| |

| |

| Follow Us | Get the newsletter |

| Treasury Secretary Janet Yellen made her case for a global corporate tax rate across the world’s major economies, part of an effort to restore U.S. leadership and credibility with allies who were often stiff-armed by the previous administration. The proposal aims to dissuade U.S. companies from decamping to havens with lower taxes as the Biden administration eyes higher levies to help pay for a $2.25 trillion infrastructure program. In her first major speech on international economic policy, Yellen marked a U.S. return to the global stage and singled out China in proclaiming that America needs a “strong presence in global markets” to level the playing field. “America first must never mean America alone,” she said. “A lack of global leadership and engagement makes our institutions and economy vulnerable.” Stocks rallied to another record after economic data indicated a U.S. recovery may be gaining momentum. The dollar fell while Treasuries were little changed. Oil sank. Here’s your markets wrap. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today’s top storiesCredit Suisse Group’s investment bank chief is set to leave the firm as part of a wider shakeup at the Swiss lender, which was battered by the margin-call meltdown that was last week’s collapse of Archegos Capital Management. Others may be at risk as well. India is witnessing a second wave of coronavirus infections as new case numbers exceed 100,000 each day. In South America, a record surge of infections in Chile is eroding support for the government’s Covid-19 policies and tarnishing one of the world’s fastest vaccination drives. In the U.S., more than 800 people are dying each day from Covid-19 while new infections rise to 64,000 cases every 24 hours. Here is the latest on the pandemic.  A woman passes a coronavirus awareness mural in New Delhi on April 2. The Indian government contends that it's prepared for the second infection wave. Photographer: Jewel Samad/AFP Another black eye for Facebook privacy. The personal data of more than half a billion Facebook users reemerged online this weekend. The leak includes personal information on 533 million users, such as phone numbers, Facebook IDs, full names, locations, birth dates, bios and in some cases email addresses. The U.S. government has deemed reports of intensifying Russian military activity on Ukraine’s border “credible” after President Joe Biden pledged to stand with Kiev against Kremlin “aggression.” The European Union also promised support for Ukraine amid reported massing of thousands of Russian troops on Ukraine's northern and eastern borders, and on Ukraine’s Crimean peninsula, which Moscow annexed in 2014. Bloodshed at the hands of Myanmar’s junta continued over the weekend. Forces loyal to military leaders who took power in a Feb. 1 coup opened fire on demonstrators Saturday. A human rights group said the junta has shot dead at least 550 civilians, including 40 children.  Relatives mourn the killing of Su Su Kyi, a young woman shot dead on her way home from work in Yangon, Myanmar, on April 2. Photographer: STR/AFP U.S. retailers could shutter tens of thousands of stores even after the pandemic subsides, as shoppers continue to turn toward e-commerce. Millions of U.S. homeowners who’ve fallen behind on mortgage payments would have more time before facing foreclosure under rules proposed Monday by the Consumer Financial Protection Bureau. What you’ll need to know tomorrow

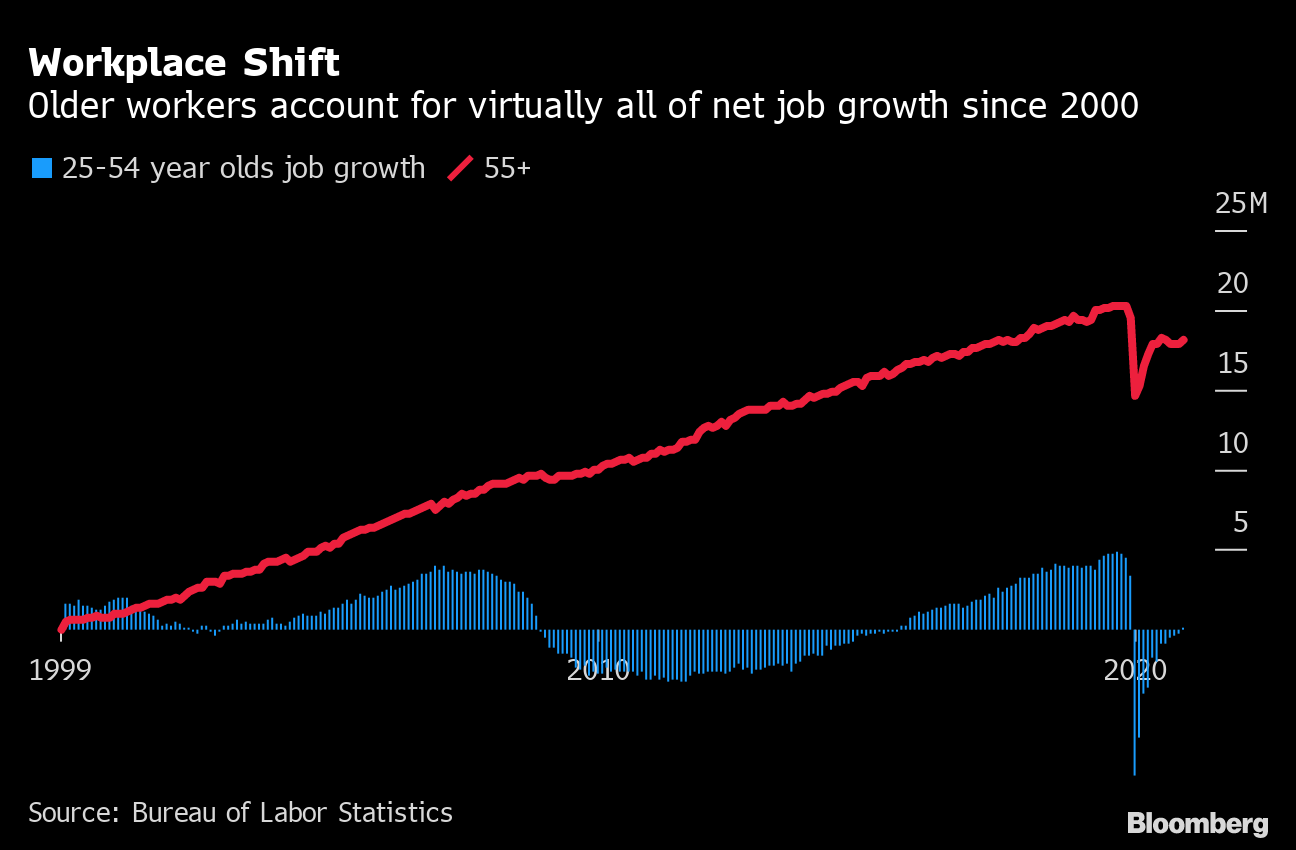

What you’ll want to read tonightThe Pandemic Is Driving a U.S. Retirement BoomMore than 3.1 million Americans age 55 or older plan to apply for Social Security benefits earlier than they once thought because of the pandemic, part of a potential trend that may not only fuel retirement, but employment.  Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg New Economy Conversations With Andrew Browne. Covid-19 has sped up the monetary revolution. China has the first central bank-issued digital currency and Bitcoin is flying high. Will electronic money empower individuals and small businesses at the expense of big banks? Will blockchain remake the modern corporation? Join us on April 20 at 10 a.m. ET for The Ascent of Digital Money. Register here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| You received this message because you are subscribed to Bloomberg's Evening Briefing newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |