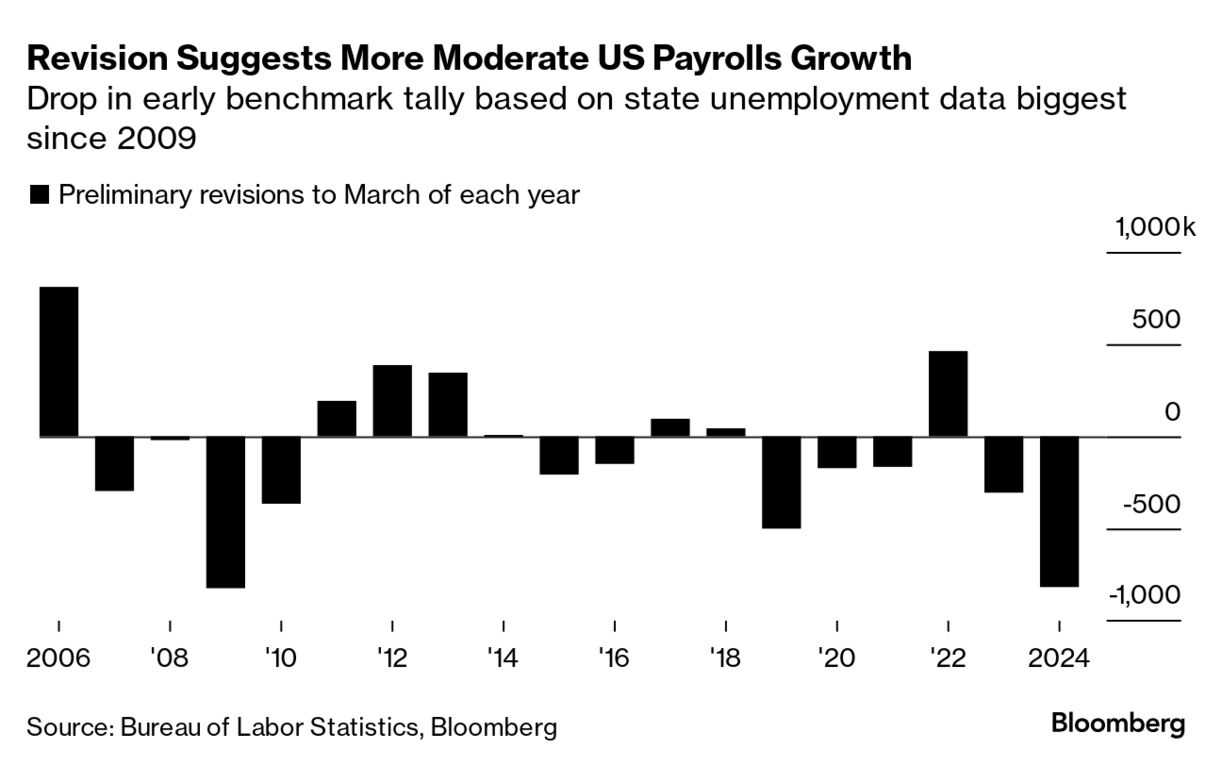

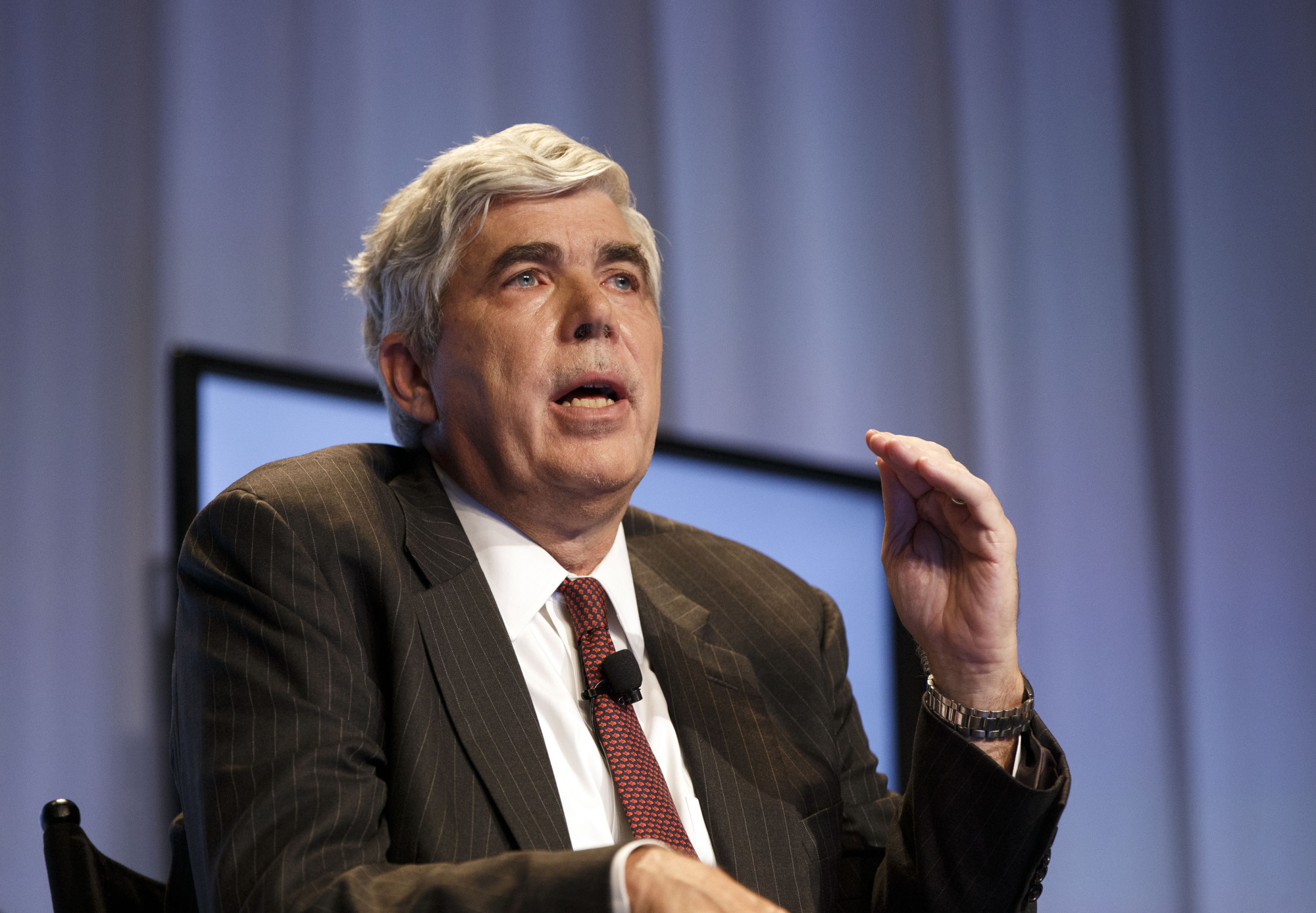

| Home prices are higher. Stocks are higher. And so is the amount of money Americans think they need to feel rich. On average, they say it takes a net worth of $2.5 million to be considered wealthy. That’s a 14% jump from last year, when the Charles Schwab Modern Wealth survey found Americans thought it took only $2.2 million. “The notion of wealth combines both numbers and emotions,” said Rob Williams, managing director of financial planning at Charles Schwab. “The jump from $2.2 million to $2.5 million demonstrates both sides—the cost of living is rising, as are, it’s likely, most Americans’ more emotion-fueled views of what it takes to be wealthy.” Perhaps unsurprisingly, the older someone is, the higher their definition of wealth is. Baby boomers said being wealthy takes $2.8 million, while millennials peg it at $2.2 million. Overall, slightly more than one-in-five Americans said they were “on track” to be wealthy—and 10% said they were wealthy already. —David E. Rovella US job growth was apparently far less robust for most of last year than previously reported, putting yet more pressure on the Fed to cut rates next month. The number of workers on payrolls will likely be revised down by 818,000 for the 12 months through March—or around 68,000 less each month—according to the Bureau of Labor Statistics’ preliminary benchmark revision. It was the largest downward revision since 2009. The revisions suggest the labor market started moderating much sooner than originally thought.  And it would seem that some got the bad news earlier than others. At least three banks managed to obtain the payroll numbers Wednesday while the rest of Wall Street was kept waiting, whipsawing markets and sowing confusion on trading desks. After the Bureau of Labor Statistics failed to post its revisions at 10 a.m. New York time, Mizuho Financial Group and BNP Paribas both called the department and got the number directly. So did Nomura Holdings. Anger quickly mounted at competitors as word spread that the BLS was releasing the number to some firms over the phone. Ken Leech, the longtime Western Asset Management chief investment officer, left his role amid probes from the Justice Department and Securities and Exchange Commission into whether some clients were favored over others in allocating gains and losses from derivatives trades. Leech, who manages some of the largest bond strategies in the US, will take an immediate leave of absence after receiving a so-called Wells notice from the SEC, the company said. Federal prosecutors in New York are said to be conducting a criminal probe into the practice known as “cherry-picking,” where winning trades are credited to favored accounts.  Kenneth Leech Photographer: Patrick T. Fallon Traders trying to buy the dip on Mexico’s peso can’t catch a break. Local politics, the dismantling of “carry trades” and concerns about the US outlook are disrupting bullish calls on what was recently the best performing emerging-market currency of 2024. The peso is down almost 4% against the dollar this week and more than 14% in the past three months, by far the worst among its peers. The peso’s six-month implied volatility has jumped to near the highest in three years. A signal from the Bitcoin derivatives market points to the growing risk of a “short squeeze” that could stoke sharp rallies, according to cryptocurrency specialist K33 Research. The metric is the funding rate for Bitcoin perpetual futures, which helps gauge how bullish or bearish speculators are. The seven-day average annualized funding rate is the lowest since March 2023, back when several regional US banks were imploding. “Perpetual swap funding rates have averaged at negative levels over the past week, while open interest has sharply increased,” K33 analysts wrote in a note. “This suggests aggressive shorting, structurally creating a setup ripe for a short squeeze.” US Vice President Kamala Harris will back measures to help grow digital assets, a policy adviser to her campaign said, highlighting efforts to court an emerging cryptocurrency industry that’s busy expanding its political influence. “She’s going to support policies that ensure that emerging technologies and that sort of industry can continue to grow,” Brian Nelson, senior campaign adviser for policy to the campaign, said when asked about the Democratic nominee’s efforts to engage the crypto community during a Bloomberg News roundtable at the Democratic National Convention. Over the centuries, maritime ports evolved from trading posts and naval bases into economies within economies that have supercharged globalization, becoming vital junctions for energy flows, hubs for infrastructure and clusters for industrial production, warehousing and distribution. Now responsible for handling 80% of the world’s annual merchandise trade, they’re having to undergo costly and painstaking conversions to digital technologies, automation and green energy—and it’s going to cost $2.2 trillion.  The Port of Los Angeles Photographer: Eric Thayer/Bloomberg The once-fictional future of flying cars, long a Hollywood fantasy made famous by films like Blade Runner, has in some fashion already arrived. The potential market for electric—and in some cases automated—flights could be $1 trillion by 2040, Morgan Stanley has estimated. If that prediction is even close to accurate, in little more than a decade the world will be spending more on flying-car trips than it currently does on conventional air travel.  The Xpeng AeroHT flying vehicle during the Beijing Auto Show in April Photographer: Qilai Shen/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Screentime: The entertainment landscape is shifting rapidly. Cable empires are crumbling, streaming giants face new challenges and innovative forces are rising. Join our resident entertainment expert Lucas Shaw on Oct. 9-10 in Los Angeles for an unparalleled experience traversing the future of media. Network with industry titans, immerse in live experiences and enjoy a curated collection of local eats. Get your tickets today. Learn More. Get the inside track of what’s happening at Jackson Hole in the Odd Lots newsletter from Joe Weisenthal and Tracy Alloway. It's only for Bloomberg.com subscribers, so sign up here or become a subscriber now. |