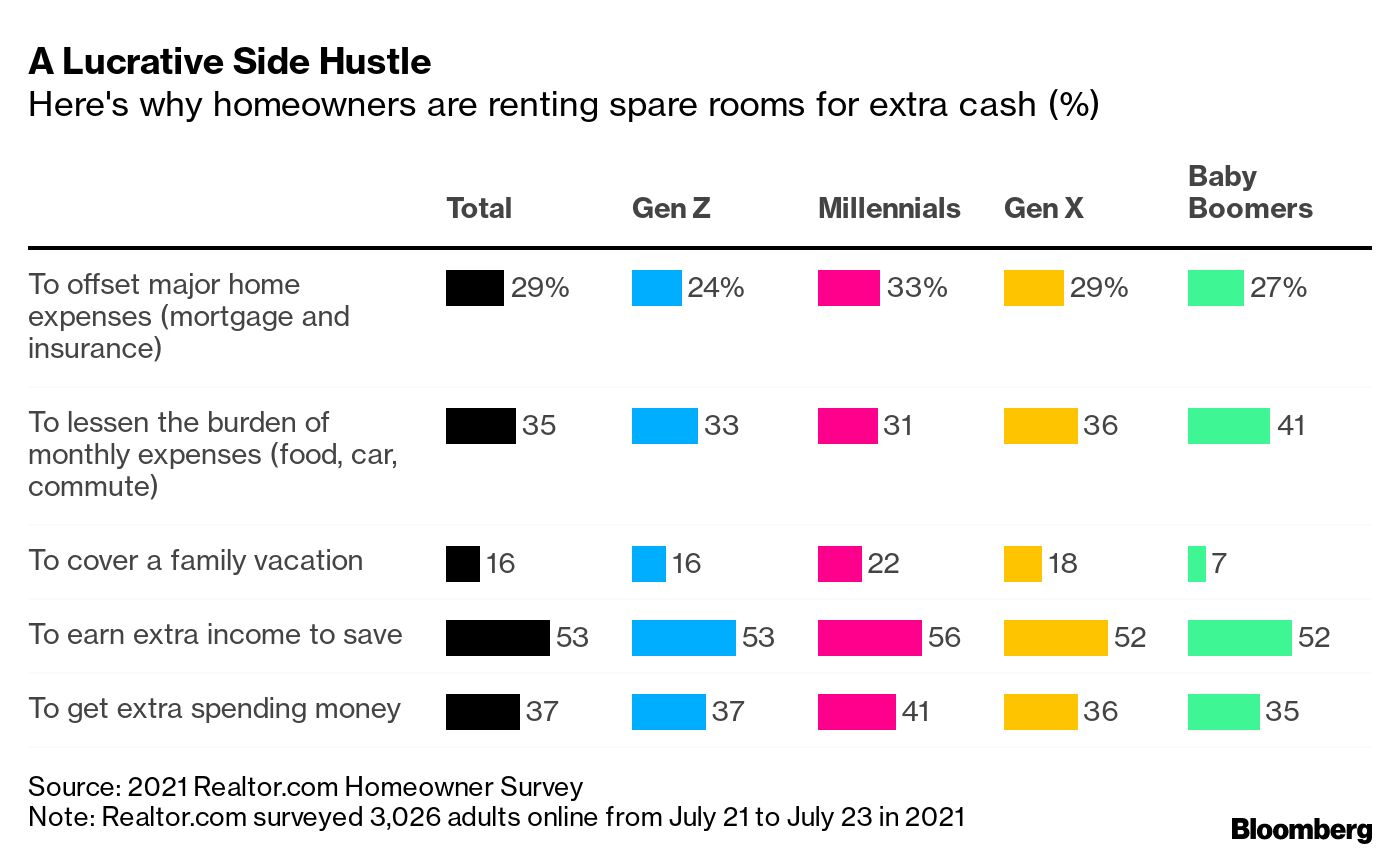

| The European Union’s top executive flew to Budapest in a bid to break a deadlock on the bloc’s proposed oil embargo against Russia. Currently, Hungarian Prime Minister Viktor Orban, who has remained friendly with the Kremlin despite its war on Ukraine, stands in the way. The EU seems set to soften its sanctions package on Russian oil exports, though it aims to keep a key shipping provision that will hinder Moscow’s ability to sell its crude. In Moscow, Vladimir Putin defied speculation that he might use an annual military parade to announce an escalation of his faltering offensive in Donbas. As Putin marked the 77th anniversary of the allied defeat of Nazi Germany, Ukrainian President Volodymyr Zelenskiy slammed his attempt to use that war to defend Russian aggression that’s killed thousands of civilians through the bombing of residential areas and alleged mass executions. France’s Emmanuel Macron drew a different historical parallel, warning against humiliating Russia with a reference to Germany’s defeat in World War I—and the aftermath. Meanwhile, a Russian government forecast shows the nation faces its deepest economic contraction in almost three decades. —Natasha Solo-Lyons Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. As Europe’s largest conflict since World War II rages in Ukraine, top Biden administration aides are increasingly convinced it could provide the U.S. with an unexpected advantage—against China. The House committee investigating the Jan. 6, 2021, attack on the U.S. Capitol by followers of Donald Trump has interviewed almost 1,000 people. But the nine-member panel has yet to talk to Trump or former Vice President Mike Pence as it seeks to conclude its wide-ranging inquiry into the unprecedented effort to block the peaceful transfer of power. The rout in big tech stocks has just begun, according to Dan Suzuki of Richard Bernstein Advisors. With Amazon down 33% this year and Meta tumbling over 40%, you might expect the carnage to be almost over. Suzuki says you would probably be wrong.  Traders on the floor of the New York Stock Exchange Photographer: Michael Nagle/Bloomberg Stocks tumbled to a 13-month low in a widespread selloff. The slide in the S&P 500 topped 3%, while the Treasury curve steepened, with the gap between five- and 30-year rates hitting the widest since March. Investors appear to be worried about the limits to Fed policy at a time when supply-chain disruptions pose a significant threat to its effort to fight inflation. Add to that Putin’s war and China’s Covid-19 lockdowns, and the picture doesn’t appear bright. Data Monday showed U.S. consumers project prices in three years to be higher compared with a month ago—itself a troubling sign for officials trying to keep longer-term expectations anchored. Here’s your markets wrap. Goldman Sachs is pulling out of working with most of the SPACs it took public. The bank, spooked by new liability guidelines from regulators, is throwing into doubt the fate of billions of dollars raised for those blank-check vehicles. Bitcoin extended losses, dropping below $32,000 for the first time since July 2021, placing its decline from a November record high to more than 50% amid a global flight from riskier investments.  Photographer: Erhan Demirtas/Bloomberg Photographer: Erhan Demirtas/Bloomberg Investors are eschewing almost everything except cash in the selloff. The Bloomberg Dollar Spot Index has beaten all other assets this month, notching a 0.6% advance at a time when stocks and bonds are diving. Investors have poured cash into an exchange-traded fund tracking Treasury bills for five weeks, clocking up the biggest inflows since 2020. Buying a home may seem like a distant dream for many in today’s cutthroat housing market. That is, unless they’re willing to share that dream with a roommate or two. With the average U.S. mortgage rate above 5% and home prices at record highs, homeownership feels increasingly out of reach, particularly for young, first-time buyers. To make it work, some are renting out rooms or basements. Bloomberg Invest—Focus on Africa: What are actionable ways in which Africa can plan its future? And what will it take for investors to deploy their capital in the continent? Join key corporate leaders and policymakers from IFC, Standard Chartered and TPG on May 17 as we explore key issues around Africa investing with an eye toward a post-pandemic world. Learn more here. |