To investors,

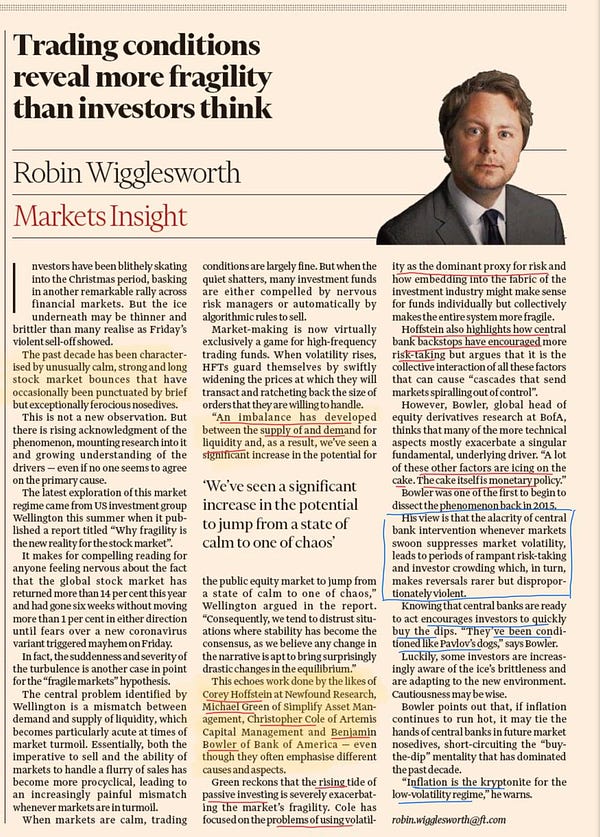

There was an article in the Financial Times recently that discussed market cycles, sell-offs, and investor risks. My friend Josh Wolfe from Lux Capital shared it on Twitter with a fairly sober warning that most young investors haven’t experienced a market downturn. Here is the article and the tweet:

This got me thinking — has the generation of 35 year olds and younger actually never experienced a market downturn?

We know that the 2009 - 2020 performance of the stock market was the single longest bull market in history. The trailing 10 year performance of the S&P 500 from today is approximately 265%. By numerous methods of evaluation, you could argue that financial assets and markets have done remarkably well over the last 12 years.

So why are we talking about this?

The more that I thought about this perspective, the more that I disagreed with it. In fact, I want to make the argument that people under the age of 35 have experienced some of the worst market downturns in history over the last 12 years. I know this is counter to the public narrative, but hear me out for a second.

First, college students who were graduating in 2009 were thrust into the Global Financial Crisis. This was the worst economic downturn since the Great Depression in the United States. While they may not have had many personal financial assets, a large percentage of them saw their parents, friends, and family get wiped out financially. The job market was excruciatingly tough and many of these young people were forced to live at home with their parents for a few years until they got their feet under them.

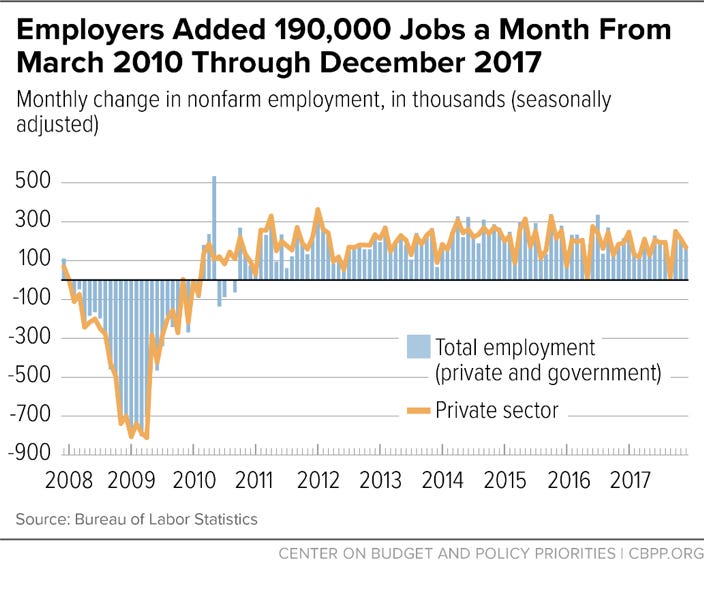

Although the multi-year bear market technically ended in March of 2009, there was still immense pain felt by people across the economy for a number of years. Take job growth for example - we didn’t see positive growth until March 2010 (a full year after the market downturn ended).

So these young people graduated right into one of the worst economic crisis in history. But that isn’t the only economic crisis they have endured. These same investors were in their early 30’s last year when they lived through a second economic recession. The COVID-19 public health crisis led to a swift economic downturn and tough labor market.

During March of 2020, all financial assets were falling at a blistering pace. Gold was down more than 10%, stocks were down 25-35%, and bitcoin was down more than 50% in a single day. There were multiple weeks where more than 6.5 million people filed for first time unemployment claims and the unemployment rate reached nearly 15% at one point. On top of that, business owners and leaders were faced with the single toughest business environment of the last 50 years — they were asked to continue to run their business while being locked in their homes by their government.

Now we quickly forget the economic recession of 2020 because the central bank and government stepped in with an incredible amount of monetary and fiscal stimulus, which drove asset prices upwards quickly. But that doesn’t take away from the fact that (a) investors lived through an incredibly painful drawdown in financial markets and (b) that citizens who lost their jobs or had their businesses impaired were still dealing with the effects for many months later.

Ok, so we have a demographic of investors that have lived through two of the worst financial markets in the last 50-100 years. That is the totality of the story, right? Nope.

We forget that young people have been investing in bitcoin and cryptocurrencies in a fairly significant way for a number of years. During that time, there have been three separate bear markets of at least an 80% drawdown in prices since 2011. Yes, you read that right. 80% drawdowns have happened THREE TIMES since 2011.

I’ll give the benefit of the doubt and say that most people were not invested in the market in 2011, or even pre-2017. But by 2017, numerous exchanges had tens of millions of users and there were hundreds of billions of dollars in market cap across the assets in the crypto industry.

Those investors who were participating in the 2017 crypto bull market got smacked in the face with a year long market crash in 2018 that saw bitcoin drop more than 80% and many other assets drop more than 95%. You could easily argue that the crypto market participants in 2018 experienced a market crash that is worse than any single market crash the stock market has ever seen. It may sound like hyperbole, but it is just math.

The crazy thing about that market crash in 2018? Majority of bitcoin holders never sold their assets. They simply held it.

Stanley Druckenmiller actually cited this as the reason that he decided to invest in bitcoin. He recently shared that Paul Tudor Jones called him and said “Do you know that when bitcoin went from $17,000 to $3,000 that 86% of the people that owned it at $17,000, never sold it?” Maybe the young people were on to something with their strong hands.

This brings us to 2021. Just this year, there have been six separate market downturns of over 20% in the first 11 months of the year. There was one drawdown of more than 50% as well. Even if you had never invested in bitcoin or cryptocurrencies before 2021, you likely experienced more 20% drawdowns this year than all 20% drawdowns in the stock market for the boomer generation’s total lifetime. Pretty crazy stuff.

So what is my point in explaining all this?

The public narrative is that young people have never experienced a market downturn. The older generations, the cynics, and the persistent bears like to propel a narrative that asset prices are being pushed up by young, naive investors who have never seen a bear market. That simply isn’t true though.

The generation of investors who are under the age of 35 have actually lived through worse financial markets than any other generation of financial investors. How many of them can claim to have lived through at least five market downturns in 12 years? Additionally, how many folks in the older generations can say they lived through an 80-95% market downturn and didn’t sell their assets, but instead bought more?

Young investors are the most resilient investors in history. They truly have diamond hands. The incumbents don’t have the stomach for this type of volatility. You could actually argue, digital natives are just built different. They store majority of their wealth in assets that have 80 vol and fluctuate 5-10% a day.

This is what happens when we live in a world with undisciplined monetary and fiscal policy. The young people refuse to play the game based on old rules. They understand that bear markets in the stock market have been outlawed and market corrections are banned. The central bank and politicians have to step in every time and prop up asset prices. And alternative assets, like bitcoin and cryptocurrencies, are the only honest market left.

Keep this in mind as you continue to watch the insanity in the legacy market. Hope you all have a great start to your day. Talk to you tomorrow.

-Pomp

SPONSORED: Are you looking to upgrade your old baggy sweats? It’s time to check out Public Rec. Their best-selling All Day Every Day Pant is the perfect combination of indoor comfort and outdoor style.

They’ve sold over 200,000 pairs and definitely live up to the hype! Finally, a more stylish alternative to sweatpants that are way more comfortable than jeans. Now your favorite lounge pants can also be your go-to’s for work, happy hour, and the gym. After a year at home, they are the pants you need now that you need pants.

Public Rec RARELY discounts, but right now, they have an exclusive offer just for Huddle Up readers. Click here and use promo code POMPLETTER to receive 10% off.

BUY NOW: Click here

THE RUNDOWN:

Fed Chairman Jerome Powell Retires the Word 'Transitory' in Describing Inflation: The nation’s economic steward said it will back off of using the word “transitory” to describe the fast pace of price increases, as Federal Reserve policymakers acknowledge the increasing risk of more persistent inflation. “We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Fed Chairman Jerome Powell told Congress on Tuesday. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.” Read more.

Libra Creator David Marcus Says He’s Leaving Facebook at Year’s End: David Marcus is leaving Facebook (now Meta) with the company’s libra (now diem) stablecoin yet to be fully launched. He said Tuesday on Twitter he was stepping down as Meta’s crypto lead and leaving the company, suggesting he’d return to his “entrepreneurial” roots. Marcus leaves the Diem project, first announced in June 2019, as it continues to face stiff regulatory headwinds. Read more.

A16z Leads $28M Round for Privacy Coin Iron Fish: Iron Fish, a decentralized blockchain network that aims to create a cryptocurrency as private as cash, has raised $27.7 million in a Series A round led by Andreessen Horowitz (a16z) ahead of the network’s Dec. 1 testnet launch. “While a number of Web 3 teams are now building developer-oriented privacy tools for blockchains, there’s also a need for mainstream privacy solutions that are accessible for everyday users,” wrote a16z general partner Ali Yahya, deal analyst Elena Burger and crypto partner Guy Wuollet in a blog post. Read more.

Five Things to Know About Twitter’s New CEO Parag Agrawal: Twitter’s co-founder and long-serving CEO, Jack Dorsey, handed the reins to former Chief Technology Officer Parag Agrawal on Monday. Here are five things to know about the new leader of one of the world’s biggest tech companies. Read more.

Borderless Capital Launches $500M Algorand-Focused Fund: Borderless Capital is launching a $500 million ALGO Fund II to help develop projects built on the Algorand blockchain. The company announced on Tuesday the fund will invest in “digital assets powering the next generation of decentralized applications on top of the Algorand blockchain network,” including projects “to disrupt the creators economy with [non-fungible tokens] and initiatives that can increase capital in the ALGO [decentralized finance] ecosystem through liquidity mining, lending, borrowing and yield farming,” the company said in the press release. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Steven Nelkovski is the CEO and Patrick O'Sullivan is the Chief Bitcoin Officer of the Perth Heat, an Australian Baseball Team. They have fully converted their entire organization to a Bitcoin Standard by holding Bitcoin on their balance sheet. They will be paying players in Bitcoin, accepting payments in Bitcoin at their stadium, and placing Bitcoin logos on the team merchandise.

In this conversation, we discuss pitching the idea to the organization, creating a Chief Bitcoin Officer role, paying players in Bitcoin, and the future of their team on the Bitcoin Standard.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Mode allows you to buy, earn and grow Bitcoin, all in one app. Not only is it an easy and safe way to buy and hold Bitcoin, Mode allows you to pay and receive up to 10% Bitcoin Cashback for FREE from its growing list of online partner brands. Download Mode today and enjoy 0% trading fees on all Bitcoin buys and sells until Dec 31, 2021. Only available in the UK.

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle Yield offers qualified businesses superior returns on USDC holdings for terms of up to 12 months. Managed by professional financial institutions, Circle Yield is the best way to earn returns on your USDC. Visit circle.com/pomp today; terms apply.

Nasdaq-listed BTCS was the first US-public company to secure today’s top layer one protocols. Recently, BTCS launched the beta version of its digital asset analytics dashboard! From across multiple exchanges, the BTCS Data Analytics Dashboard lets you evaluate your entire portfolio’s performance with plans to add year-end reports and yield earning on your crypto through linking to staking pools. Test out the BTCS Data Analytics Dashboard today at BTCS.com

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Ethernity.io is the world’s first authenticated and licensed NFT platform, trusted by over 150,000 members. Visit Ethernity.io, where you can buy and sell authenticated NFTs from top notable figures, rights, license, and IP holders you can’t find anywhere else; the start of an entire ecosystem bringing utility to #NFTs.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.