| US core inflation hit a 40-year high, dashing hopes the Federal Reserve will dial back interest-rate hikes that may tip the country into a downturn and further damage the global economy. That number excludes rent and food, but those aren’t getting cheaper either (though people still want their Pizza Hut). The inflation problem seems to run deep and almost certainly means another 75 basis-point hike is coming next month. The International Monetary Fund cut its global forecast as its chief economist warned “the worst is yet to come” and “for many people, 2023 will feel like a recession.” Another looming issue is liquidity in Treasuries, Janet Yellen warned this week. “If the Treasury market seizes up,” Robert Burgess wrote in Bloomberg Opinion, the global economy and financial system will have much bigger problems than elevated inflation.” Meanwhile, when it comes to the US housing market, things are just getting weird. UK Prime Minister Liz Truss fired Kwasi Kwarteng as Chancellor of the Exchequer after only 38 days on the job. She’s preparing to make a humiliating reversal on key parts of her widely-derided economic plan. Britain’s descent into crisis is devouring the credibility of UK institutions—including the prime minister, the Treasury, the Bank of England, the Tories and the nation’s asset management industry.

Xi Jinping will likely be reappointed China’s top leader this weekend as the Communist Party gathers for its once-in-five-years plenum. The party has already reaffirmed Xi’s status as its center, setting the stage for continuation of policies such as a campaign billed as tackling corruption to competition with the US. But at least one policy is already leaving markets shaken—a doubling-down on his “Covid zero” policy sent stocks tumbling. Shuli Ren argues in Bloomberg Opinion that markets can’t survive much more.  Xi Jinping Source: Bloomberg A war of words between the US and Saudi Arabia is escalating after President Joe Biden threatened to punish the Saudis for a cut in OPEC+ output—just as US gasoline prices tick up before the midterm elections. Some in the Biden administration view the cut as potentially undermining a plan spearheaded by Yellen to cap the price of Russian oil. In Europe, Germany is backing joint European Union debt to avert a winter energy crisis. Ironically, Russian LNG sales are still helping fill the continent's storage tanks.

Covid-19 cases are rising again in pockets of the world, in part because the hyper-contagious omicron strain is splintering into many subvariants. Some of them show a striking ability to evade antibodies. And while long Covid affects millions of people, it largely eases with time, according to the first rigorous study of the condition.

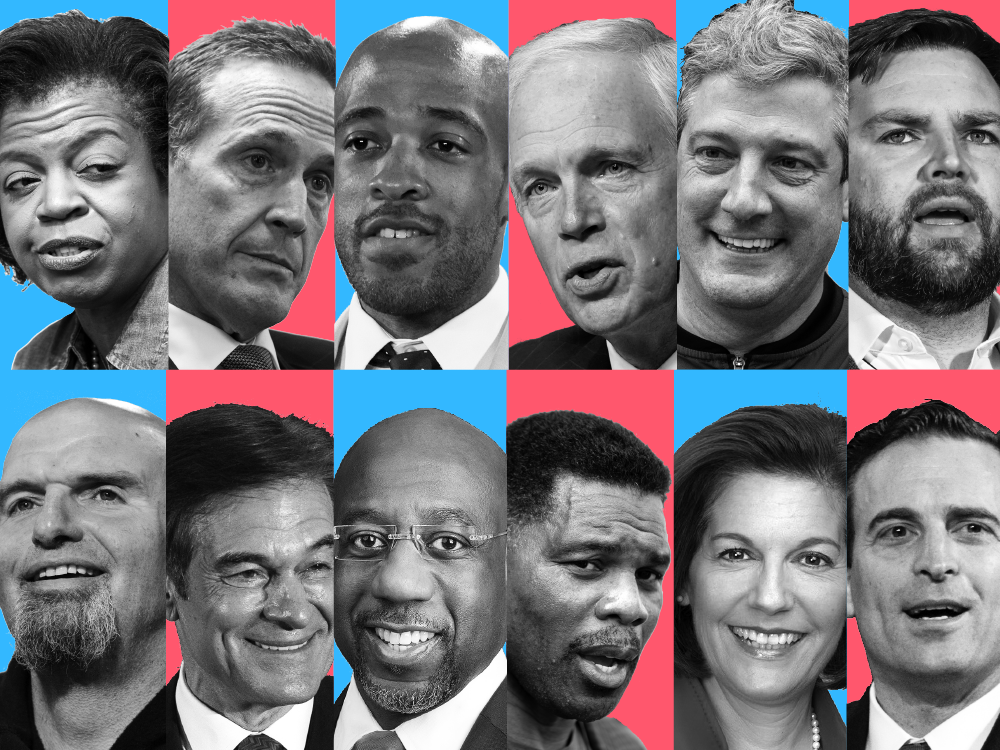

Pricey art seems immune to the global slowdown if attendance at Frieze London is any indication. “Luxury is not a proxy for the general economy,” said Jean-Jacques Guiony, chief financial officer of LVMH Moet Hennessy Louis Vuitton SE, which reported a 19% rise in sales. And two people have signed up for a SpaceX trip around the moon: Dennis Tito, the world’s first space tourist, and his wife Akiko. Actual spacecraft pending.  The booth for Hauser & Wirth at Frieze London. Photographer: Alex Delfanne Election Day can’t come soon enough for Senate Democrats. A summer marked by the stunning reversal of federal abortion rights by a Republican appointee-controlled Supreme Court tempered GOP expectations. But the party may be regaining momentum thanks to stubborn inflation. Here are three plausible outcomes for the battle to control the Senate. Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. The Bloomberg Equality Summit: Join us in London on Oct. 17-18 for conversations on creating a blueprint for a future based on equitable prosperity. What does a post-pandemic model of development look like? How can a new middle class drive innovation, and what role does the private sector play in creating wealth for all? Speakers include executives from Fidelity International, the John Lewis Partnership, the London Stock Exchange and more. Learn more here. |