|

|

I believe Bob Hoye, a veteran market analyst out of Vancouver has the answer. Not surprisingly, gold shares perform best when the real price of gold rises. Bob measures the real price of gold in terms of the commodities (the CRB Index) and oil. As that cost advantage becomes obvious to the market, gold share begin to rise. The price of oil relative to gold is especially important because it accounts for about 60% of the cost of gold mine production.

Here is the current status of gold relative to the CRB.

Here is the current relationship between the price of gold and crude oil.

While the U.S. equity market continues to buy into the idea that the Fed can orchestrate a soft landing, the oil markets are suggesting a significant slowdown in global demand resulting from declining global economic activity. Lower oil prices should help boost gold mining profits. Likewise as you can see from the Gold/CRB chart, gold has recently started to rise relative to a basket of soft and hard commodities.

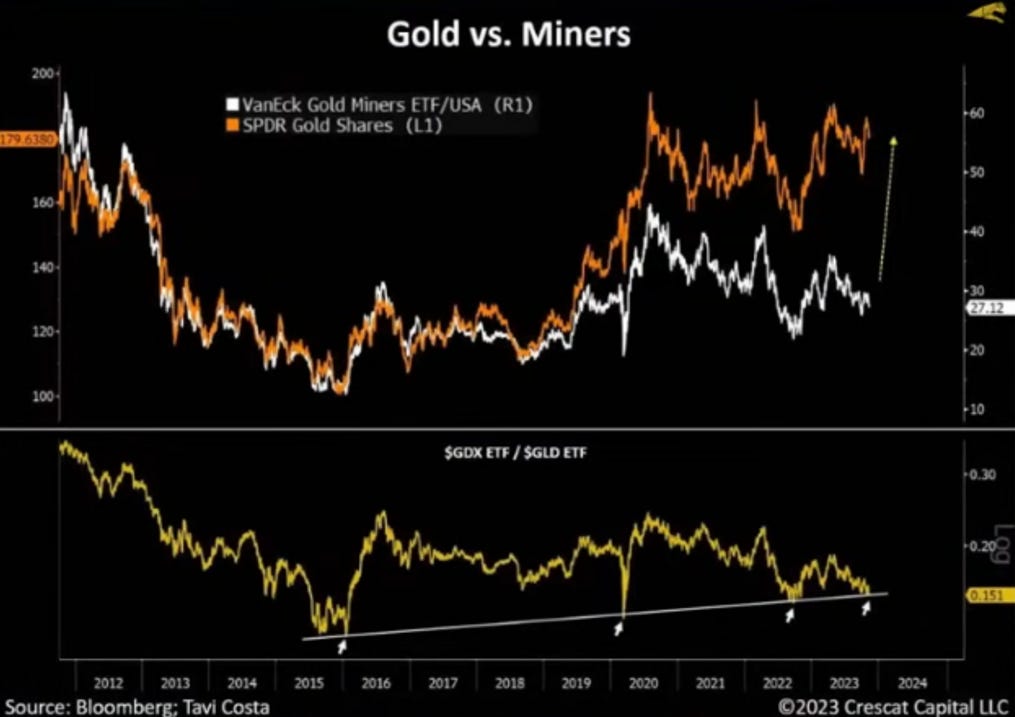

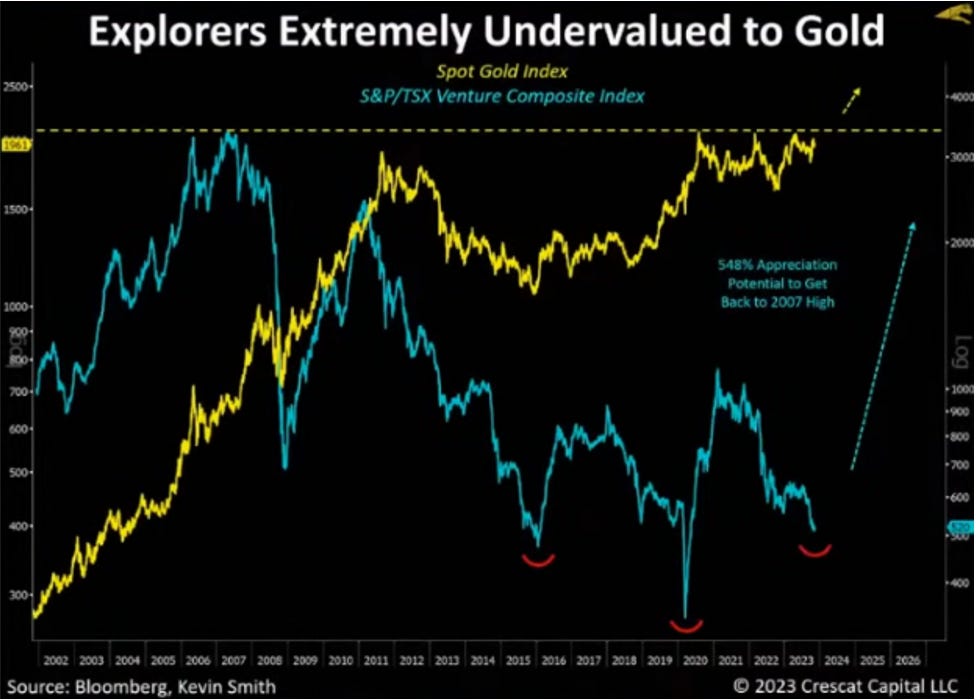

Still gold shares are hugely out of fashion and have not kept up with the price of gold which has actually risen by about 9% so far this year. The following chart compliments of Tavi Costa of Crescat Capital illustrates the tepid performance of gold shares relative to gold bullion.

With median inflation in the U.S. still at 5.5%, long dated US Treasuries appear to be reading the tea leaves much more accurately than the equity markets. Keep in mind that the U.S. Treasury markets have a much better track record of predicting future economic activity than the equity markets.

There are a number of indicators that suggest the U.S. is entering a recession. U.S. durable goods plunged in October as war-spending has declined. And U.S. Home sales have crashed to the slowest since 2010. And, with housing affordability the lowest since at least the early 1980s, there is little incentive for new homes to be built especially in this higher interest rate regime.

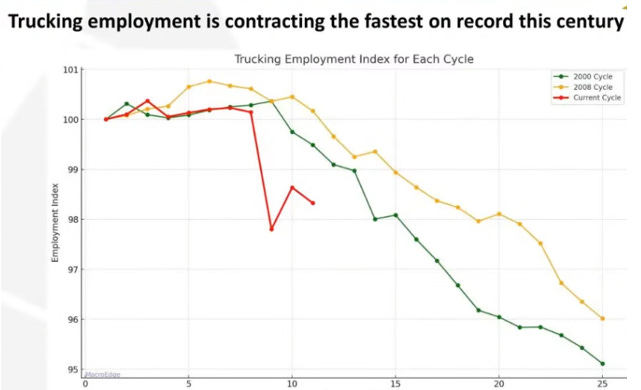

Also, the the middle class is increasingly falling on hard times. According to a report by Bloomberg this week, Americans outside of the wealthiest quintile have run out of extra savings and have started to raid their 401-K accounts just to pay the rent and keep food on the table. To the extent that is the true, it may explain why trucking employment is contracting the fastest on record this century.

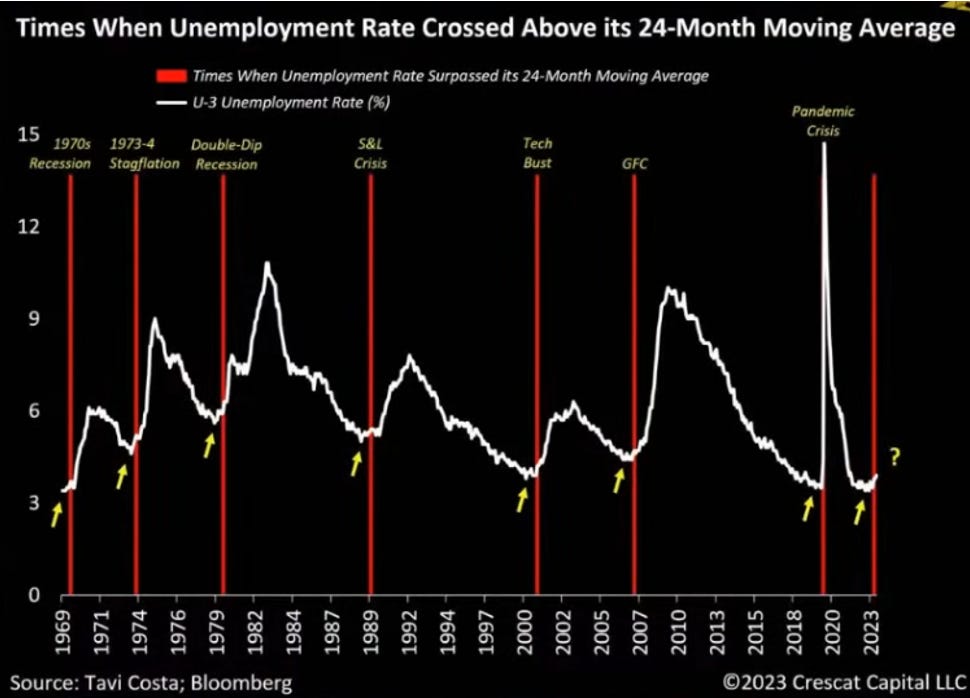

The last indicator of a recession is usually unemployment. And while that number is still low, it has just now risen above its 24-month moving average. As the following chart shows, soon after the unemployment number crosses over the 24-month moving average, unemployment surges. Again, thanks to Tavi Costa of Crescat Capital for this insight.

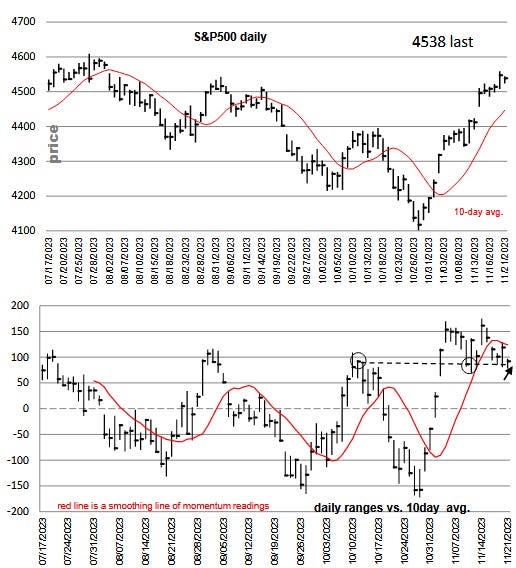

So equity investors living in their make believe world eternal bliss and profits keep buying stocks. But on Tuesday November 21, Michael Oliver (OliverMSA.Com) made sure his subscribers were aware that the S&P is very near the breaking point. He published the following chart and noted a specific value for the S&P 500 that is just slightly above above the Tuesday close of 4538 which if hit, will snap the existing structure and likely indicate the party for equity investors is over! As of Wednesday, Nov. 22, the number specified by Michael was not hit. But it is very, very close!

When the equity market party is over, that should be bullish for long dated U.S. Treasuries at least in the short term especially if a deep recession brings down the CPI. With an emerging recession combined a bear market in equities, you can expect even better profit margins for gold miners as cost of production falls and massive new money creation is likely to drive the price of gold much higher. Investors smarting from their stock losses will be looking to rising gold prices and especially to rising gold share prices as a place to go to hedge their losses. The last time that happened was following the 2008 financial Crisis. Gold and gold shares entered a massive bull market that peaked in 2011 and it took a decade for the S&P to catch up with gold.

There is reason to believe we are near a similar outcome as we end 2023. If so, the greatest upside will likely come from the junior exploration stocks. As this chart demonstrates the shares of explorers are massively undervalued vis-a-vis gold and senior gold producers like Newmont and Barrick.

You may want to consider subscribing to J Taylor’s Gold, Energy & Tech Stocks where I cover several companies with emerging world class gold discoveries that are likely to become takeover targets by major gold producers. At this point in time, those shares are out of focus of most investors. But that will change as it has in past gold bull markets as the profit margins of gold producers surge. Positioning yourself now ahead of the herd will be to your advantage.

Best wishes,

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.