his advice could have turned $10,000 into roughly $90,000 in a year.

Ah... but how many people followed his advice and sold?

I would bet that less than 50% followed his advice to sell. (Honestly, I'd bet that MOST people DID NOT sell.)

"Calling an audible," as they say in football – overriding the coach's play call – cost those people a lot of money...

It actually cost some of them everything...

Take a look:

By the summer of 2001 – a little less than two years after the peak – shares of Uniphase fell below where they started when Porter recommended them.

And they kept falling. And falling. And falling.

This was a brilliant trade by Porter. A brilliant trade is made up of two parts... a great "buy" and a great "sell."

Readers who only took his buy advice, and not his sell advice, lost all of their profits. In many cases, they ended up with losses – which is incredible when you think about it. But it's true.

I tell you this story because I believe today will turn out to be a time like 1999, where certain tech stocks can soar higher than anyone can imagine – and then crash beyond any reason.

How you handle the ups and the downs will determine whether you walk away with a fortune or walk away with less money than when you started.

Porter and I have used trailing stops since we started writing investment newsletters together in 1996. Back then, we set simple trailing stops based on simple numbers, like 25%.

Today – with the help of our good friend Dr. Richard Smith – we do it in a much smarter way. We typically use "smart trailing stops" from his TradeStops service. Smart trailing stops change over time as volatility changes. So now, our trailing stops are based on volatility – the more volatile a stock, the wider its trailing stop.

In the next few months, you will likely hear a lot about the "Melt Up" in stocks, and the following meltdown. What should you do to participate in the Melt Up – and limit your downside risk in the meltdown?

The answer is simple: You should do what Porter did in 2000 – and use a trailing stop. You can use any type of trailing stop you see fit – just use one! And follow it!

Good investing,

Steve

P.S. While you can use any trailing stop you want, I believe that TradeStops has done the best homework on which types of trailing stops work best. I urge you to look into Richard's "smart trailing stops" at Tradestops.com. And you can learn how to sign up right here. |

Further Reading:

"A great trade is made up of two things... a great buy and a great sell," Steve writes. You can avoid losing all your gains on a stock like Uniphase. But you must have a plan. Read more here: The Biggest Thing My Subscribers Screw Up. "Eventually – whether it's next week, next month, or next year – a hurricane will hit the stock market," Richard Smith writes. He shares how to prepare, while still taking full advantage of this bull market, right here: The Biggest Downside to 'Buy and Hold'. |

|

NEW HIGHS OF NOTE LAST WEEK Lockheed Martin (LMT)... "offense" contractor Deere (DE)... tractors Alcoa (AA)... aluminum Office Depot (ODP)... office supplies Best Buy (BBY)... big box retailer Procter & Gamble (PG)... household goods Cigna (CIG)... health care Royal Caribbean Cruises (RCL)... cruises Apple (AAPL)... iPhone maker Nvidia (NVDA)... computer chips JD.com (JD)... China's Amazon Momo (MOMO)... Chinese social media

NEW LOWS OF NOTE LAST WEEK Chipotle Mexican Grill (CMG)... troubled burrito maker SeaWorld Entertainment (SEAS)... troubled theme park Macy's (M)... troubled retailer JC Penney (JCP)... troubled retailer Schlumberger (SLB)... troubled oil services company |

|

| Two more ways to protect yourself from a stock market crash... Like me, Ben Morris believes stocks can move higher from here... But he also knows a correction is inevitable. Stop losses are one way to protect yourself. And Ben recommends two other tools as well... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

The last time the government did this (in 2012) you could have collected separate, one-time payments of $1,383... $2,844... and $3,620, while barely lifting a finger. Now it's about to happen again... But the projected deadline to opt in is coming up fast. Don't worry – it's easy to position yourself. Get the details here. |

| The Single Most Important Rule for Buying Investment Real Estate | | By Peter Churchouse | | Friday, August 11, 2017 |

| | If you want to be successful in real estate investing, you absolutely must get one thing right... |

| | FINALLY! A Good Setup in Gold Stocks | | By Dr. Steve Sjuggerud | | Thursday, August 10, 2017 |

| | We actually – finally – have a good setup for gold stocks right now... if you're bold enough for it... |

| | The Only Two Reasons to Hire a Financial Planner | | By Dr. David Eifrig | | Wednesday, August 9, 2017 |

| | In general, you know what the best, most sound financial decisions for your life are... But we've talked to several folks in different life stages. And there are two specific situations when you might consider hiring your own financial planner... |

| | A Major Reversal in China's Currency | | By Dr. Steve Sjuggerud | | Tuesday, August 8, 2017 |

| | The idea of investing in China has become more mainstream in recent months. But there are still plenty of "bogeymen" surrounding the idea of investing in China... |

| | I Can't Believe Smart People Can Be This Stupid | | By Dr. Steve Sjuggerud | | Monday, August 7, 2017 |

| | Whoa! I couldn't believe it when I read it! |

|

|

|

|