| We're up 35% in Four Months – With More to Come | | By Dr. Steve Sjuggerud | | Tuesday, June 27, 2017 |

| My True Wealth Systems readers are up 35% in just four months on one trade...

How are we up so much? We made a massively contrarian bet.

In March, we placed a short-term bet on lower oil prices. We were so confident in the trade that we made it with "leverage" to increase our potential gains.

Oil prices have crashed in recent weeks. They fell by nearly $10 per barrel in the past month. And now, True Wealth Systems readers are up 35% on our trade in a little less than four months.

Today, I'll show you exactly how we did it... And why, despite the recent fall, oil prices could move even lower in the near term.

Let's get started...

----------Recommended Links---------

| Critical 'Melt Up' Briefing scheduled this Thursday, June 29

Something big just changed with Dr. Steve Sjuggerud's Melt Up thesis. It signals we need to take a totally new approach. He'll explain the details during a critical Melt Up Briefing from our Baltimore headquarters on Thursday, June 29. Sign up here to reserve your spot. |

|---|

| Behind Uber's Shake-Up

In last week's Investor Hour Show, Porter discusses the shake-up at Uber with CEO Kalanick's resignation, and Buck channels his best Arianna Huffington impression as evidence mounts that she's getting ready to play a role in the future of the car-for-hire business. Listen here... |

|---|

---------------------------------

True Wealth Systems readers are sitting on 35% profits, as I write. But our reason for entering the trade hasn't changed. Oil prices can move lower from here in the short run.

Here's why...

We originally bet on lower oil prices for a handful of reasons...

First, traders were incredibly bullish on oil prices. Specifically, the Commitment of Traders (COT) Report, which measures the actions of traders in the futures markets, showed oil traders had reached their most extreme level of optimistic bets – ever.

That gave us a massive contrarian opportunity. You see, when futures traders all make the same extreme bet, the opposite tends to happen. And that's exactly what was happening in March... Oil traders were all betting on higher oil prices.

On top of that, the economics for oil made no sense... Oil inventories were hitting multiyear highs. And oil rigs were coming back online. More oil was being pumped, despite plenty of existing supply.

The opportunity was obvious. So we shorted oil, with leverage, through the ProShares UltraShort Bloomberg Crude Oil Fund (SCO).

SCO is a simple fund, designed to return twice the opposite daily return for oil. So if oil falls 1% in a day, SCO will rise around 2%.

Oil is down 15% since our initial short, and we're up 35% on shares of SCO. Things have worked out perfectly so far.

Now that we're four months in, I have two important points to make:

| 1. The extreme from oil traders HAS gone away. However, | | | | | 2. Oil prices can still fall further. |

The simplest reason oil prices can keep falling is supply and demand...

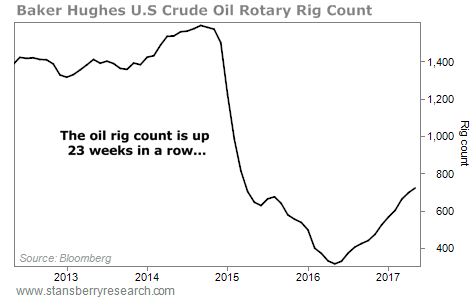

Just look at the chart below. It shows the number of active oil rigs... And it has been rising for 23 straight weeks, which hasn't happened in three decades...

Rig counts have risen dramatically over the past year... And they're showing no signs of stopping.

More oil rigs working means that more oil is flooding the market. And increasing oil supply (all things staying equal) means that oil prices will likely keep going down.

On top of those increasing rig counts, oil inventories continue to approach record highs. In other words, we have a glut of oil... And drillers are fixated on pulling more and more out of the ground.

Today's supply-and-demand situation doesn't differ much from what we saw back in March when we first recommended shorting oil. But the extreme from oil traders is gone.

True Wealth Systems readers are up 35% in just four months. However, we expected to be in this trade a maximum of six months. And based on the current situation in the oil markets, we will likely keep our trade on for the full six months to maximize our gains.

Oil might run higher in the long run. But we're up 35% in four months betting the opposite way... And we don't think our trade is over yet.

We'll let you know when the situation changes.

Good investing,

Steve

Editor's note: Unlike oil today, stocks just keep going higher as the "Melt Up" continues... And everyone is wondering, "When will the bottom fall out?" This Thursday at 8 p.m. Eastern time, Steve will join Porter Stansberry to explain how to safely profit from the final innings of this bull market... and even make money on the way down. Click here to reserve your spot. |

Further Reading:

"Investors are refusing to give up... But energy stocks keep moving lower," Brett Eversole writes. Trying to catch the bottom is a dangerous game. Learn how to know when it's safe to buy right here: Don't Follow the Crowd Into Energy Stocks. The situation in oil will likely get worse before it gets better – but oil-industry titan Flavious Smith expects big changes further down the road. He believes two emerging global powers could send demand skyrocketing in the coming years. Catch up on his bullish argument here and here. |

|

MORE PROOF THAT 'BORING' STOCKS RULE THE WORLD

Today's chart highlights one of our favorite strategies at work... buying companies that sell simple products. You don't need to sell flashy or innovative products to have a successful business. "Boring" products like cigarettes, soda, coffee, and Twinkies are always in demand. These staples are the cornerstones of steady, profitable businesses that generate good cash flows for investors. For proof, we'll look at a fast-food giant... Restaurant Brands International (QSR) is the one of the world's largest fast-food companies. Its popular brands include Burger King (burgers), Tim Hortons (coffee and donuts), and Popeyes Louisiana Kitchen (fried chicken). These strong, long-lasting brands can stay popular for decades... They generate millions of dollars in revenues, and they don't require additional spending from the company. (In other words, they're what our colleague Porter Stansberry calls " capital efficient" businesses.) As you can see, shares of QSR have soared lately. They're up nearly 50% in the past year alone, and they recently hit a new all-time high. Until people stop drinking coffee and eating burgers, this uptrend is likely to continue... |

|

| A 25% rise in the Canadian dollar is likely, starting now... Betting on lower oil prices was a contrarian call four months ago. Today, we're seeing a new opportunity to profit from betting against the crowd... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

You can ignore everything and still take massive gold stock gains with one strange new strategy. Our friends at Casey Research are sharing the whole story so you can see all the proof for yourself. Click here. |

| A Historic Change Is Underway in Chinese Stocks | | By Dr. Steve Sjuggerud | | Monday, June 26, 2017 |

| | This one move will ultimately cause hundreds of billions of dollars to flow into Chinese stocks in the coming years... |

| | Steve's Incredible Prediction Just Happened... Did You Listen? | | By Justin Brill | | Saturday, June 24, 2017 |

| | Steve Sjuggerud's bold China prediction is now a reality... |

| | Don't Follow the Crowd Into Energy Stocks | | By Brett Eversole | | Friday, June 23, 2017 |

| | Energy investors are making a big mistake... |

| | Do You Have a Job or a Career? | | By Mark Ford | | Thursday, June 22, 2017 |

| | As it turns out, retirement today is this: After giving up a fairly well-paid full-time job, you take on several poorly paid part-time jobs (without benefits) to pay for your ever-increasing retirement expenses. But it doesn't have to be that way... |

| | Build This 'Foundation Fund' to Smooth out Life's Surprises | | By Dr. David Eifrig | | Wednesday, June 21, 2017 |

| | The radio is playing as you drive down the road... And then, out of the blue, your car engine stutters and dies... |

|

|

|

|