| Why I'm Buying This Breakout Market Today | | By Dr. Steve Sjuggerud | | Tuesday, March 7, 2017 |

| In January, my True Wealth Systems computers alerted me to the big story the rest of the world was missing…

They told me a stealth bull market was beginning in Europe.

You see, European stocks are staging a major breakout this year. And that's why the computers behind my high-priced True Wealth Systems service are signaling now is the time to buy.

But I've got an even more important reason to own Europe today… one that could mean triple-digit gains if history is any guide.

Let me explain…

----------Recommended Link---------

---------------------------------

Let's think about two different investments… We'll call them Investment A and Investment B.

A and B are similar… but not identical. They generally move up and down together… But they don't track each other perfectly.

You can think about it in terms of the housing market. For example, if your neighbor's house goes up in value, then chances are yours will go up, too.

It's not a one-for-one move, of course. One might move ahead of the other in the short run. But over the long run, the differences typically aren't huge. If asset prices are going up in general, then your house and your neighbor's house are both going up in value.

Investment A and Investment B are not houses. But over long periods of time, they have similar returns – they are correlated.

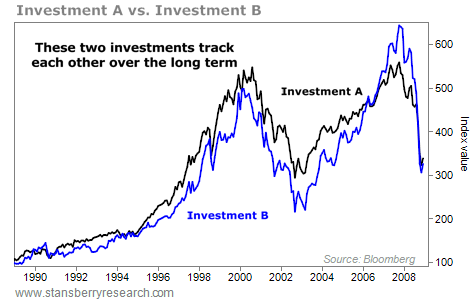

You can see how these two investments track each other on the next chart. The returns don't match up exactly month over month, or even year over year. But over a couple of decades, things even out. Take a look:

Based on this chart, over the long term, it doesn't matter if you own Investment A or Investment B. They end up with similar returns over long periods.

Like you and your neighbor's house, the major shifts are similar. But what if your house spent a decade rising while your neighbor's home value went nowhere?

That wouldn't make much sense. It would mean that the overall landscape for homes was likely strong – because your house increased in value – but that your neighbor's house was left behind for some reason.

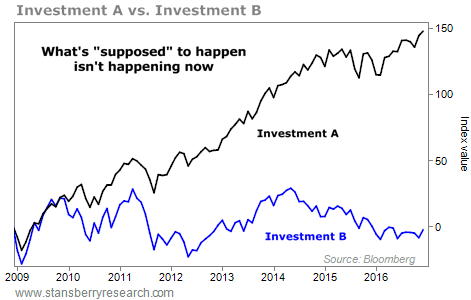

You'd end up with a chart like this…

What would you do in this situation?

My answer is simple… I'd sell my house at that elevated price and buy my neighbor's at a low price!

This is the incredible situation we've seen in European and U.S. stocks over the last several decades…

The charts above aren't random lines. They show the S&P 500 (Investment A) and the EURO STOXX 50 Index (Investment B), which tracks Europe's blue-chip stocks.

The first chart shows how things work during normal times. The U.S. performs better sometimes – like during the late 1990s. And at other times, Europe performs better – like during the mid-2000s. But the long-term returns for U.S. and Europe stocks have been similar.

If that's the case, then why should we care about owning European stocks today? Why shouldn't we just buy U.S. stocks and forget about Europe?

Well, as the second chart shows, we have an extreme situation today.

While U.S. and European stocks move together over the long term, they CAN differ over the shorter term… And when those differences reach extremes, it sets up incredible buying opportunities.

That's exactly what we have today… an incredible buying opportunity in European stocks.

The last time we saw an extreme anywhere close to this was 2002. What happened next? A massive multi-year bull market in European stocks. As I explained in DailyWealth last month…

| If you'd waited for the uptrend before buying, then you would have bought European stocks in mid-2003. By late 2007, you would have made 172% gains. U.S. stocks returned just 74% over the same period. |

|

I believe we could be at the start of a similar move right now. My True Wealth Systems computers show Europe is officially entering a stealth bull market. And with eight years of massive underperformance behind it, we could potentially see triple-digit gains from here.

That's the No. 1 reason I'm buying European stocks in 2017. And I suggest you do the same.

Good investing,

Steve

P.S. Later this week, I'll be releasing a brand-new presentation that will show you how to beat the market by 50%, on average, on every trade you make – even European stocks. Be on the lookout for the details soon. |

Further Reading:

"We're in uncharted territory today," Steve writes. The underperformance in Europe has never been so huge... But in the past, similar extremes led to massive breakouts in European stocks. And that means this time, our upside could be bigger than ever. Learn more here: Shocking Underperformance Leads to a New Stealth Bull Market. "Normally, when gold goes up, gold stocks go up even more," Steve writes. But that's not happening today. Gold-stock buyers are behaving differently from investors in gold... And that means the bottom is still to come. Read more here: Why Gold Stocks Are Underperforming Gold. |

|

ANOTHER NEW LOW FOR THIS CAMERA MAKER

Today's chart teaches a valuable investing lesson: Stay away from stock market "fads"... In the past, we've outlined the dangers of hot trends like fitness stock Fitbit (FIT) and social-media company Twitter (TWTR). But one of our favorite ways to show this idea at work is by checking in on innovative camera maker GoPro (GPRO). It's not hard to see why the company is so popular... People love being able to attach cameras to their helmets, cars, surfboards, and even their dogs. Not long after the company went public, we warned readers about GoPro's extreme valuation. Investors had bid the company to a sky-high valuation of 10 times sales... and we noted it was due for a correction. When companies reach these "stratospheric" valuations, they are priced for perfection. Any small mishap, and the train comes off the rails... And that's exactly what happened. As you can see below, the situation has only deteriorated. Since our last check-up in November 2015, GoPro shares are down nearly 60%. And shares just struck a new all-time low on Monday. GoPro may sell a fascinating product... but as we've proven, that doesn't make it a winning investment... |

|

| Triple-digit upside in Japanese stocks right now... Europe's stealth bull market is underway. But Europe isn't the only market I'm interested in today. In fact, we have another likely triple-digit opportunity in Japanese stocks... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Wall Street legend Dr. David Eifrig, Jr. says there's one critical step every American should take to get ready for this historic event... Learn more here. |

| The Cheapest, Most Hated Asset Today | | By Dr. Steve Sjuggerud | | Monday, March 6, 2017 |

| Everything has gone up. The "Trump Bump" has turned into a frenzy... Nothing is cheap anymore... right? My friend, you are not looking hard enough... |

| | The Real Reason Why Stocks Just Hit an All-Time High | | By Justin Brill | | Saturday, March 4, 2017 |

| | More than seven in 10 Americans who watched President Trump's speech on Tuesday night came away with a positive reaction, according to a CNN poll... |

| | Why Gold Stocks Are Underperforming Gold | | By Dr. Steve Sjuggerud | | Friday, March 3, 2017 |

| | Gold stocks are down 11% since February 6... But gold prices are up 1%. |

| | Three Clues for Finding Companies That Jump off the Page | | By Dan Ferris | | Thursday, March 2, 2017 |

| | My research partner and I read every shareholder letter issued by companies in the S&P 500 Index... |

| | What to Do With Gold and Silver Today | | By Ben Morris | | Wednesday, March 1, 2017 |

| | Precious metals are making a move... |

|

|

|

|