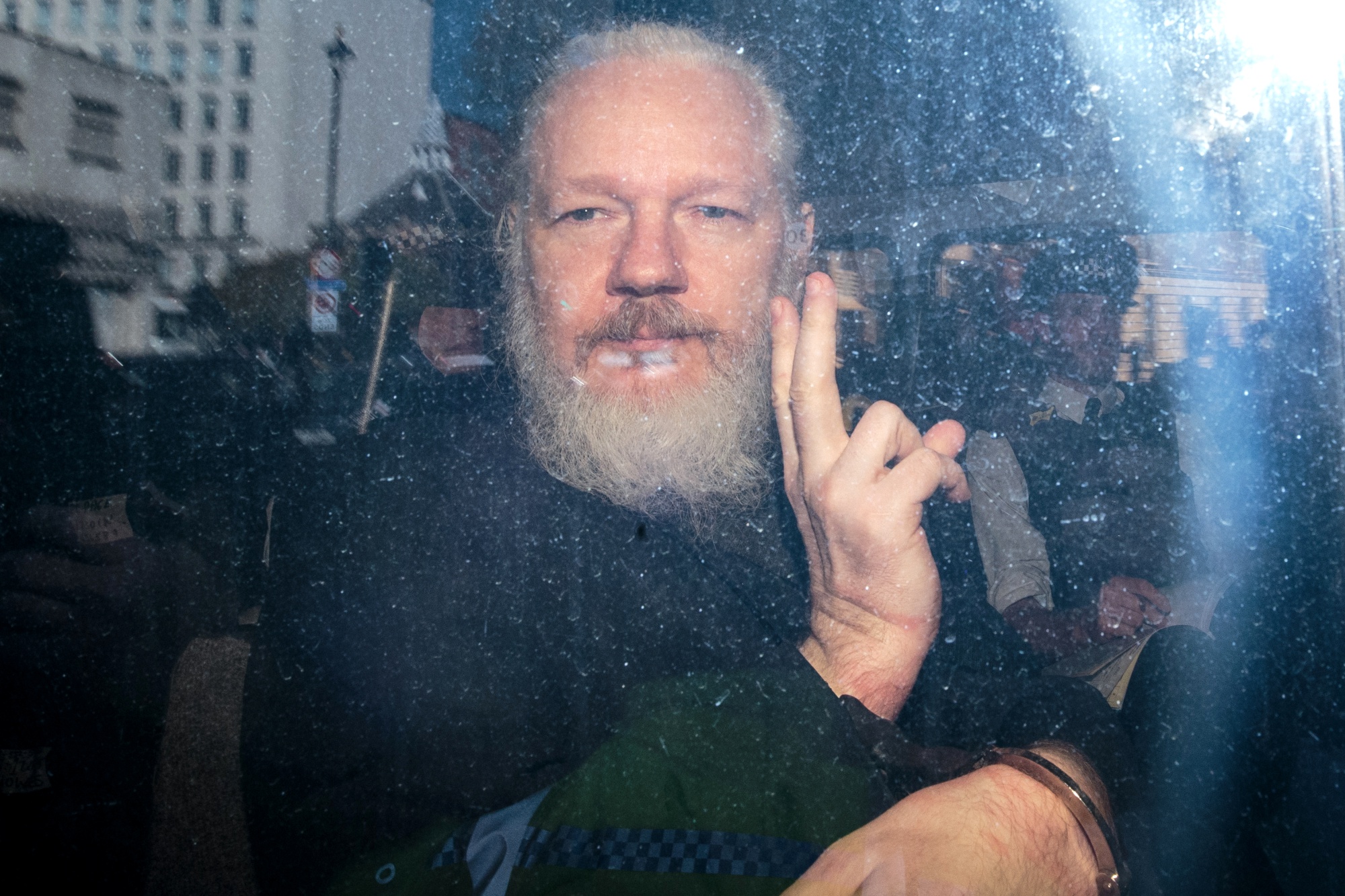

| Hedge fund short sellers are under renewed scrutiny, and this time it’s by the U.S. government, not WallStreetBets. The Justice Department has launched an expansive criminal investigation into short selling by hedge funds and research firms, scrutinizing their symbiotic relationships and hunting for signs that they improperly coordinated trades or broke other laws to profit. The scope is wide-ranging: federal investigators are examining trading in at least several dozen stocks, including well-known short targets such as Luckin Coffee and Banc of California. It’s not clear which firms if any may emerge as targets of the probe. The investigation opens a new front in an already treacherous era for short-sellers, clobbered by the pandemic and cooked by retail traders. The latter have taken to social media to gloat, saying they “told you so.” —Margaret Sutherlin Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. More news on the Covid-19 omicron variant. A small study in the U.K. showed boosters provide around 75% protection against the new variant—significantly less than previous mutations. In Singapore two cases of omicron were discovered in people who had already received booster shots. Over in the U.S., most of the cases traced to the new variant have so far entailed only mild illnesses in people who were vaccinated, health officials said Friday. The delta variant continues to drive another wave of hospitalizations in the U.S., sending healthcare workers to the brink once again. Here’s the latest on the pandemic.  Workers spray disinfectant inside an Asiana Airlines plane in Incheon, South Korea, as the country grapples with rising Covid-19 cases. Photographer: SeongJoon Cho/Bloomberg As the White House says inflation has peaked, Americans remain concerned that high prices are eating away at their paychecks. Consumer costs rose last month at the fastest annual pace since 1982 with gasoline, shelter, food and vehicles leading the way. Republicans are trying to use inflation to get a certain few Democrats to help them block Biden’s “Build Back Better” economic package. For Wall Street, the data reinforced expectations the Federal Reserve will accelerate the wind-down of its bond-buying program at the central bank’s final meeting of the year next week. Here’s your markets wrap. For more than two decades, MSCI was a bland Wall Street company that made its money arranging stocks into indexes for other companies that sell investments. Then in 2019 it transformed itself into an “ESG investing leader.” Only ESG in this case has little if anything to do with what investors consider environmental, social and governance investing. Bloomberg Businessweek reports that MSCI’s popular ratings, which drive trillions of dollars in investments, are actually aimed at protecting companies, not the planet. The Biden administration has ordered an immediate halt to new federal support for coal plants and other carbon-intensive projects overseas, a major policy shift intended to drive investment in renewable energy. But the White House said it wouldn’t apply to current projects and won’t stop U.S. coal companies from seeking business overseas. The administration has been under scrutiny for the speed of approving oil and gas projects on federal lands this week. It’s been a week for China. Evergrande finally defaulted and the government changed its economic tune. While Beijing sorts out a tough year, U.S. policymakers were warned that more shocks are coming from its economic rival, and that they are very unprepared for them. The Republican-appointee dominated U.S. Supreme Court, this time in a case out of Texas, dealt yet another blow to the ability of women to end a pregnancy should they choose to do so. The U.S. government moved a step closer to prosecuting Julian Assange on espionage charges after London judges ruled that the WikiLeaks chief can be extradited.  Julian Assange Photographer: Jack Taylor/Getty Images Europe If you follow the world of cryptocurrency even casually, you know it produces a constant supply of jargon. There’s NFT, dapp, DeFi and tokenomics to name a few. Now brace yourself for a new one: Web3. The idea is that crypto isn’t just for sending money or speculation, but could be used to build a whole new web. Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. China is one of the world’s biggest stories. Sign up to receive Next China, a weekly dispatch on where China stands and where it's headed next |