|

|

Today’s letter is brought to you by ResiClub!

ResiClub is the leading publication for the residential real estate market.

Housing affordability is the worst that it has been in 40 years and the team at ResiClub has covered the decline in great detail.

Readers get news, commentary, data, and analysis from industry insiders.

ResiClub is written by Lance Lambert, who is widely considered the best residential real estate reporter in the country.

Subscribe today and stay informed on the largest asset class in the world.

To investors,

There is strong debate in the market about the US economy. One side believes the Federal Reserve will pull off the impossible and guide us towards a soft landing. The other side thinks the economy is showing significant red flags and is destined for a recession.

The truth is that no one knows what is going to happen.

That won’t stop people from trying to figure it out though. There are trillions of dollars, and many reputations, on the line in this debate. Take Anne Walsh, the Chief Investment Officer for Guggenheim Partners Investment Management, who told Bloomberg last week “we still see a recession coming, although our base case is a mild recession, and as a result we still see rate cuts [coming]. We are actually predicting they start sooner rather than later.”

James Solloway, the Chief Market Strategist at asset management firm SEI, told Marketwatch last week that the big problem in the economy today is how many people are expecting these interest rate cuts. His view is that 3% inflation is not problematic as long as the market believes the Fed will keep interest rates at the current level or potentially raise them further.

These are just two anecdotal opinions though. What does the market believe?

Ann Saphir writes for Reuters:

“Futures contracts that settle to the Fed's policy rate fell, and now reflect about a 47% chance of a Fed rate cut by March, down from 55% earlier in the day.

Just a week ago the probability of an interest-rate cut in March from the current range of 5.25%-5.5% was seen at nearly 80%, reflecting faster-than-expected declines in inflation. Fed policymakers themselves had also signaled at their December meeting that their rate-hike campaign was likely at an end and that in 2024 they would probably start to reverse course.

In the last week, though, signs of the consumer's continued strength and indications that the inflation battle has not yet been won have eroded confidence in the likelihood that the Fed will pivot all that soon.

Central bankers, in this last week of public commentary before a self-imposed quiet period ahead of their late-January meeting, have also suggested a rate cut may not be imminent, even as they continue to call out progress on the inflation fight and hold the door open to a rate hike a little later in the year.”

That pesky inflation continues to rear it’s ugly head.

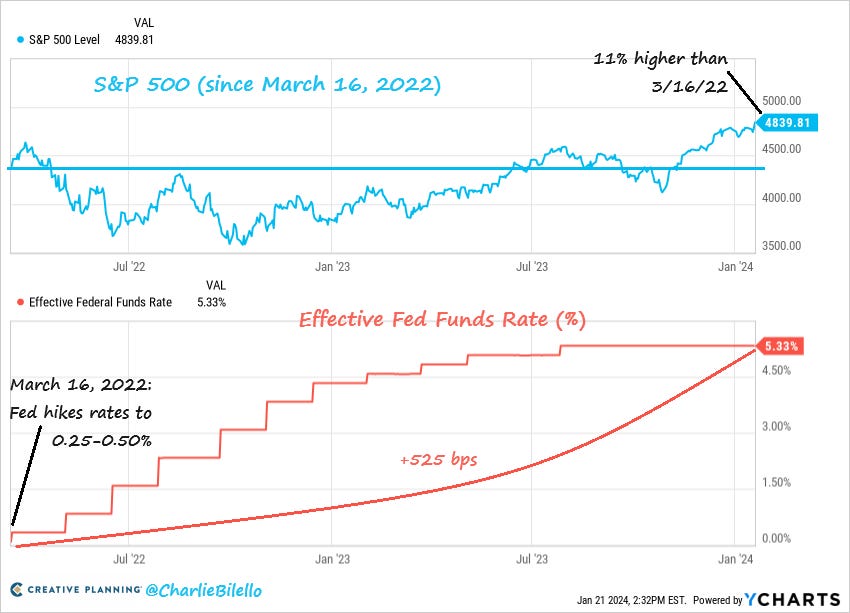

Another interesting point comes from Creative Planning’s Charlie Bilello who explains “the S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022.”

But there is one factor that most people are not considering at all — what if the Federal Reserve and the entire market is operating with bad data? What if inflation is already back to the 2% inflation target?

Truflation, the leading alternative inflation measurement, is showing the current inflation rate is 1.86%. That is nearly 50% lower than the Fed’s current reading of 3.4%.

This is noteworthy because almost no one is considering this possibility.

If the Fed has already accomplished their goal of getting inflation back to the 2% target, and there are meaningful signs of a potential recession, it would be prudent for the Fed to start cutting interest rates sooner than the market expects.

Some of you may ask me — what signs of a recession exist today?

Paul Davidson of USA Today points out the following:

“A measure of small business hiring plans fell to the lowest level since June and marked the second lowest reading since the pandemic-induced recession in 2020, the National Federation of Independent Business said last week.”

“Both manufacturers and service companies said they cut jobs in December, the first time that’s happened since October 2022, according to Ludtka and surveys by the Institute for Supply Management.”

“Job growth was revised down in 11 of 12 months last year, Ludtka says. That often occurs when the economy is at an inflection point, or shifting from growth to contraction.”

“In the third quarter, credit card debt hit a record high of $1.1 trillion and delinquencies were at their highest level since 2011, according to the Federal Reserve Bank of New York and Ludtka.”

“Net profit margins for S&P 500 companies likely shrank to 10.9% in the fourth quarter, the lowest level since late 2020, FactSet, a financial data and software company, estimated Friday ahead of earnings season.”

“The yield on the 3-year Treasury bond has been well above the 10-year Treasury for more than a year, notes Gus Faucher, chief economist of PNC Financial Services Group.” (known as inverted yield curve)

Each of these signs are worth paying attention to, but none of them guarantee a recession will happen. This is the beauty and difficulty of financial markets. Uncertainty rules the day.

Regardless of whether a recession comes or not, my best guess is that we will see looser monetary policy to end the year than we have today. How severe the loosening will be, along with the exact timing, is up for debate.

But economies around the world are addicted to cheap money and central banks are more than happy to deliver the drug of choice. We can fight the trend in the short-term, but the long-term trend may as well be written in stone.

Cheap money. Higher asset prices. And a lot of investors who will have to figure it out along the way.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Darius Dale is the Founder & CEO of 42Macro.

In this conversation, we talk about global liquidity, Macro Weather Model, bitcoin & other risk assets, and impact of fiscal stimulus.

Listen on iTunes: Click here

Listen on Spotify: Click here

My Appearance on Fox Business Friday with Charles Payne

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.