|

To investors,

Predictions of an incoming recession have been happening since the Federal Reserve began to raise interest rates at the fastest pace in history. The theory is that market participants would pull back from financial markets and stop consuming goods/services as the price of capital increased.

Naturally, we would expect to see home prices falling aggressively in this environment.

That is not what we have seen so far though. ResiClub’s Lance Lambert has been covering the US housing market for years and wrote a guest post below to explain why home prices remain strong despite increased interest rates. You can subscribe to ResiClub for free by clicking here to get a daily analysis of the residential real estate market.

There’s no doubt about it, deteriorated housing affordability is a major headwind for the U.S. housing market. That said, the lack of inventory for sale is a tailwind for the U.S. housing market. The lack of existing inventory on the market is the primary reason that spiked mortgage rates haven’t translated into a greater pullback in national house prices.

This morning, Realtor.com published its inventory reading for October. Let’s take a closer look at the data.

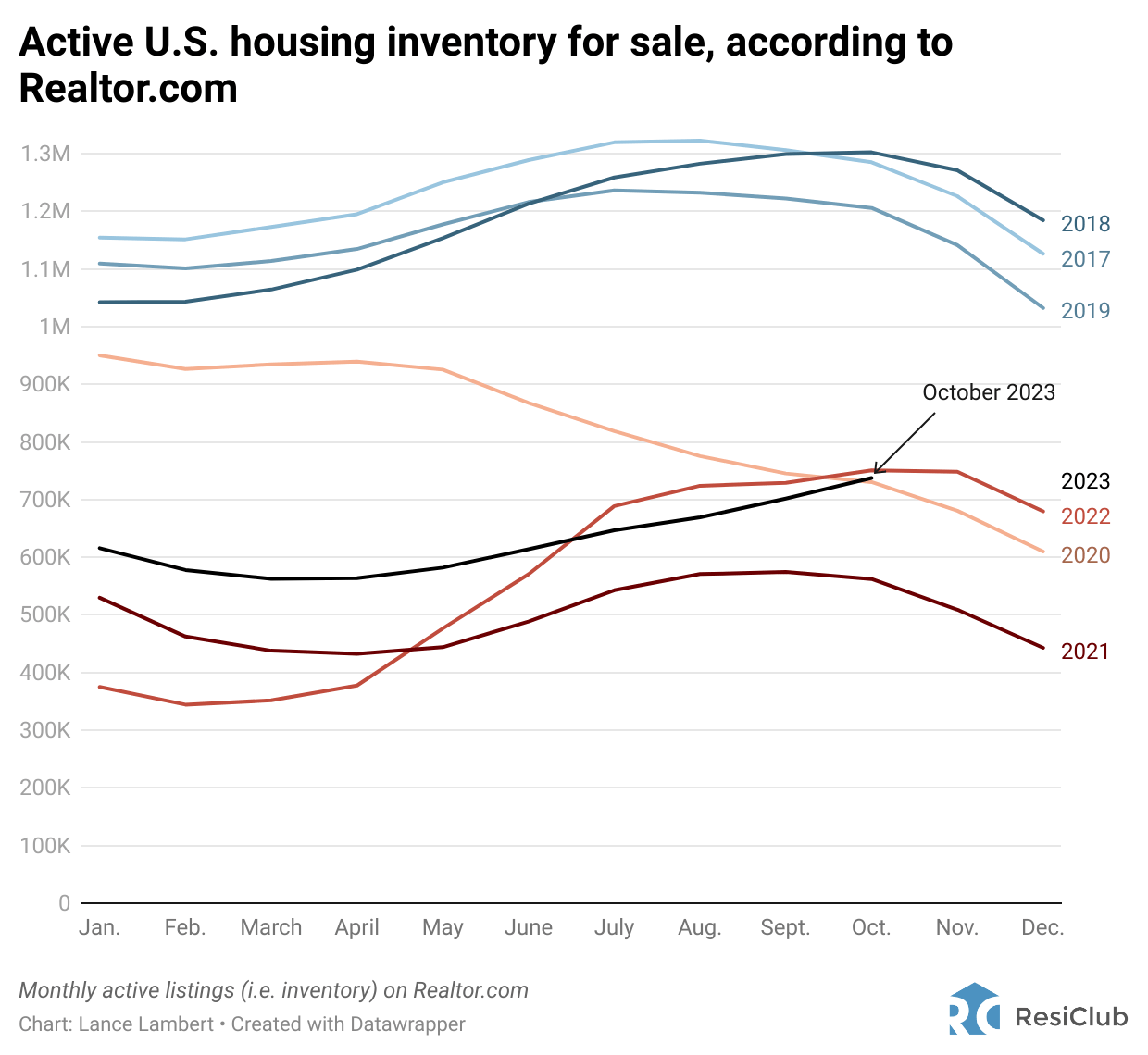

In October 2023, there were 737,480 active listings on Realtor.com. That’s -2% below October 2022 (752,314 active listings), however, it’s +30.5% above the height of the Pandemic Housing Boom in October 2021 (565,205 active listings).

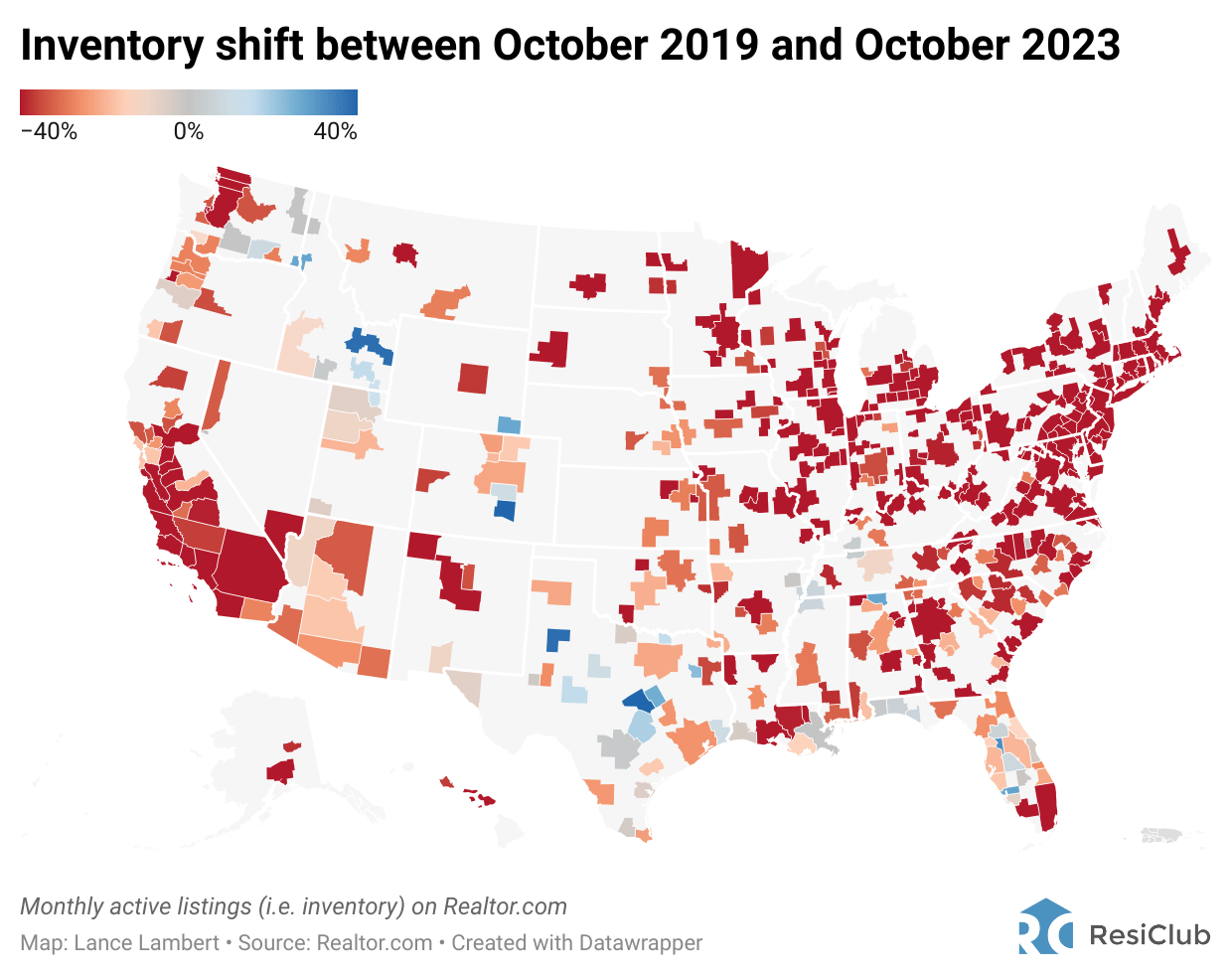

But also it still pales in comparison to pre-pandemic levels: Active listings in October 2023 were -39% below October 2019 levels when there were 1,208,001 U.S. homes for sale.

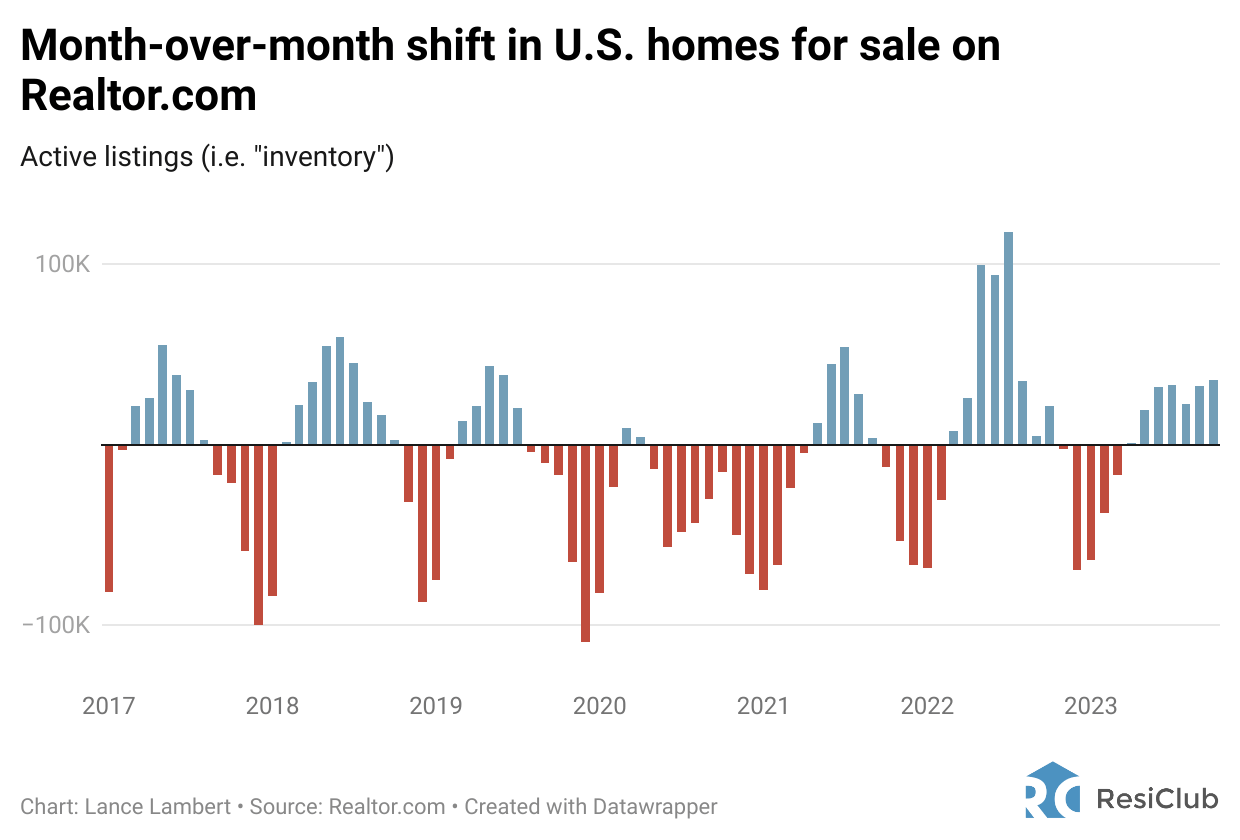

How inventory has shifted between September and October, by year, according to Realtor.com:

October 2017: -21,247

October 2018: +2,773

October 2019: -16,595

October 2020: -15,329

October 2021: -12,361

October 2022: +21,229

October 2023: +35,664

Big picture: The October 2023 jump in active listings clearly indicates that the U.S. housing market experienced more significant cooling than usual last month, undoubtedly influenced by mortgage rates surpassing 8%.

The increase in active listings during October can be attributed to mortgage rates spiking to 8%, which priced out more potential buyers, resulting in homes lingering on the market for longer periods.

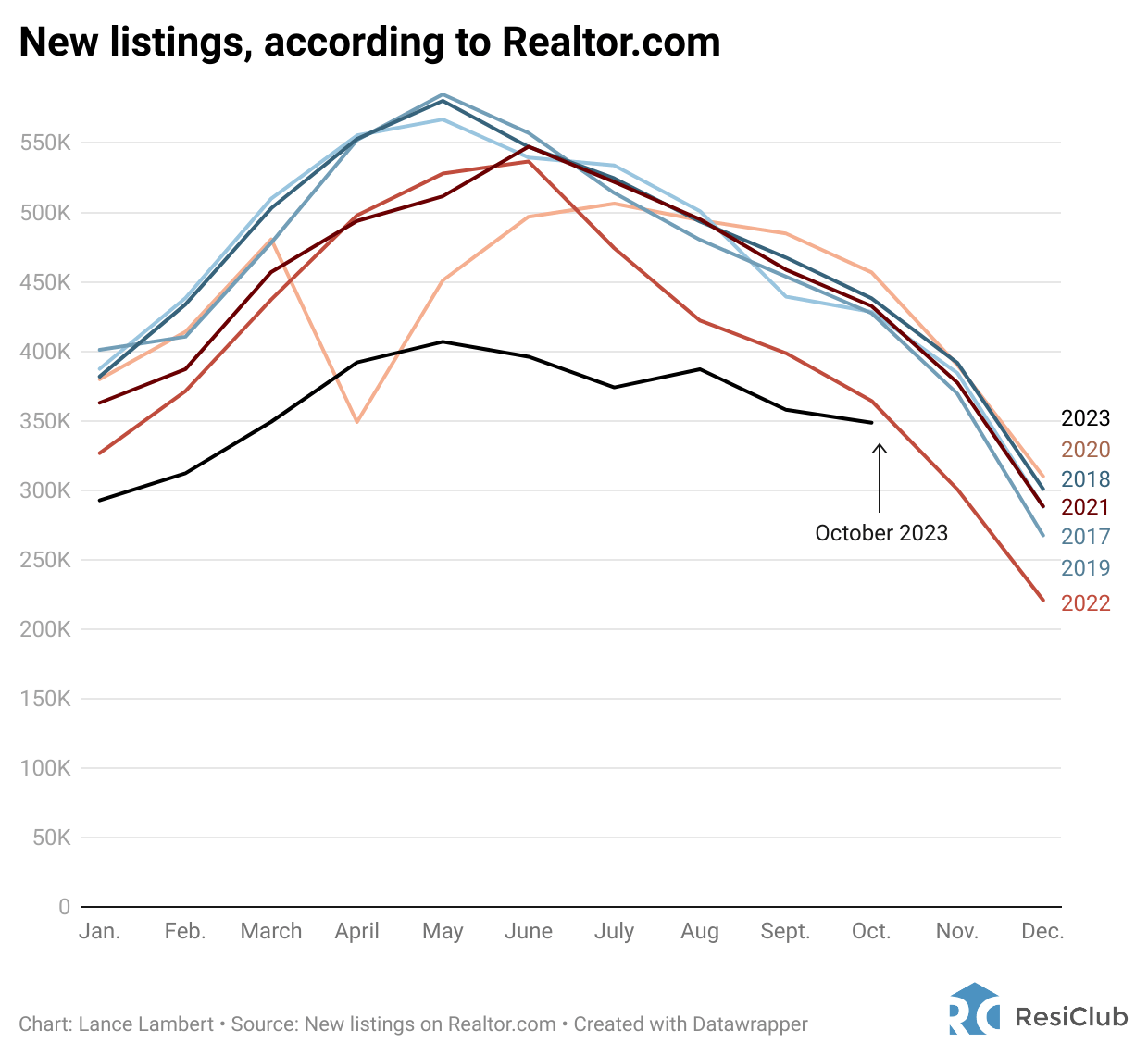

How do we know that? Because active listings (i.e. every home for sale) rose despite the fact that new listings (i.e. new homes coming up for sale) fell in October (see chart above).

The lack of “new listings” is one reason inventory hasn’t ticked up even higher. At least that’s what Amherst's CEO Sean Dobson recently told ResiClub.

“During the pandemic what was happening is that new listings volume was pretty healthy, there were plenty of people coming to market for sale, but the velocity at which they were selling was so fast that it was drawing down the inventory. Now it's completely flipped. The pace to draw down inventory on a percentage basis is healthy, but there is just no one selling. The new listings volume has just crashed,” Dobson tells ResiClub.

Why does inventory matter so much?

If inventory begins to rise quickly, in theory, it signals a weakening market. If inventory begins to fall quickly, in theory, it signals a strengthening housing market.

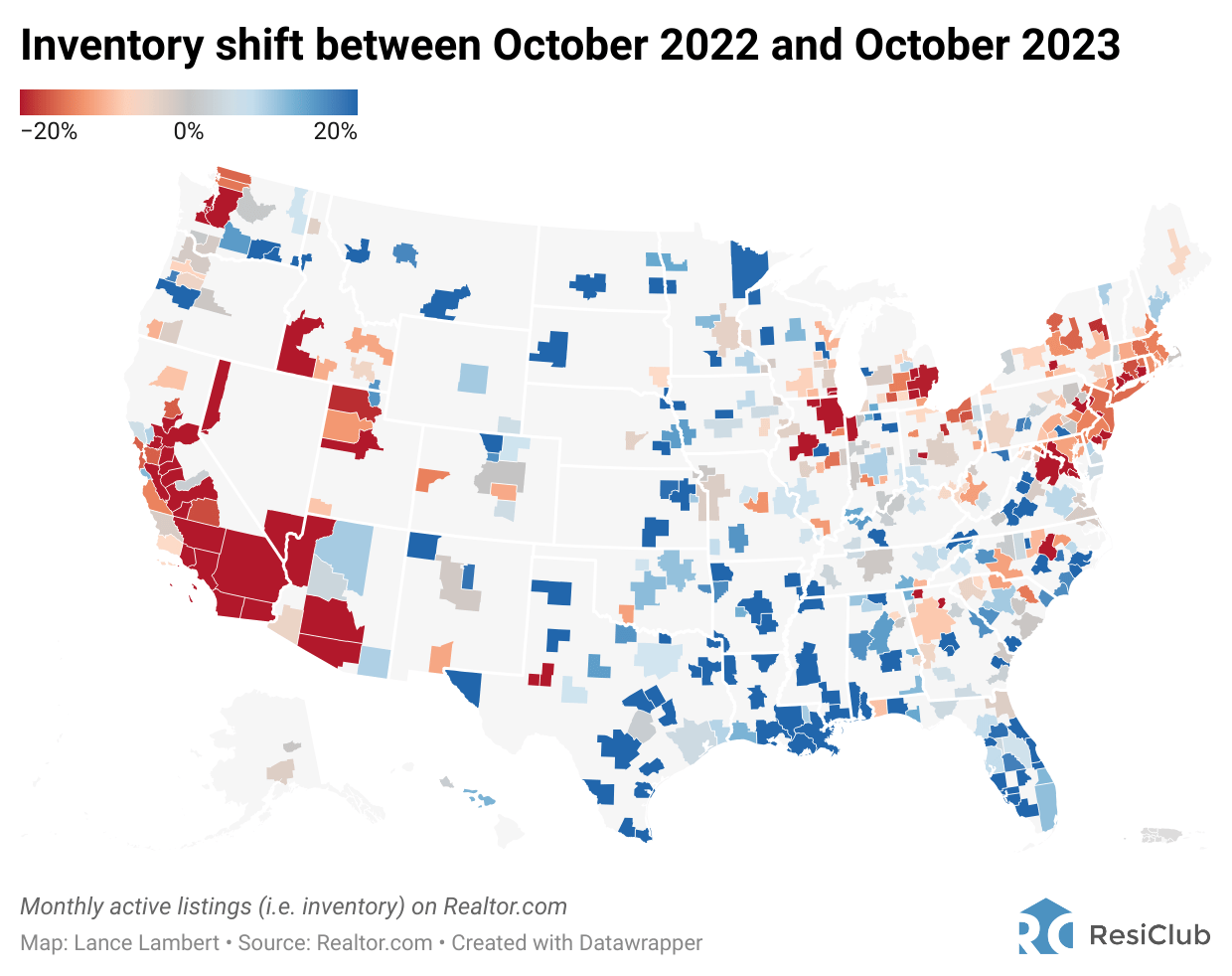

Realtor.com's latest inventory report indicates that several areas in and around Texas and Florida are experiencing a slowdown (see map above).

For months, I’ve been telling readers to not just watch Austin, but to also watch places like Baton Rouge (inventory is up +25.4% year-over-year), San Antonio (+20.6% year-over-year), Memphis (+30.3% year-over-year), and New Orleans (+26.1% year-over-year).

If you click the first map below, you’ll be taken to a link where you can view an interactive map showing year-over-year inventory change between Sept. 2022 and Sept. 2023 in America’s 400 largest regional housing markets.

If you click the second map below, you’ll be taken to a link where you can view an interactive map showing the inventory change between Sept. 2019 and Sept. 2023 in America’s 400 largest regional housing markets.

Inventory shift between October 2022 and October 2023: Click here

Inventory shift between October 2019 and October 2023: Click here

Today’s letter was a guest post from ResiClub’s Lance Lambert. ResiClub is the premier data and analysis platform for the residential real estate market. I co-founded ResiClub with Lance earlier this year to address the national crisis related to housing affordability.

Please subscribe to read the daily analysis on US housing for free.

-Anthony Pompliano

Praying for Exits is a pseudonymous account that is run by one of the most interesting early stage investors in venture capital.

In this conversation, we talk about aerospace, artificial intelligence, defense technology, current state of venture capital, media, and why being pseudonymous is so advantageous for this specific investor.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Pseudonymous investor talks Space, AI, and Defense Tech

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.