| More Articles | Free Reports | Premium Services By John Pangere, Editor, Freeport Strategic Opportunities I woke with a start. My heart was pounding. A cold sweat beaded my brow. I couldn’t help thinking about how vulnerable my finances were… How would my family and I survive a bout of inflation? What if America’s towering debt finally came crashing down? What if the dollar lost its reserve currency status and suffered a spectacular crash? This was how many of my mornings began. It wasn’t just unhealthy – it was eating me alive. I didn’t have a backup. I didn’t have the safety net that would allow me to sleep easy at night. Then I got my financial house in order. And I started to sleep soundly again… Every so often, I remind myself of the move I made to rid myself of those fears. I fetch my gold coins and hold them in my hand.

John holding some of the gold coins that help him sleep well at night There’s something about holding these coins that gives me a warm feeling. Whatever happens with debt, deficits, and dollar debasement, I know my family and I are protected. Plus, these coins aren’t bad to look at. American Eagles, South African Krugerrands, Austrian Philharmonics – I’ve got them all. And as we’ll explore today, gold is doing exactly what I expect it to. It’s helping me preserve my buying power. While the dollars in my bank account buy me less of the same goods and services each year, my gold is going up in value and offsetting the effects of dollar inflation. The Most Beautiful Chart in the World It’s all in this chart… It shows the price of an ounce of gold in U.S. dollars going back to the start of the millennium.

As you can see, gold is up 895% in U.S. dollar terms since 2000. And last year, it shot up 27%. That’s more than the 25% gain for the S&P 500. It’s also more than the 26% gain for the Nasdaq 100. And already this year, it’s up another 9%. Which means it’s still outpacing the S&P 500 (up 3.6% year to date) and the Nasdaq (up 2.1% year to date). But most investors are completely ignoring the gold bull market. Go to a gold mining industry event, and you’ll know what I’m talking about. The halls are empty. No one is attending apart from the die-hard gold bugs. I know this from talking with industry insiders and brokers in Vancouver, where many mining companies have their headquarters. Instead of focusing on gold, most mainstream investors are glued to AI stocks, the Magnificent Seven tech stocks, and the latest crypto news. Ask your neighbors or your work colleagues about Nvidia or Bitcoin, and it will likely spark a lively conversation. Ask them about gold and you’re more likely to get a deer-in-the-headlights look. And that’s great for folks in the know about gold. While most investors are sweating over news of Chinese AI model DeepSeek… Trump’s tariff threats… and what the Fed will do next, gold is steadily rising and making folks who hold it richer. But don’t expect the rally in gold to stay under the radar for long… | Recommended Link | | | | Luke Lango here, I just alerted my followers to three new crypto trades with the help of my POWER 5 crypto algo… Trump could enact new crypto policies providing a rare window of opportunity to make more money in his first 100 days than his entire second term. The time to act is now. Click here now to watch the replay and get details on three new trades. |  |

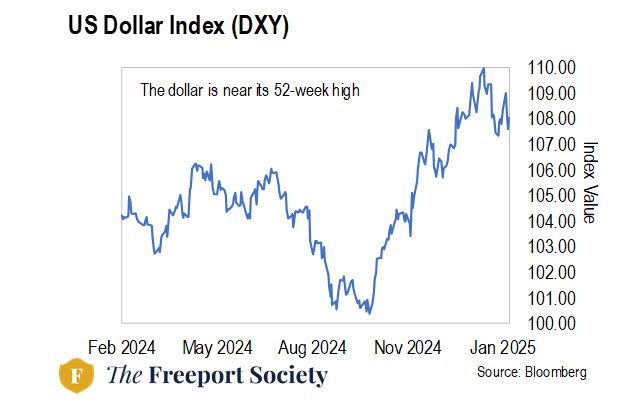

Gold Will Hit $3,000 by June Right now, gold trades at $2,868 an ounce. I expect it to hit $3,000 an ounce by June. From there, $3,500 an ounce isn’t off the table. Gold’s recent price action is telegraphing a sustained rally in 2025. That’s due to how it’s trading relative to the U.S. Dollar Index. It tracks the exchange value of the dollar versus a basket of major trading-partner currencies. As you can see in this next chart, over the past 12 months, it’s up 3.5%.

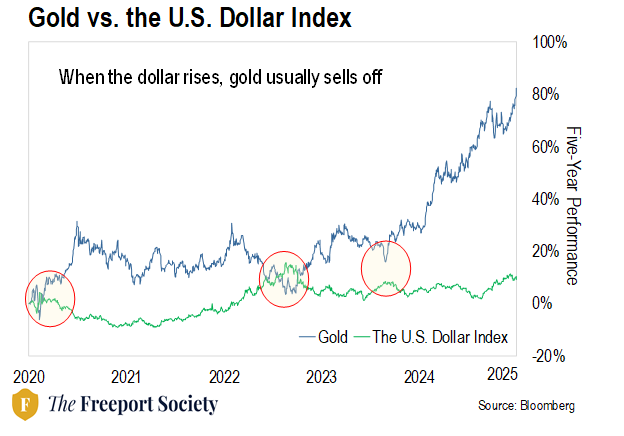

Typically, when the dollar strengthens like that, the price of gold drops. Gold is traded globally in U.S. dollars. When the dollar strengthens, this makes gold more expensive in foreign currencies. This reduces demand from international buyers. Also, investors in the U.S. tend to buy gold when the dollar is weakening to protect themselves against dollar devaluation. When it’s strengthening, this lowers demand from U.S. buyers. But that’s not happening right now. Both gold and the U.S. Dollar Index are rising. You can see what I mean in the chart below. It shows the relationship between the price of gold (blue line) and the U.S. Dollar Index (green line) going back to 2020.

As you can see from the circled areas on the chart, the gold price has tended to dip when the U.S. Dollar Index rises. But since late 2024, the U.S. Dollar Index and gold have been rising together. That shows how strong the rally in gold has been. Even a strengthening dollar hasn’t been able to keep it down. And gold isn’t just hitting new highs in U.S. dollar terms. It’s also setting records in terms of the euro… the Japanese yen… the British pound… the Canadian dollar… the euro… the Swiss franc… the Australian dollar… and the Chinese yuan. So, how do we play this? | Recommended Link | | | | A switch was flipped last September that could rapidly accelerate a massive global economic shift. The NYT says it will: “split history into before and after.” No matter where you live or what you do it will have huge implications for you. Click here for 3 steps to prepare. |  |

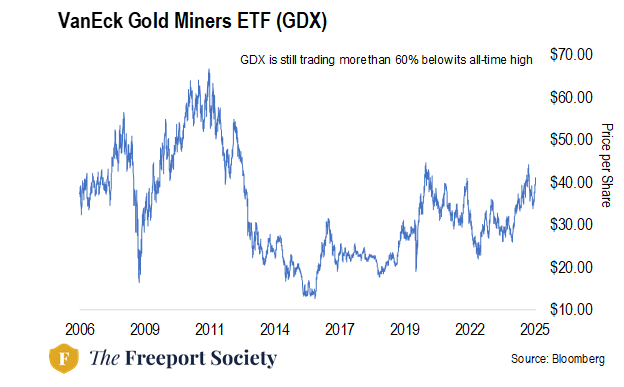

How to Play It When gold is making new highs across major currencies, it’s a sign of strong momentum. And it’s a great time to jump in on the trade. The best place to start is with physical gold. You can buy some bullion coins like I did. These are not rare – or numismatic – coins that collectors go for. Numismatic coins trade at a hefty premium to the price of gold. Bullion coins, on the other hand, are primarily bought and sold for their precious metal content, not their rarity value. So, they trade in line with the price of gold plus a small premium for minting costs. Once you own physical gold, the next step is to add in some gold mining stocks. You can do this by way of the VanEck Gold Miners ETF (GDX). It’s an exchange-traded fund (ETF) that tracks the performance of the largest gold mining companies around the world. Gold miners give you leverage – or extra oomph – over the price of physical gold. A gold mining company has fixed costs to mine an ounce of gold. It doesn’t matter if gold is selling at $1,000 or $1,500 an ounce… that cost stays the same. So, when the gold price rises, gold miners’ profits explode higher. Let’s say ACME Gold is mining gold at a cost of $900 an ounce. With gold selling for $1,000 an ounce, ACME Gold books a profit of $100 an ounce. But if the gold price climbs to $1,500, its profit per ounce leaps to $600. That’s a 500% jump in profits – even though gold went up only 11%. This sends the company’s shares surging, too. That’s what makes gold miners some of the most explosive stocks in the world when the gold price is rising. And there’s plenty of room for GDX to run higher. As you can see from the chart below, it’s about 60% below the all-time high it set in 2011… when gold was trading at $1,000 an ounce less than it is today.

So, now is a great time to add some shares of GDX to your stash of gold coins. If GDX gets back to its all-time high – and I expect it will as gold continues to climb – that’s about a 70% profit from here. Regards, |