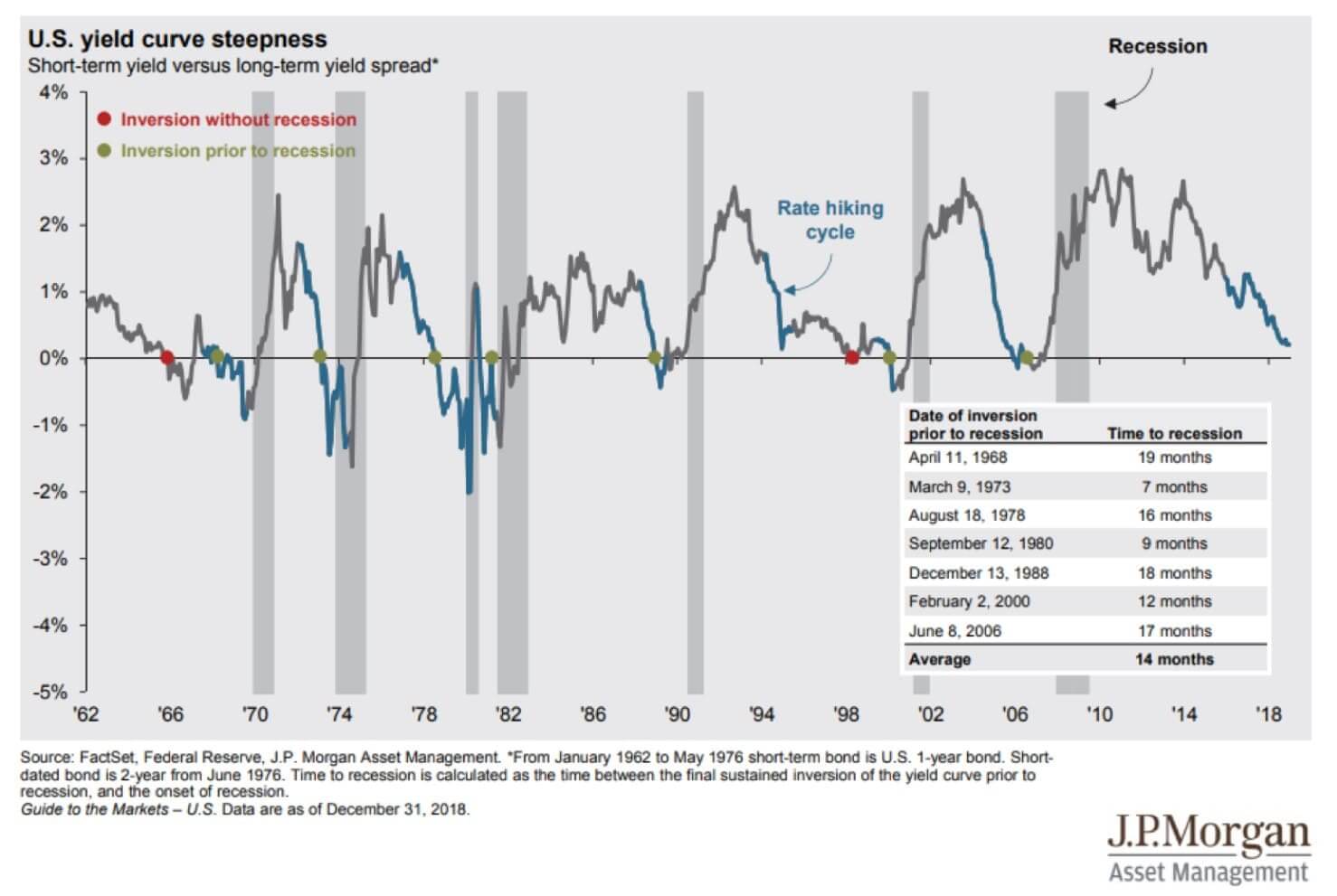

| 60-year-old market indicator flashes red It’s been a reliable predictor of a recession for six decades. Today I’m talking about the ‘inverted yield curve’. After last week, that phrase slipped out of Wall Street and onto the lips of ordinary people. What’s all the fuss about the yield curve…and why does it matter to you? Well, it probably doesn’t affect you directly. However, it’s the implications for the broader market that matter. An inverted yield curve means that the US government’s 10-year Treasury bond interest rate is lower than the government’s 30-day Treasury bond interest rate. In other words, as of today, the bond with the longest timeframe will pay you less than the bond with a shorter timeframe. Traditionally, longer dated bonds are meant to pay investors a higher interest amount. This is because that money is being locked away for longer. However, with the 30-year US Treasury bond being worth less than the short-term one, it means investors are betting that the future is going to be worse than the present. Essentially, it’s a signal that future interest rates are going to be cheaper than today’s interest rates. And lower interest rates aren’t actually a good thing for the economy… Risk-free product just got risky Now, I get it. Talking bonds is boring. But that’s the point of them. Next to cash, they are meant to be the least risky investment product. Because of this, they’re perceived to be the next safest alternative to cash in the bank. To compliment that, bonds tend to offer a slighter higher interest rate than cash stored at the bank. While bonds offer only a small increase on cash stored at the bank, they have become a bellwether for how the economy is travelling. So when the bond yields are ‘inverted’, the US market panics. Because it means that the perceived safety of bonds is under threat. Are the jitters justified? Since 1962, the yield curve has inverted nine times. And in seven of those times, a US recession has followed within 24 months… US yield curve – 1962 to now

Source: JPMorgan; Advisor Perspectives1 However, there’s more to this story than just one bond rate slipping beneath another one. The yield curve is ‘steepening’ right now. Or, more plainly put, it’s falling at a faster rate than we’ve seen before. To make matters worse, it isn’t just the inversion or the steepness of the yield curve that’s causing concern. There’s a third problem. And an untested one at that… Bond holders lose money Grant Williams, editor of the blog Things That Make You Go Hmmm, stood up at the Sprott Natural Resource Symposium and told the room there was US$14 trillion worth of negative-yielding products worldwide. That was in the last week of July. Two weeks later, that figure has grown to US$17 trillion.2 But let’s take a back step. What are negative-yielding bonds? Traditionally, a bond holder receives income earned through interest, at a set time. In simple terms, it’s a way of receiving money for taking the risk to lend money to a company. Let me put it this way. Imagine you lend me $10 today. And in one year’s time, I give you back $11. That means you have ‘earned’ $1 in interest for lending that money today. However, a negative-yielding bond is the flip side of that. A negative-yielding bond means the company that issued it is being paid to create debt. So rather than receiving income, the bond holder is now paying for the privilege of lending money to a corporation. In dollar terms, if you lend me $10 today, a year from now I would give you back $9. It’s absurd. There’s no way you would lend me money today only to receive less in a year’s time. Yet, there is US$17 trillion of those sorts of deals floating through the financial system today. It’s highly unusual and, quite frankly, unprecedented. Yet it’s becoming increasingly common within the global financial system as negative interest rates take hold. While the yield curve inversion is familiar and something the markets have seen before, negative-yielding bonds are not. To put all of this into context, the last time the US bond yield inverted was in 2008 after the financial crisis hit markets. The difference was that negative-yielding bonds didn’t exist then. My point is, we just don’t know the impact of this. Buckle up, investors. We have a bumpy couple of years ahead. | Until next time, |  | | Shae Russell,

Editor, The Daily Reckoning Australia |

|